Working with the Takeaways Throughout this chapter we have considered the financial state- ments of Apple Inc. and have undertaken select financial analysis using the Takeaways. Utilize these same tools to analyze the financial data of L puter peripherals. The following information was re statements as of year-end March 31, 2017 and 2016: International, a manufacturer of com- by Logitech in the company's financial March 31 (in thousands) 2017 2016 Current assets . $1,027,845 $ 926,247 Total assets 1,498,677 507,078 1,324,147 414,930 564,199 2,018,100 119,317 183,111 56,615 Current liabilities. Total liabilities.. Net sales... Net income.. Cash provided by operating activities.. Expenditures on property, plant, and equipment . 642,566 2,221,427 205,876 278,728 31,804 Required 1. Calculate the return on sales ratio for each year and comment on Logitech's profitability. 2. Calculate the current ratio for each year and comment on Logitech's liquidity. 3. Calculate the debt-to-total-assets ratio for each year and comment on Logitech's solvency. 4. Calculate the free cash flow for each year and comment on what this means for Logitech. 5. Apple's fiscal year-end occurs near the end of September, whereas Logitech uses a March year- end. How might this affect a comparison of the financial results of the two companies?

Working with the Takeaways Throughout this chapter we have considered the financial state- ments of Apple Inc. and have undertaken select financial analysis using the Takeaways. Utilize these same tools to analyze the financial data of L puter peripherals. The following information was re statements as of year-end March 31, 2017 and 2016: International, a manufacturer of com- by Logitech in the company's financial March 31 (in thousands) 2017 2016 Current assets . $1,027,845 $ 926,247 Total assets 1,498,677 507,078 1,324,147 414,930 564,199 2,018,100 119,317 183,111 56,615 Current liabilities. Total liabilities.. Net sales... Net income.. Cash provided by operating activities.. Expenditures on property, plant, and equipment . 642,566 2,221,427 205,876 278,728 31,804 Required 1. Calculate the return on sales ratio for each year and comment on Logitech's profitability. 2. Calculate the current ratio for each year and comment on Logitech's liquidity. 3. Calculate the debt-to-total-assets ratio for each year and comment on Logitech's solvency. 4. Calculate the free cash flow for each year and comment on what this means for Logitech. 5. Apple's fiscal year-end occurs near the end of September, whereas Logitech uses a March year- end. How might this affect a comparison of the financial results of the two companies?

Chapter1: Role Of Accounting In Society

Section: Chapter Questions

Problem 5Q: The following information was taken from the Netflix financial statements. For Netflix, sales is the...

Related questions

Question

Practice Pack

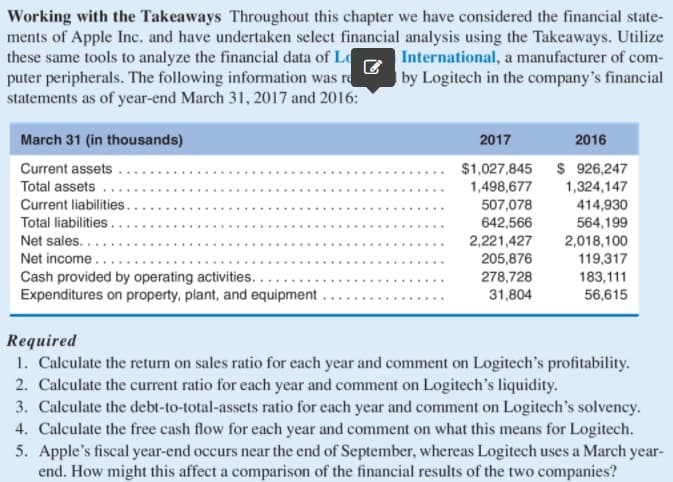

Working with the Takeaways throughout this chapter we have considered the financial statements of Apple Inc. and have undertaken select financial analysis using the Takeaways. Utilize

these same tools to analyze the financial data of

Logitech International, a manufacturer of computer peripherals. The following information was reported by Logitech in the company’s financial statements as of year-end March 31, 2017 and 2016.

1. Calculate the return on sales ratio for each year and comment on Logitech’s profitability.

2. Calculate thecurrent ratio for each year and comment on Logitech’s liquidity.

3. Calculate the debt-to-total-assets ratio for each year and comment on Logitech’s solvency.

4. Calculate thefree cash flow for each year and comment on what this means for Logitech.

5. Apple’s fiscal year-end occurs near the end of September, whereas Logitech uses a March year-end. How might this affect a comparison of the financial results of the two companies?

1. Calculate the return on sales ratio for each year and comment on Logitech’s profitability.

2. Calculate the

3. Calculate the debt-to-total-assets ratio for each year and comment on Logitech’s solvency.

4. Calculate the

5. Apple’s fiscal year-end occurs near the end of September, whereas Logitech uses a March year-end. How might this affect a comparison of the financial results of the two companies?

Transcribed Image Text:Working with the Takeaways Throughout this chapter we have considered the financial state-

ments of Apple Inc. and have undertaken select financial analysis using the Takeaways. Utilize

these same tools to analyze the financial data of Ld

puter peripherals. The following information was re

statements as of year-end March 31, 2017 and 2016:

International, a manufacturer of com-

| by Logitech in the company's financial

March 31 (in thousands)

2017

2016

$1,027,845 $ 926,247

1,498,677

507,078

642,566

2,221,427

205,876

278,728

31,804

Current assets

Total assets

1,324,147

Current liabilities.

414,930

564,199

2,018,100

119,317

183,111

56,615

Total liabilities..

Net sales...

Net income.

Cash provided by operating activities....

Expenditures on property, plant, and equipment

Required

1. Calculate the return on sales ratio for each year and comment on Logitech's profitability.

2. Calculate the current ratio for each year and comment on Logitech's liquidity.

3. Calculate the debt-to-total-assets ratio for each year and comment on Logitech's solvency.

4. Calculate the free cash flow for each year and comment on what this means for Logitech.

5. Apple's fiscal year-end occurs near the end of September, whereas Logitech uses a March year-

end. How might this affect a comparison of the financial results of the two companies?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning