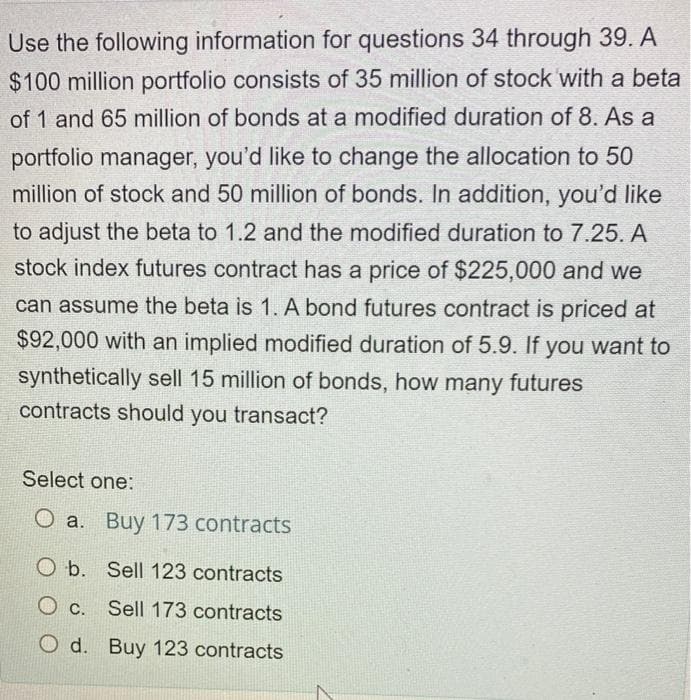

Use the following information for questions 34 through 39. A $100 million portfolio consists of 35 million of stock 'with a beta of 1 and 65 million of bonds at a modified duration of 8. As a portfolio manager, you'd like to change the allocation to 50 million of stock and 50 million of bonds. In addition, you'd like to adjust the beta to 1.2 and the modified duration to 7.25. A stock index futures contract has a price of $225,000 and we can assume the beta is 1. A bond futures contract is priced at $92,000 with an implied modified duration of 5.9. If you want to synthetically sell 15 million of bonds, how many futures contracts should you transact? Select one: O a. Buy 173 contracts O b. Sell 123 contracts c. Sell 173 contracts O d. Buy 123 contracts

Use the following information for questions 34 through 39. A $100 million portfolio consists of 35 million of stock 'with a beta of 1 and 65 million of bonds at a modified duration of 8. As a portfolio manager, you'd like to change the allocation to 50 million of stock and 50 million of bonds. In addition, you'd like to adjust the beta to 1.2 and the modified duration to 7.25. A stock index futures contract has a price of $225,000 and we can assume the beta is 1. A bond futures contract is priced at $92,000 with an implied modified duration of 5.9. If you want to synthetically sell 15 million of bonds, how many futures contracts should you transact? Select one: O a. Buy 173 contracts O b. Sell 123 contracts c. Sell 173 contracts O d. Buy 123 contracts

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section11.3: Financial Models

Problem 23P: Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of...

Related questions

Question

Transcribed Image Text:Use the following information for questions 34 through 39. A

$100 million portfolio consists of 35 million of stock 'with a beta

of 1 and 65 million of bonds at a modified duration of 8. As a

portfolio manager, you'd like to change the allocation to 50

million of stock and 50 million of bonds. In addition, you'd like

to adjust the beta to 1.2 and the modified duration to 7.25. A

stock index futures contract has a price of $225,000 and we

can assume the beta is 1. A bond futures contract is priced at

$92,000 with an implied modified duration of 5.9. If you want to

synthetically sell 15 million of bonds, how many futures

contracts should you transact?

Select one:

O a. Buy 173 contracts

O b. Sell 123 contracts

c.

Sell 173 contracts

O d. Buy 123 contracts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,