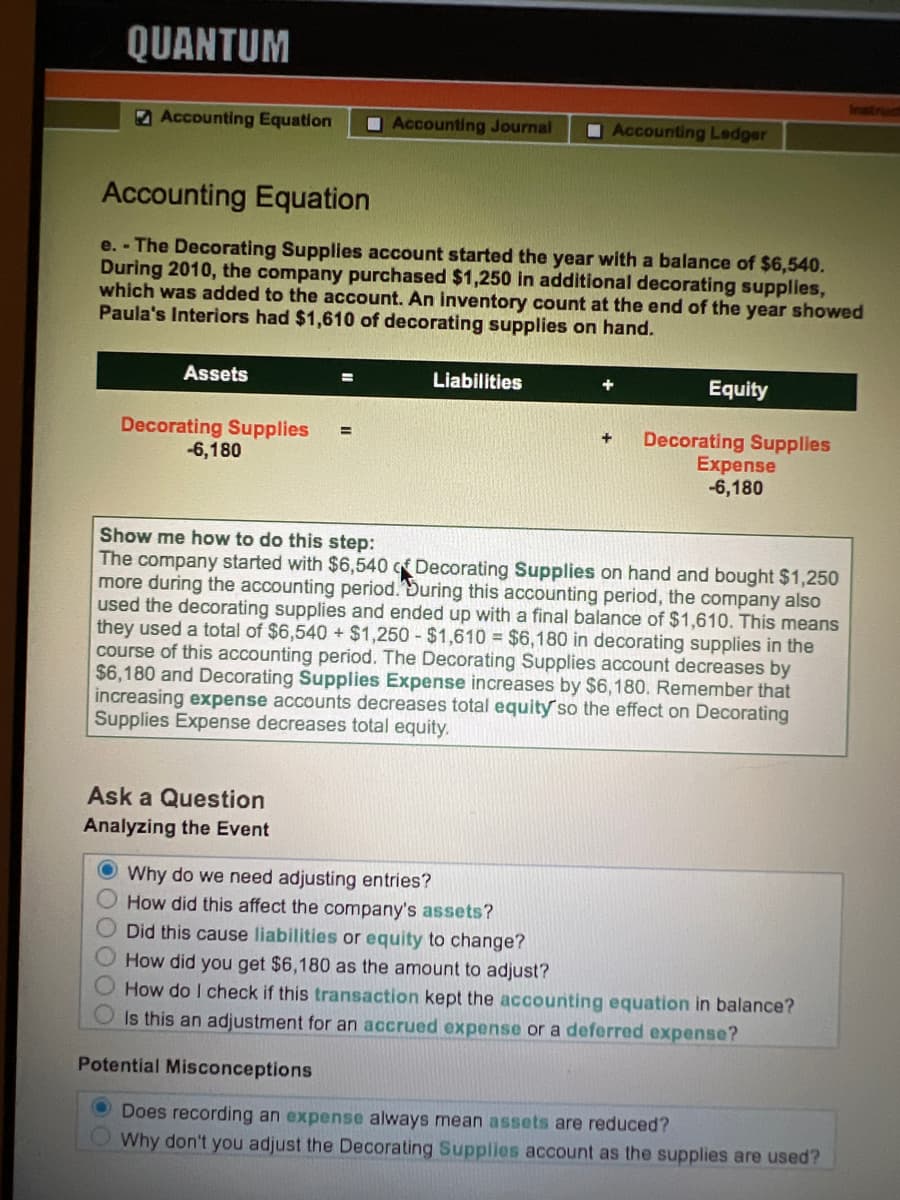

e. - The Decorating Supplies account started the year with a balance of $6,540. During 2010, the company purchased $1,250 in additional decorating supplies, which was added to the account. An İnventory count at the end of the year show Paula's Interiors had $1,610 of decorating supplies on hand. Assets Liabilities Equity Decorating Supplies -6,180 Decorating Supplies Expense -6,180 %3D Show me how to do this step: The company started with $6,540 Decorating Supplies on hand and bought $1,250 more during the accounting period.During this accounting period, the company also used the decorating supplies and ended up with a final balance of $1,610. This means they used a total of $6,540 + $1,250 - $1,610 = $6,180 in decorating supplies in the course of this accounting period. The Decorating Supplies account decreases by $6,180 and Decorating Supplies Expense increases by $6,180. Remember that increasing expense accounts decreases total equity so the effect on Decorating Supplies Expense decreases total equity.

e. - The Decorating Supplies account started the year with a balance of $6,540. During 2010, the company purchased $1,250 in additional decorating supplies, which was added to the account. An İnventory count at the end of the year show Paula's Interiors had $1,610 of decorating supplies on hand. Assets Liabilities Equity Decorating Supplies -6,180 Decorating Supplies Expense -6,180 %3D Show me how to do this step: The company started with $6,540 Decorating Supplies on hand and bought $1,250 more during the accounting period.During this accounting period, the company also used the decorating supplies and ended up with a final balance of $1,610. This means they used a total of $6,540 + $1,250 - $1,610 = $6,180 in decorating supplies in the course of this accounting period. The Decorating Supplies account decreases by $6,180 and Decorating Supplies Expense increases by $6,180. Remember that increasing expense accounts decreases total equity so the effect on Decorating Supplies Expense decreases total equity.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2E: Cost of Goods Sold and Income Statement Schuch Company presents you with the following account...

Related questions

Question

It told me the answer after getting it incorrect but didn’t tell me how to calculate it for future problems similar to this concept. Can someone help me please?

Transcribed Image Text:QUANTUM

Accounting Equation

Accounting Journal

IAccounting Ledger

Accounting Equation

e. - The Decorating Supplies account started the year with a balance of $6,540.

During 2010, the company purchased $1,250 in additional decorating supplies,

which was added to the account. An İnventory count at the end of the year showed

Paula's Interiors had $1,610 of decorating supplies on hand.

Assets

Liabilities

Equity

%3D

Decorating Supplies

-6,180

Decorating Supplies

Expense

-6,180

%3D

+

Show me how to do this step:

The company started with $6,540 c Decorating Supplies on hand and bought $1,250

more during the accounting period.During this accounting period, the company also

used the decorating supplies and ended up with a final balance of $1,610. This means

they used a total of $6,540 + $1,250 - $1,610 = $6,180 in decorating supplies in the

course of this accounting period. The Decorating Supplies account decreases by

$6,180 and Decorating Supplies Expense increases by $6,180. Remember that

increasing expense accounts decreases total equity so the effect on Decorating

Supplies Expense decreases total equity.

Ask a Question

Analyzing the Event

O Why do we need adjusting entries?

O How did this affect the company's assets?

Did this cause liabilities or equity to change?

How did you get $6,180 as the amount to adjust?

How do I check if this transaction kept the accounting equation in balance?

Is this an adjustment for an accrued expense or a deferred expense?

Potential Misconceptions

O Does recording an expense always mean assets are reduced?

Why don't you adjust the Decorating Supplies account as the supplies are used?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning