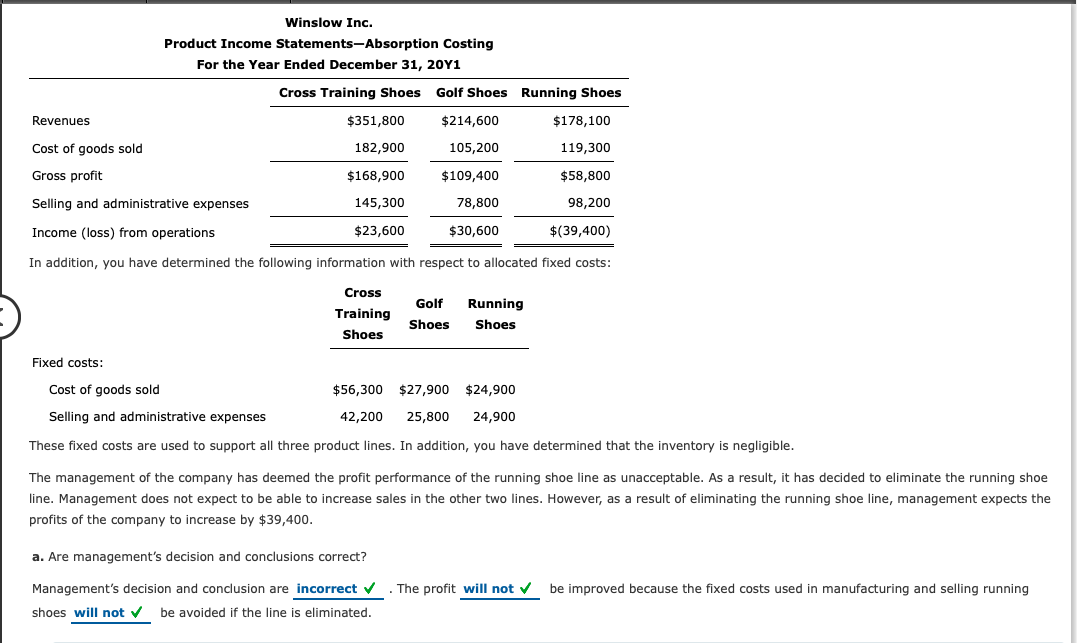

Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31, 20Y1 Cross Training Shoes Golf Shoes Running Shoes Revenues $351,800 $214,600 $178,100 Cost of goods sold 182,900 105,200 119,300 Gross profit $168,900 $109,400 $58,800 Selling and administrative expenses 145,300 78,800 98,200 Income (loss) from operations $23,600 $30,600 $(39,400) In addition, you have determined the following information with respect to allocated fixed costs: Cross Golf Running Training Shoes Shoes Shoes Fixed costs: Cost of goods sold $56,300 $27,900 $24,900 Selling and administrative expenses 42,200 25,800 24,900 These fixed costs are used to support all three product lines. In addition, you have determined that the inventory is negligible. The management of the company has deemed the profit performance the running shoe line as unacceptable. As a result, it has decided to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a result of eliminating the running shoe line, management expects the profits of the company to increase by $39,400. a. Are management's decision and conclusions correct? Management's decision and conclusion are incorrect v . The profit will not v be improved because the fixed costs used in manufacturing and selling running shoes will not v be avoided if the line is eliminated.

Winslow Inc. Product Income Statements-Absorption Costing For the Year Ended December 31, 20Y1 Cross Training Shoes Golf Shoes Running Shoes Revenues $351,800 $214,600 $178,100 Cost of goods sold 182,900 105,200 119,300 Gross profit $168,900 $109,400 $58,800 Selling and administrative expenses 145,300 78,800 98,200 Income (loss) from operations $23,600 $30,600 $(39,400) In addition, you have determined the following information with respect to allocated fixed costs: Cross Golf Running Training Shoes Shoes Shoes Fixed costs: Cost of goods sold $56,300 $27,900 $24,900 Selling and administrative expenses 42,200 25,800 24,900 These fixed costs are used to support all three product lines. In addition, you have determined that the inventory is negligible. The management of the company has deemed the profit performance the running shoe line as unacceptable. As a result, it has decided to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a result of eliminating the running shoe line, management expects the profits of the company to increase by $39,400. a. Are management's decision and conclusions correct? Management's decision and conclusion are incorrect v . The profit will not v be improved because the fixed costs used in manufacturing and selling running shoes will not v be avoided if the line is eliminated.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 26BEA

Related questions

Question

Transcribed Image Text:Winslow Inc.

Product Income Statements-Absorption Costing

For the Year Ended December 31, 20Y1

Cross Training Shoes

Golf Shoes Running Shoes

Revenues

$351,800

$214,600

$178,100

Cost of goods sold

182,900

105,200

119,300

Gross profit

$168,900

$109,400

$58,800

Selling and administrative expenses

145,300

78,800

98,200

Income (loss) from operations

$23,600

$30,600

$(39,400)

In addition, you have determined the following information with respect to allocated fixed costs:

Cross

Golf

Running

Training

Shoes

Shoes

Shoes

Fixed costs:

Cost of goods sold

$56,300 $27,900 $24,900

Selling and administrative expenses

42,200

25,800

24,900

These fixed costs are used to support all three product lines. In addition, you have determined that the inventory is negligible.

The management of the company has deemed the profit performance of the running shoe line as unacceptable. As a result, it has decided to eliminate the running shoe

line. Management does not expect to be able to increase sales in the other two lines. However, as a result of eliminating the running shoe line, management expects the

profits of the company to increase by $39,400.

a. Are management's decision and conclusions correct?

Management's decision and conclusion are incorrect v

. The profit will not v

be improved because the fixed costs used in manufacturing and selling running

shoes will not v be avoided if the line is eliminated.

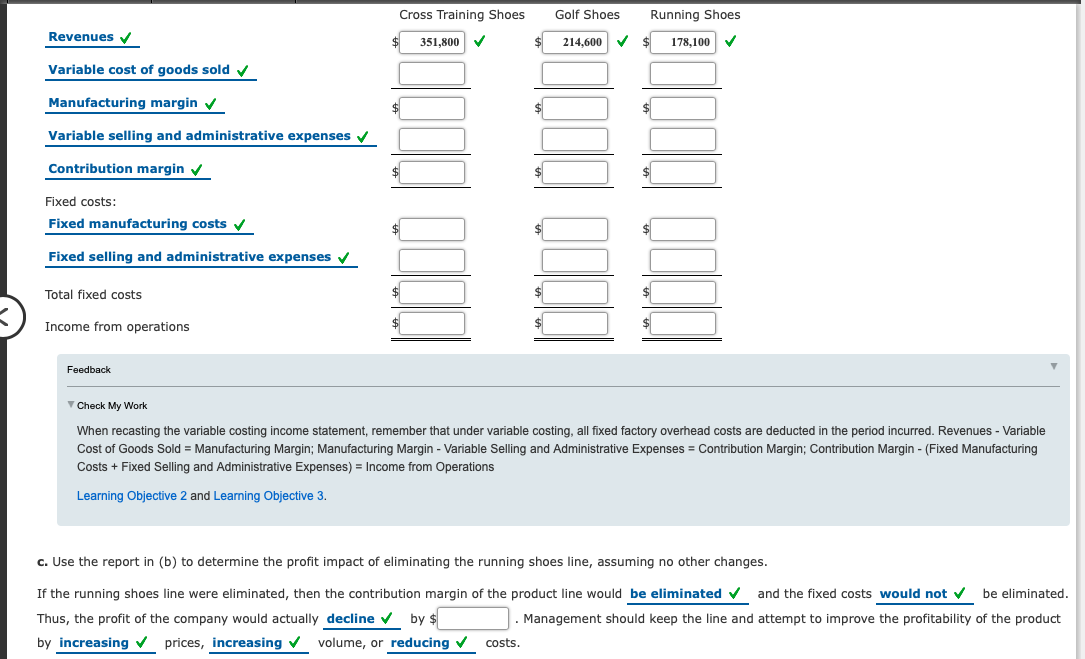

Transcribed Image Text:Cross Training Shoes

Golf Shoes

Running Shoes

Revenues V

351,800

214,600

$

178,100

Variable cost of goods sold v

Manufacturing margin v

$

Variable selling and administrative expenses v

Contribution margin v

$

Fixed costs:

Fixed manufacturing costs v

$

Fixed selling and administrative expenses v

Total fixed costs

Income from operations

Feedback

V Check My Work

When recasting the variable costing income statement, remember that under variable costing, all fixed factory overhead costs are deducted in the period incurred. Revenues - Variable

Cost of Goods Sold = Manufacturing Margin; Manufacturing Margin - Variable Selling and Administrative Expenses = Contribution Margin; Contribution Margin - (Fixed Manufacturing

Costs + Fixed Selling and Administrative Expenses) = Income from Operations

Learning Objective 2 and Learning Objective 3.

c. Use the report in (b) to determine the profit impact of eliminating the running shoes line, assuming no other changes.

If the running shoes line were eliminated, then the contribution margin of the product line would be eliminated v and the fixed costs would not v be eliminated.

Thus, the profit of the company would actually decline v by $

Management should keep the line and attempt to improve the profitability of the product

by increasing prices, increasing v volume, or reducing v

costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub