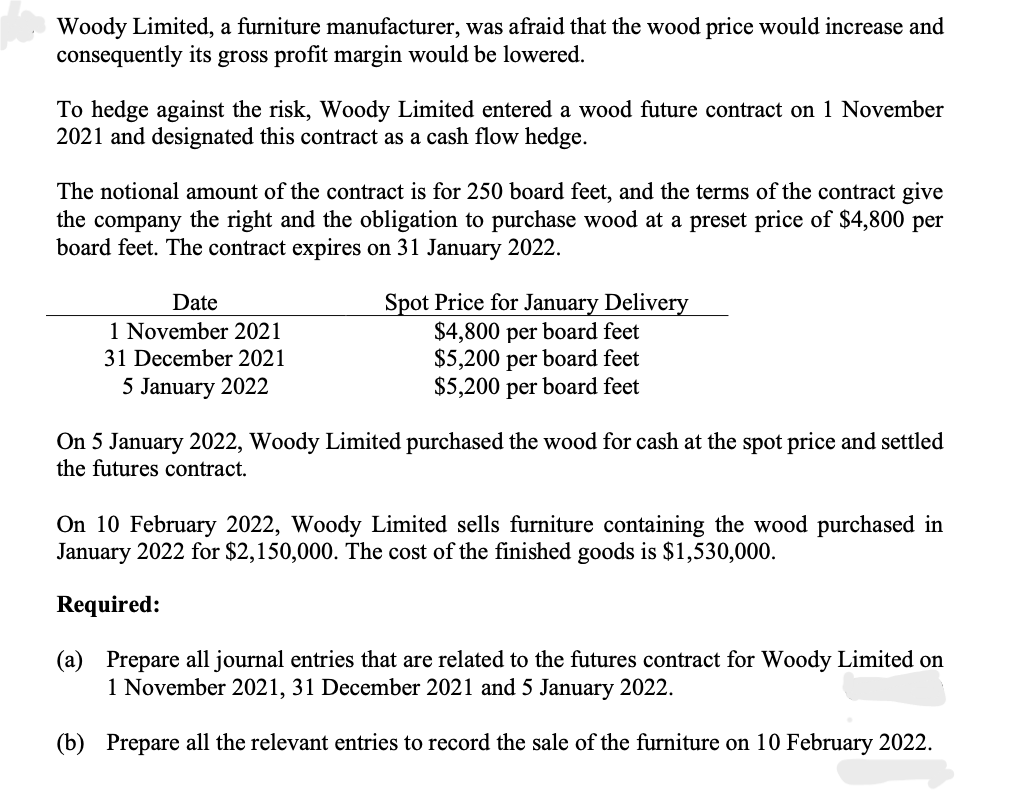

Woody Limited, a furniture manufacturer, was afraid that the wood price would increase and consequently its gross profit margin would be lowered. To hedge against the risk, Woody Limited entered a wood future contract on 1 November 2021 and designated this contract as a cash flow hedge. The notional amount of the contract is for 250 board feet, and the terms of the contract give the company the right and the obligation to purchase wood at a preset price of $4,800 per board feet. The contract expires on 31 January 2022.

Woody Limited, a furniture manufacturer, was afraid that the wood price would increase and consequently its gross profit margin would be lowered. To hedge against the risk, Woody Limited entered a wood future contract on 1 November 2021 and designated this contract as a cash flow hedge. The notional amount of the contract is for 250 board feet, and the terms of the contract give the company the right and the obligation to purchase wood at a preset price of $4,800 per board feet. The contract expires on 31 January 2022.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 15E: On January 1, 2019, Piper Company entered into an agreement with Save-Mart to sell its most popular...

Related questions

Question

please help me to solve this problem and please do not give answer in image formate

Transcribed Image Text:Woody Limited, a furniture manufacturer, was afraid that the wood price would increase and

consequently its gross profit margin would be lowered.

To hedge against the risk, Woody Limited entered a wood future contract on 1 November

2021 and designated this contract as a cash flow hedge.

The notional amount of the contract is for 250 board feet, and the terms of the contract give

the company the right and the obligation to purchase wood at a preset price of $4,800 per

board feet. The contract expires on 31 January 2022.

Spot Price for January Delivery

$4,800 per board feet

$5,200 per board feet

$5,200 per board feet

Date

1 November 2021

31 December 2021

5 January 2022

On 5 January 2022, Woody Limited purchased the wood for cash at the spot price and settled

the futures contract.

On 10 February 2022, Woody Limited sells furniture containing the wood purchased in

January 2022 for $2,150,000. The cost of the finished goods is $1,530,000.

Required:

(a) Prepare all journal entries that are related to the futures contract for Woody Limited on

1 November 2021, 31 December 2021 and 5 January 2022.

(b) Prepare all the relevant entries to record the sale of the furniture on 10 February 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning