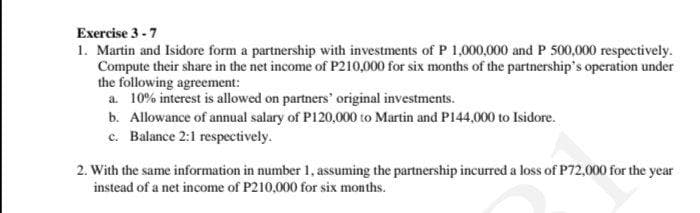

Exercise 3 -7 1. Martin and Isidore form a partnership with investments of P 1,000,000 and P 500,000 respectively. Compute their share in the net income of P210,000 for six months of the partnership's operation under the following agreement: a. 10% interest is allowed on partners' original investments. b. Allowance of annual salary of P120,000 to Martin and P144,000 to Isidore. c. Balance 2:1 respectively. 2. With the same information in number 1, assuming the partnership incurred a loss of P72,000 for the instead of a net income of P210,000 for six months. year

Exercise 3 -7 1. Martin and Isidore form a partnership with investments of P 1,000,000 and P 500,000 respectively. Compute their share in the net income of P210,000 for six months of the partnership's operation under the following agreement: a. 10% interest is allowed on partners' original investments. b. Allowance of annual salary of P120,000 to Martin and P144,000 to Isidore. c. Balance 2:1 respectively. 2. With the same information in number 1, assuming the partnership incurred a loss of P72,000 for the instead of a net income of P210,000 for six months. year

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 2SEB

Related questions

Question

Need help with answering these two questions, correct answers are circled.

Transcribed Image Text:Exercise 3 -7

1. Martin and Isidore form a partnership with investments of P 1,000,000 and P 500,000 respectively.

Compute their share in the net income of P210,000 for six months of the partnership's operation under

the following agreement:

a. 10% interest is allowed on partners' original investments.

b. Allowance of annual salary of P120,000 to Martin and P144,000 to Isidore.

c. Balance 2:1 respectively.

2. With the same information in number 1, assuming the partnership incurred a loss of P72,000 for the year

instead of a net income of P210,000 for six months.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College