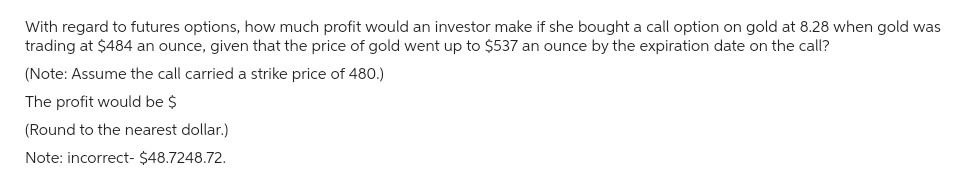

With regard to futures options, how much profit would an investor make if she bought a call option on gold at 8.28 when gold was trading at $484 an ounce, given that the price of gold went up to $537 an ounce by the expiration date on the call? (Note: Assume the call carried a strike price of 480.)

Q: Which type of security does it refer to? “First pay two times the Original Purchase on each share of…

A: First pay two times the Original Purchase on each share of Series A Preferred. Thereafter, Series A…

Q: From the table, calculate 6 moths, 1 year and 1.5 years spot rates using bootrapping process given…

A: Bootstrapping refers to the technique of deriving the implied spot interest rates of zero-coupon…

Q: A forward rate agreement is equivalent to which of the following interest rate options: A. long a…

A: A forward rate agreement (FRA) is an over-the-counter financial contract between two parties, where…

Q: Harwell Printing Co. is considering the purchase of new electronic printing equipment. It would…

A: Harwell Printing Co. is considering the purchase of new electronic printing equipment, It would…

Q: True or False: With flexibility and control being key factors: I would rather use internal financing…

A: Internal financing refers to use of retained earnings or internal accruals. In this case external…

Q: If a firm earns $375 billion in profits for the year and they retain $218 billion, what is the…

A: Profit = $375 billion Retained = $218 billion Retention rate = ? Dividend payout rate = ? After…

Q: Assume a par value of $1,000. Caspian Sea plans to issue a 14.00 year, semi-annual pay bond that has…

A: A financial instrument that does not affect the ownership of the common shareholders or management…

Q: What are some examples of the analysts’ recommendations for the stocks and the forecasted growth…

A: Walmart, one of the largest retail corporations in the world, has been attracting the attention of…

Q: The firm just paid an annual dividend of $2 per share and plans to decrease that amount by 10% next…

A: To solve this question we will use the dividend discount model here. As per the dividend discount…

Q: Assume that you are a consultant to Broske Inc., and you have been provided with the following data:…

A: Next dividend (D1) = $0.67 Current market price (P0) = $42.50 Growth rate (g) = 0.08 Cost of…

Q: An entity borrows money on a short-term note with the expectation that this short-term borrowing…

A: Introduction: Short term note- These are debts instrument that a firm must pay within a year.

Q: You are planning a new project that is to be entirely financed by issuing new debt. The project will…

A: Net present value (NPV) = Present value of cash inflows - Initial Investment. If there is cost of…

Q: Draw the profit diagram (profit not payoff) of a portfolio consisting of a long position in two call…

A: The payoff diagram for a portfolio consisting of various long and short positions in call options…

Q: The Western Capital Growth mutual fund has: Total assets $ 804,500,000 Total liabilities $…

A: Net asset value per share = (Total Assets - Liabilities) / Number of shares outstanding

Q: Dave and Diana are married and will file married jointly. What is their taxable income if they have…

A: Data given: AGI=$115,000 Mortgage interest $15,000 Real estate taxes of $4,500 State income taxes…

Q: QUESTION 7 "Before making additional balancing adjustments to the Balance Sheet, what is the…

A: Based on the given balance sheet and without making any adjustments the answers to the questions are…

Q: You are considering how to invest part of your retirement savings. You have decided to put $300,000…

A: Data given: Investible amount=$300,000 Investment details: 52% of amount in GoldFinger 21% of…

Q: d. $4,170 every 3 months for 3 years and $1.410 each quarter for the following 25 quarters, all…

A: The present value of a benefit represents the value of the benefit today, based on the expected cash…

Q: Suppose that company A has an asset worth £10 million yielding an interest of 7%. Suppose that A is…

A: A Japanese firm has an asset that pays an interest in £. The firm wants to transform the asset to an…

Q: Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube…

A: Operating cash flow is the amount of cash generated by the company on regular basis. It is net…

Q: A couple plans to save for their child's college education. What principle must be deposited by the…

A: Amount required (FV) = $39,000 Quarterly interest rate (r) = 0.0175 (0.07 / 4) Quarterly period (n)…

Q: You decided to speculate in the market and sold 7 platinum futures contracts when the futures price…

A: Total profit or loss on settlement date = Number of contracts*Contract size*(Futures selling price -…

Q: Venture Finance: Given the exit equation (Series A) = C (12) - C (15) + 1/2 * C (24) - 1/6 * C (46).…

A: Venture Finance refers to financing a new startup or early-stage company with capital financing…

Q: Prepare a one-page infographic depicting the differences between the direct and absorption costing…

A: Variable Cost - Variable cost is the cost which is per unit fixed and vary with the level of…

Q: 5. The price of Gamma Corp. stock will be either $62 or $86 at the end of the year. Call options are…

A:

Q: What are the payout methods? Select all that apply. Group of answer choices a. Bank loan b. Buyout…

A: Companies often pay out a percentage of their profits to shareholders as dividends, which can take…

Q: Bond A is a coupon bond. It has a face value of $100. The coupon rate is 5%, and the market interest…

A: A bond is a kind of debt security issued by the government and private companies for raising funds…

Q: define and explain convenience yield, and describe how it is incorporated into the futures pricing…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Find the present value of the annuity that will pay $850 every month for 3 years from an account…

A: To calculate the present value we will use the below formula Present value = P*[1-(1+r)-n]/r Where…

Q: A stock has a required return of 13.5% and is expected to sell for $135.7 in 6 years. It does not…

A: The stock's value today would be present value of stock at required rate of return.

Q: 2 The management of Kunkel Company is considering the purchase of a $21,000 machine that would…

A: Purchase cost = $21,000 Reduction in operating costs = $5,000 Useful life = 5 years Required rate of…

Q: extraordinary

A: i) To calculate the weighted average of the three independent estimates of dividend growth rate…

Q: damentals. You have Beta €10

A: To estimate the fair value for the equity of Alpha S.A., we can use the Price/Book Value ratio of…

Q: Which of the following is the correct ranking of the price risk. Coupon Rate 6% 8% 6% Bond A B C O…

A: The risk that a rise in market interest rates will decrease the value of the bond is called price…

Q: QUESTIONS: A. What is the weighted average cost of capital for Orange Ltd? B. With reference to…

A: A. To calculate the weighted average cost of capital (WACC) for Orange Ltd, we need to determine the…

Q: Several years ago the Jakob Company sold a $1,000 par value, noncallable bond that now has 20 years…

A: Semiannual coupon amount = $35 (i.e. $1000 * 0.07 / 2) Semiannual period = 40 (i.e. 20 year * 2)…

Q: You are given the following information for Lighting Power Company. Assume the company's tax rate is…

A: The weighted average cost of capital refers to the method of capital budgeting that is used for the…

Q: Investors should hold the stock one day before the payment ex-dividend declaration date to receive…

A: DIVIDEND DATE Declaration date is the date when the board of director announce the payment for…

Q: Please help: options for matching answers are trend analysis, vertical analysis, retained analysis…

A: Assets, liabilities and equity are three important component of accounting equation. After each and…

Q: Karamo's Shoe Stores Incorporated is considering opening an additional suburban outlet. An aftertax…

A: Coefficient of variation shows the relative measurement of the standard deviation with its mean…

Q: Bill started saving for his retirement when he was 37. Each month he depo $100.00 into an annuity…

A: Future value of amount includes the amount being that is deposited and amount of compounded interest…

Q: Suppose you are 25 years old and would like to retire at age 60. Furthermore, you would like to have…

A: The concept of time value of money will be used and applied here. As per the concept of time value…

Q: Consider the following information regarding the performance of a money manager in a recent month.…

A: The asset allocation and security selection of a fund manager and that of index are known. The…

Q: The six-month S&P 500 futures index you are considering buying. The current value of the index is…

A: To calculate the fair value of the six-month S&P 500 futures index, we need to take into account…

Q: Partial plc is considering what projects to undertake with the limited capital it has for…

A: Divisible Projects are those projects which can be accepted or rejected partly. Indivisible projects…

Q: Compute the expected return and standard deviation. (Do not round intermediate calculations and…

A: Expected return = (Probability of Fast growth state*Return for the state)+(Probability of slow…

Q: Suppose that put options on a stock with strike prices $30 and $35 cost $4 and $7, respectively.…

A: The bull spread would use a strike price of $35 and cost C1 $7 by writing put option and buy put…

Q: In the context of coupon-paying bonds, which of the following are most likely determined by market…

A: Coupon bond are type of bond issued with a fixed paid coupon payment at annual interest rate. Coupon…

Subject:- finance

Step by step

Solved in 3 steps

- Suppose that you enter into a short futures contract to sell July silver for $17.20 per ounce. The size of the contract is 5,000 ounces. The initial margin is $4,000, and the maintenance margin is $3,000.What change in the futures price will lead to a margin call?What happens if you do not meet the margin call?Suppose that you enter into a short futures contract to sell July silver for $27.20 per ounce. The size of the contract is 5,000 ounces. The initial margin is $4,000, and the maintenance margin is $ 3,000. What change in the futures price will lead to a margin call? What happens if you do not meet the margin call? Question 33 options: The price of silver must drop to $27.00 per ounce for there to be a margin call. If the margin call is not met, your broker closes out your position. The price of silver must rise to $27.40 per ounce for there to be a margin call. If the margin call is not met, your broker closes out your position. The price of silver must rise to $27.40 per ounce for there to be a margin call. If the margin call is not met, the position remains open until the margin declines to $0.0. The price of silver must drop to $26.20 per ounce for there to be a margin call. If the margin call is not met, your broker closes out your position. Please answer fast I give you upvote.The futures price of gold is $800. Futures contracts are for 100 ounces of gold, and the margin requirement is $4,000 a contract. The maintenance market requirement is $1,200. You expect the price of gold to rise and enter into a contract to buy gold. How much must you initially remit? Round your answer to the nearest dollar. $ If the futures price of gold rises to $855, what is the profit and return on your position? Round your answer for profit to the nearest dollar and for return to the nearest whole number. Profit: $ Return: % If the futures price of gold declines to $784, what is the loss on the position? Round your answer to the nearest dollar. Enter the answer as a positive value. $ If the futures price declines to $756, what must you do? Round your answer to the nearest dollar. Enter the answer as a positive value. The investor will have to $ to restore the initial $4,000 margin. If the futures price continues to decline to $740, how much do you have in your…

- The current price of gold is $300 per ounce. Carrying costs in total are 0.5% (not including interest) of the gold value payable in 6 months time. If the interest rate is 8%, is there an arbitrage opportunity if the gold futures price for delivery in six months is $310 per ounce? B. If an arbitrage opportunity exists, explain how you would conduct it and calculate the arbitrage profit. C. Why is it not possible in reality to perfectly hedge a portfolio using Options and/or futures Instruments? D. Explain the shortcomings of LTCM’s financial strategy that led to its eventual downfall.A trader owns a commodity that provides no income and has no storage costs as part of a long-term investment portfolio. The trader can buy the commodity for $1250 per ounce and sell it for $1245 per ounce. The trader can borrow funds at 6% per year and invest funds at 3% per year. (Both interest rates are expressed with continuous compounding.) For what range of one-year forward prices does the trader have no arbitrage opportunities? Assume there is no bid–offer spread for forward prices. Between 1245 and 1250 Between 1288 and 1321 Between 1283 and 1327 None of the aboveDonna Doni, CFA, wants to explore potential inefficiencies in the futures market. The TOBEC stock index has a spot value of 185. TOBEC futures contracts are settled in cash and underlying contract values are determined by multiplying $100 times the index value. The current annual risk-free interest rate is 6.0%.a. Calculate the theoretical price of the futures contract expiring six months from now, using the cost-of-carry model. The index pays no dividends.The total (round-trip) transaction cost for trading a futures contract is $15.b. Calculate the lower bound for the price of the futures contract expiring six months from now.

- Consider a 6-months futures contract on gold. We assume no income and that $1 per ounce per 6-months to store gold, with the payment being made at the end of the period. The spot price is $1620 and risk free rate is 2% for all maturities. How can an arbitrageur earn profit is the price of 6-month gold futures is 1630$?I decide to use call options instead of using futures contracts. I purchase 500 ounces of calls. The premium is $90 per ounce for a call expiring in December 2022 with a strike of $1,950. What do I spend in premium, and what is my profit/loss if the spot price of gold is $2,000 per ounce in Dec 2022 when the contract expires? This question is a continuation of question 4. The premium is $90 for a call expiring in December 2022 with a strike of $1,950 per ounce. The premium is $60 for a call expiring in December 2022 with a strike of $2,100 per ounce. I decide to purchase a call with the $1,950 strike and to sell (short) a call with the $2,100 Strike. Complete the following table; include the premium in all payoff calculations. Payoff Payoff Payoff Dec 2022 Long call Short call long call strike=$1,950 and Spot price strike=$1,950…A one-year gold futures contract is selling for $1,247. Spot gold prices are $1,200 and the one-year risk-free rate is 2%. a) According to spot-futures parity, what should be the futures price? b) What risk-free strategy can investors use to take advantage of the futures mispricing, and what would be the profits from that strategy?

- Sixty futures contracts are used to hedge an exposure to the price of silver. Each futurescontract is on 5,000 ounces of silver. At the time the hedge is closed out, the basis is $0.20per ounce. What is the effect of the basis on the hedger’s financial position if (a) the traderis hedging the purchase of silver and (b) the trader is hedging the sale of silver?The one-year futures price on a particular stock - index portfolio is 1,124.91, the stock index currently is 1, 116, the one-year risk-free interest rate is 2.61%, and the year-end dividend that will be paid on a $1,116 investment in the index portfolio is $13.73. By how much is the contract mispriced? future price - parity priceIf you buy a put option on a $100,000 Treasure bond futures contract with an exercise price of 97 and the price of the Treasury bond futures is 130 at expiration, is the contract in the money, out of the money or at the money? What is your profit or loss on the contract if the premium was $5,000? The exercise price and the futures price are quoted in points and each point is $1,000.