William Curtis is a personal finance expert and owns Much Money Consulting. This is his first month of operations and William h hired you to do his accounting. The following transactions are for the month of October. a. On October 2, William Curtis invested $32,600 cash into his business. b. On October 4, purchased $925 of office supplies for cash. c. On October 6, purchased $13,600 of office equipment on credit. d. On October 10, received $3,000 cash as revenue for being a guest on the TV show CityTalk. e. On October 12, paid for the office equipment purchased in transaction (c). f. On October 16, billed a customer $5,400 for delivering a corporate workshop on smart investing. g. On October 18, paid October's rent for the downtown office with $3,500 cash. h. On October 26, collected all cash for the account receivable created in transaction (f). i. On October 31, withdrew $5,000 cash from the business for a trip to Hawaii. 1. Not available in Connect. 2. Not available in Connect. 3. Prepare the journal entries for the month of October.

William Curtis is a personal finance expert and owns Much Money Consulting. This is his first month of operations and William h hired you to do his accounting. The following transactions are for the month of October. a. On October 2, William Curtis invested $32,600 cash into his business. b. On October 4, purchased $925 of office supplies for cash. c. On October 6, purchased $13,600 of office equipment on credit. d. On October 10, received $3,000 cash as revenue for being a guest on the TV show CityTalk. e. On October 12, paid for the office equipment purchased in transaction (c). f. On October 16, billed a customer $5,400 for delivering a corporate workshop on smart investing. g. On October 18, paid October's rent for the downtown office with $3,500 cash. h. On October 26, collected all cash for the account receivable created in transaction (f). i. On October 31, withdrew $5,000 cash from the business for a trip to Hawaii. 1. Not available in Connect. 2. Not available in Connect. 3. Prepare the journal entries for the month of October.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 3R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Topic Video

Question

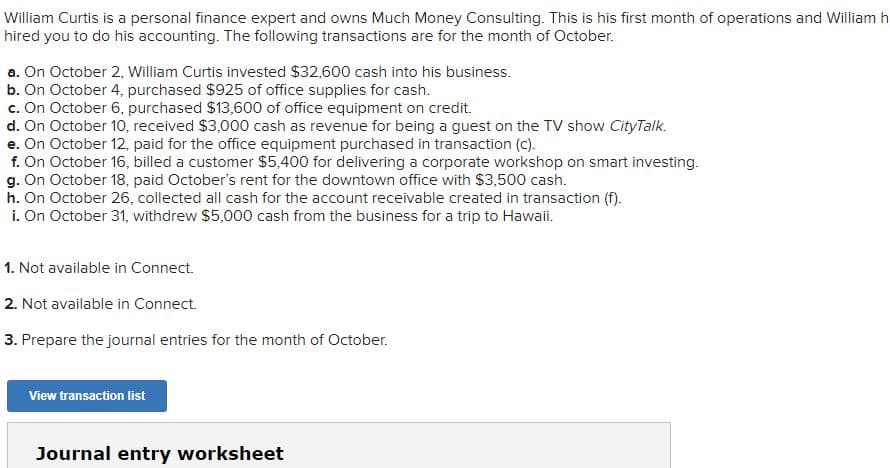

Transcribed Image Text:William Curtis is a personal finance expert and owns Much Money Consulting. This is his first month of operations and William h

hired you to do his accounting. The following transactions are for the month of October.

a. On October 2, William Curtis invested $32,600 cash into his business.

b. On October 4, purchased $925 of office supplies for cash.

c. On October 6, purchased $13,600 of office equipment on credit.

d. On October 10, received $3,000 cash as revenue for being a guest on the TV show CityTalk.

e. On October 12, paid for the office equipment purchased in transaction (c).

f. On October 16, billed a customer $5,400 for delivering a corporate workshop on smart investing.

g. On October 18, paid October's rent for the downtown office with $3,500 cash.

h. On October 26, collected all cash for the account receivable created in transaction (f).

i. On October 31, withdrew $5,000 cash from the business for a trip to Hawaii.

1. Not available in Connect.

2. Not available in Connect.

3. Prepare the journal entries for the month of October.

View transaction list

Journal entry worksheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning