Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. Indirect Expense Cost Allocation Base Supervision $ 82,500 Number of employees Utilities 50,000 Square feet occupied Insurance 22,500 Value of assets in use Total $ 155,000 Departmental data for the company’s recent reporting period follow. Department Employees Square Feet Asset Values Materials 27 25,000 $ 6,000 Personnel 9 5,000 1,200 Manufacturing 63 55,000 37,800 Packaging 51 15,000 15,000 Total 150 100,000 $ 60,000 1. Use this information to allocate each of the three indirect expenses across the four departments. 2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. Indirect Expense Cost Allocation Base Supervision $ 82,500 Number of employees Utilities 50,000 Square feet occupied Insurance 22,500 Value of assets in use Total $ 155,000 Departmental data for the company’s recent reporting period follow. Department Employees Square Feet Asset Values Materials 27 25,000 $ 6,000 Personnel 9 5,000 1,200 Manufacturing 63 55,000 37,800 Packaging 51 15,000 15,000 Total 150 100,000 $ 60,000 1. Use this information to allocate each of the three indirect expenses across the four departments. 2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter6: Financial Statements And The Closing Process

Section: Chapter Questions

Problem 1SEB: INCOME STATEMENT From the partial work sheet for Major Advising below, prepare an income statement....

Related questions

Question

Exercise 22-5 Departmental expense allocations LO P2

Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow.

| Indirect Expense | Cost | Allocation Base | |

| Supervision | $ | 82,500 | Number of employees |

| Utilities | 50,000 | Square feet occupied | |

| Insurance | 22,500 | Value of assets in use | |

| Total | $ | 155,000 | |

Departmental data for the company’s recent reporting period follow.

| Department | Employees | Square Feet | Asset Values | |||||||||

| Materials | 27 | 25,000 | $ | 6,000 | ||||||||

| Personnel | 9 | 5,000 | 1,200 | |||||||||

| Manufacturing | 63 | 55,000 | 37,800 | |||||||||

| Packaging | 51 | 15,000 | 15,000 | |||||||||

| Total | 150 | 100,000 | $ | 60,000 | ||||||||

1. Use this information to allocate each of the three indirect expenses across the four departments.

2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

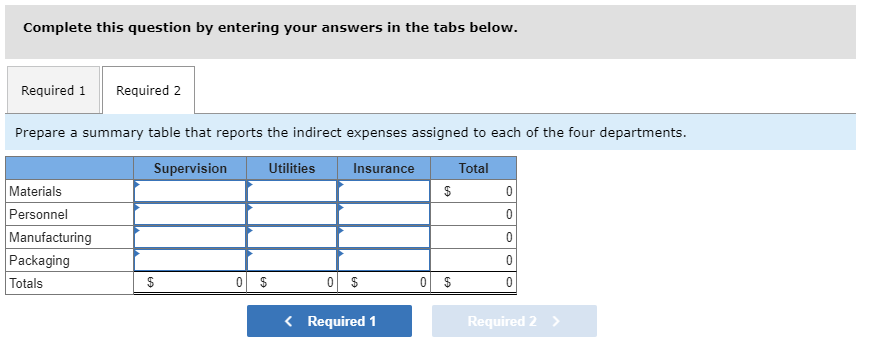

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare a summary table that reports the indirect expenses assigned to each of the four departments.

Supervision

Utilities

Insurance

Total

Materials

Personnel

Manufacturing

Packaging

Totals

0 $

< Required 1

Required 2 >

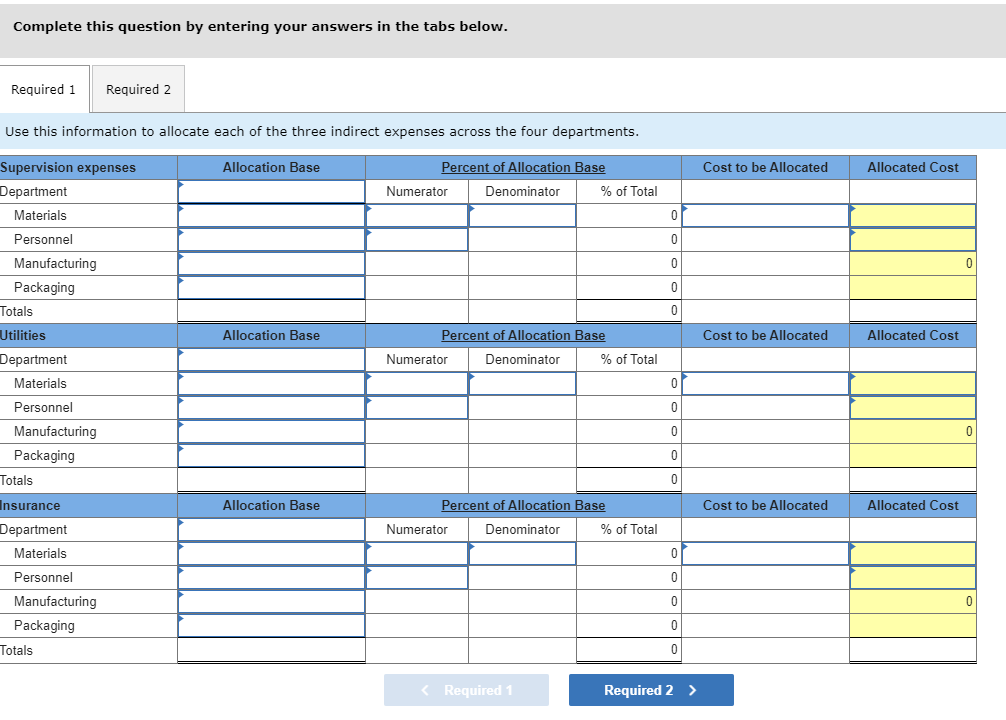

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Use this information to allocate each of the three indirect expenses across the four departments.

Supervision expenses

Department

Allocation Base

Percent of Allocation Base

Cost to be Allocated

Allocated Cost

Numerator

Denominator

% of Total

Materials

Personnel

Manufacturing

Packaging

Totals

Utilities

Allocation Base

Percent of Allocation Base

Cost to be Allocated

Allocated Cost

Department

Numerator

Denominator

% of Total

Materials

Personnel

Manufacturing

Packaging

Totals

Insurance

Allocation Base

Percent of Allocation Base

Cost to be Allocated

Allocated Cost

Department

Numerator

Denominator

% of Total

Materials

Personnel

Manufacturing

Packaging

Totals

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning