Exercise 22-23 Profit margin and investment turnover LO A2 L'Oréal reports the following for a recent year for the major divisions in its cosmetics branch. Total Assets Total Assets € millions Professional products Consumer products Luxury products Sales Income End of Year € 2,717 € 552 € 2,624 Beginning of Year € 2,516 9,530 4,507 1,765 5,994 3,651 5,496 4,059 791 Active cosmetics 1,386 278 830 817 Total €18,140 € 3,386 €13,099 €12,888 1. Compute profit margin for each division. Which L'Oréal division has the highest profit margin? 2. Compute investment turnover for each division. Which L'Oréal division has the best investment turnover? Completo thic quection by ontoxing voUN ancua Ns in the tahc holou

Exercise 22-23 Profit margin and investment turnover LO A2 L'Oréal reports the following for a recent year for the major divisions in its cosmetics branch. Total Assets Total Assets € millions Professional products Consumer products Luxury products Sales Income End of Year € 2,717 € 552 € 2,624 Beginning of Year € 2,516 9,530 4,507 1,765 5,994 3,651 5,496 4,059 791 Active cosmetics 1,386 278 830 817 Total €18,140 € 3,386 €13,099 €12,888 1. Compute profit margin for each division. Which L'Oréal division has the highest profit margin? 2. Compute investment turnover for each division. Which L'Oréal division has the best investment turnover? Completo thic quection by ontoxing voUN ancua Ns in the tahc holou

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter24: Decentralized Operations

Section: Chapter Questions

Problem 24.3CP

Related questions

Question

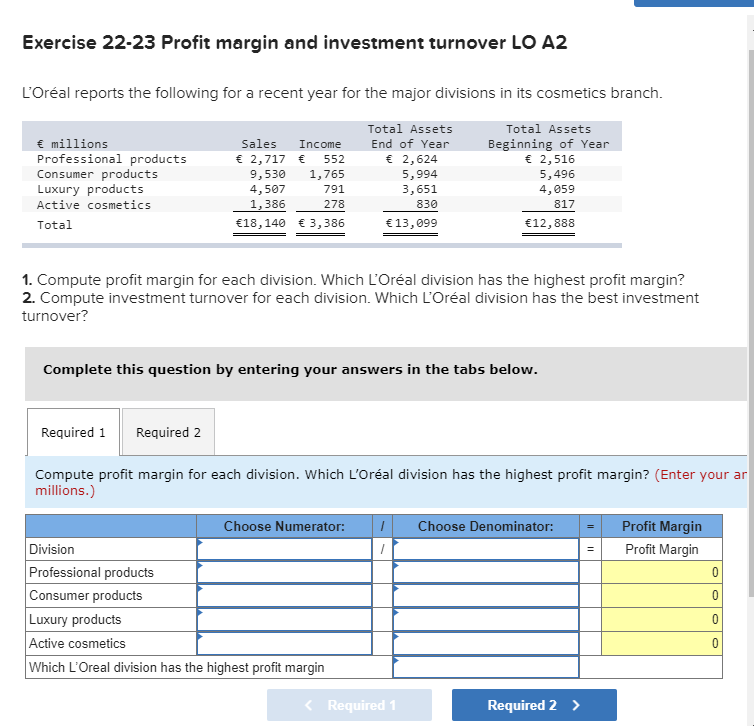

Exercise 22-23 Profit margin and investment turnover LO A2

L’Oréal reports the following for a recent year for the major divisions in its cosmetics branch.

| € millions | Sales | Income | Total Assets End of Year |

Total Assets Beginning of Year |

|||||||||||

| Professional products | € | 2,717 | € | 552 | € | 2,624 | € | 2,516 | |||||||

| Consumer products | 9,530 | 1,765 | 5,994 | 5,496 | |||||||||||

| Luxury products | 4,507 | 791 | 3,651 | 4,059 | |||||||||||

| Active cosmetics | 1,386 | 278 | 830 | 817 | |||||||||||

| Total | € | 18,140 | € | 3,386 | € | 13,099 | € | 12,888 | |||||||

1. Compute profit margin for each division. Which L’Oréal division has the highest profit margin?

2. Compute investment turnover for each division. Which L’Oréal division has the best investment turnover?

Transcribed Image Text:Exercise 22-23 Profit margin and investment turnover LO A2

L'Oréal reports the following for a recent year for the major divisions in its cosmetics branch.

Total Assets

Total Assets

€ millions

Professional products

Consumer products

Luxury products

Sales

End of Year

Beginning of Year

€ 2,516

5,496

Income

€ 2,717 € 552

€ 2,624

9,530

4,507

1,765

5,994

3,651

791

4,059

Active cosmetics

1,386

278

830

817

Total

€18,140 € 3,386

€13,099

€12,888

1. Compute profit margin for each division. Which L'Oréal division has the highest profit margin?

2. Compute investment turnover for each division. Which L'Oréal division has the best investment

turnover?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute profit margin for each division. Which L'Oréal division has the highest profit margin? (Enter your ar

millions.)

Choose Numerator:

Choose Denominator:

Profit Margin

Division

Profit Margin

Professional products

Consumer products

Luxury products

Active cosmetics

Which L'Oreal division has the highest profit margin

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning