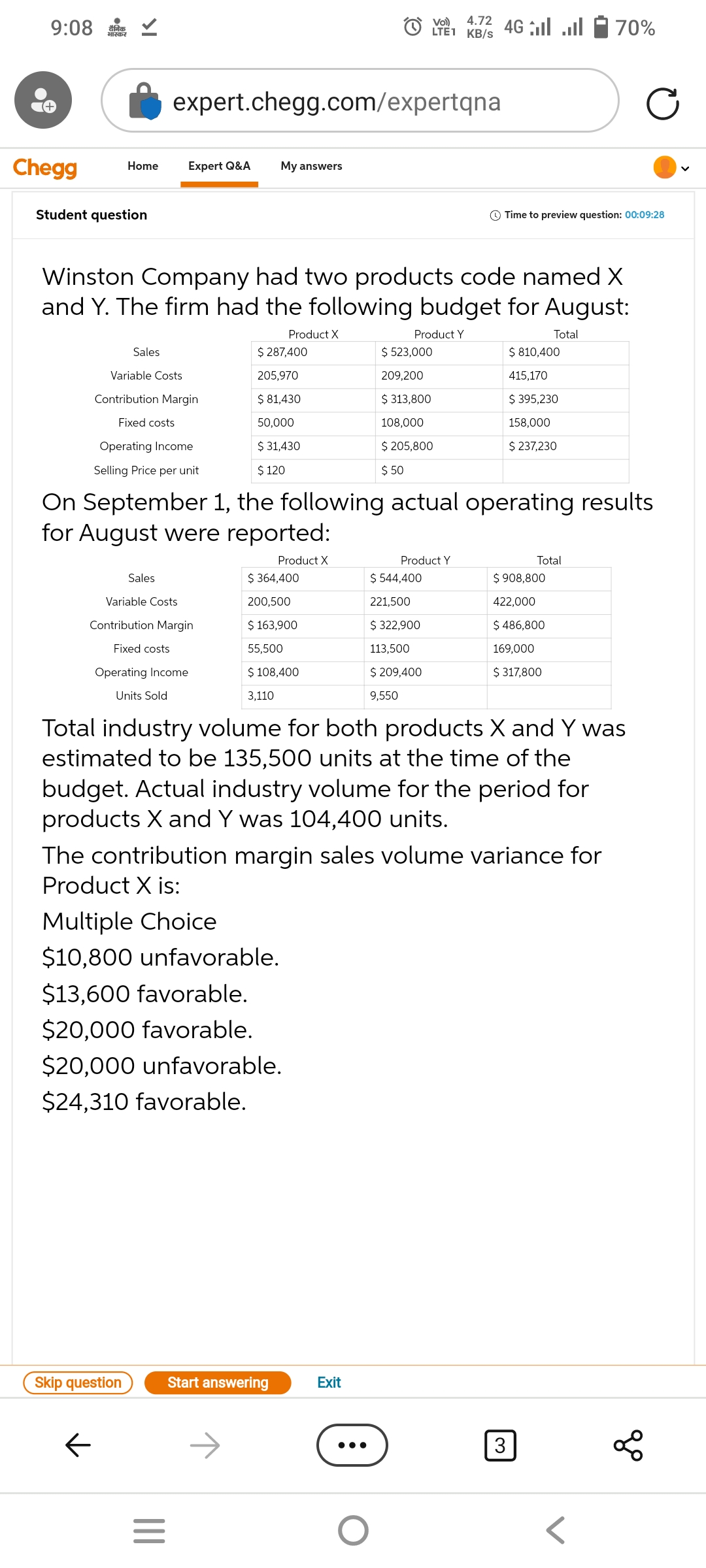

Winston Company had two products code named X and Y. The firm had the following budget for August: Product Y Total Sales Variable Costs Contribution Margin Fixed costs Operating Income Selling Price per unit Sales Variable Costs Contribution Margin Fixed costs Operating Income Units Sold Product X $ 287,400 205,970 $ 81,430 50,000 $ 31,430 $ 120 On September 1, the following actual operating results for August were reported: Product X $364,400 200,500 $ 163,900 55,500 $ 108,400 3,110 $ 523,000 209,200 $ 313,800 108,000 $ 205,800 $50 Multiple Choice $10,800 unfavorable. $13,600 favorable. $20,000 favorable. $20,000 unfavorable. $24,310 favorable. Product Y $ 810,400 415,170 $395,230 158,000 $ 237,230 $ 544,400 221,500 $ 322,900 113,500 $ 209,400 9,550 Total $ 908,800 422,000 $ 486,800 169,000 $ 317,800 Total industry volume for both products X and Y was estimated to be 135,500 units at the time of the budget. Actual industry volume for the period for products X and Y was 104,400 units. The contribution margin sales volume variance for Product X is:

Winston Company had two products code named X and Y. The firm had the following budget for August: Product Y Total Sales Variable Costs Contribution Margin Fixed costs Operating Income Selling Price per unit Sales Variable Costs Contribution Margin Fixed costs Operating Income Units Sold Product X $ 287,400 205,970 $ 81,430 50,000 $ 31,430 $ 120 On September 1, the following actual operating results for August were reported: Product X $364,400 200,500 $ 163,900 55,500 $ 108,400 3,110 $ 523,000 209,200 $ 313,800 108,000 $ 205,800 $50 Multiple Choice $10,800 unfavorable. $13,600 favorable. $20,000 favorable. $20,000 unfavorable. $24,310 favorable. Product Y $ 810,400 415,170 $395,230 158,000 $ 237,230 $ 544,400 221,500 $ 322,900 113,500 $ 209,400 9,550 Total $ 908,800 422,000 $ 486,800 169,000 $ 317,800 Total industry volume for both products X and Y was estimated to be 135,500 units at the time of the budget. Actual industry volume for the period for products X and Y was 104,400 units. The contribution margin sales volume variance for Product X is:

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercise 18.3. Required: 1. Calculate the cost of each unit using variable...

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:9:08 दैनिक

भास्कर

Chegg Home

Student question

Sales

Variable Costs

Contribution Margin

Fixed costs

Operating Income

Selling Price per unit

Sales

Expert Q&A

Winston Company had two products code named X

and Y. The firm had the following budget for August:

Product Y

Total

Variable Costs

Contribution Margin

Fixed costs

Operating Income

Units Sold

expert.chegg.com/expertqna

Skip question

←

My answers

Multiple Choice

$10,800 unfavorable.

|||

$ 287,400

205,970

$ 81,430

50,000

$ 31,430

$ 120

=

On September 1, the following actual operating results

for August were reported:

Product X

$13,600 favorable.

$20,000 favorable.

$20,000 unfavorable.

$24,310 favorable.

Product X

$364,400

200,500

$ 163,900

55,500

$ 108,400

3,110

Start answering

Vol)

LTE1 KB/S

ا... | 46 4.72

$ 523,000

209,200

$ 313,800

108,000

$ 205,800

$ 50

Exit

Total industry volume for both products X and Y was

estimated to be 135,500 units at the time of the

budget. Actual industry volume for the period for

products X and Y was 104,400 units.

The contribution margin sales volume variance for

Product X is:

O

Product Y

$ 544,400

221,500

$ 322,900

113,500

$ 209,400

9,550

Time to preview question: 00:09:28

$ 810,400

415,170

$ 395,230

158,000

$ 237,230

70%

Total

$ 908,800

422,000

$ 486,800

169,000

$ 317,800

go

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning