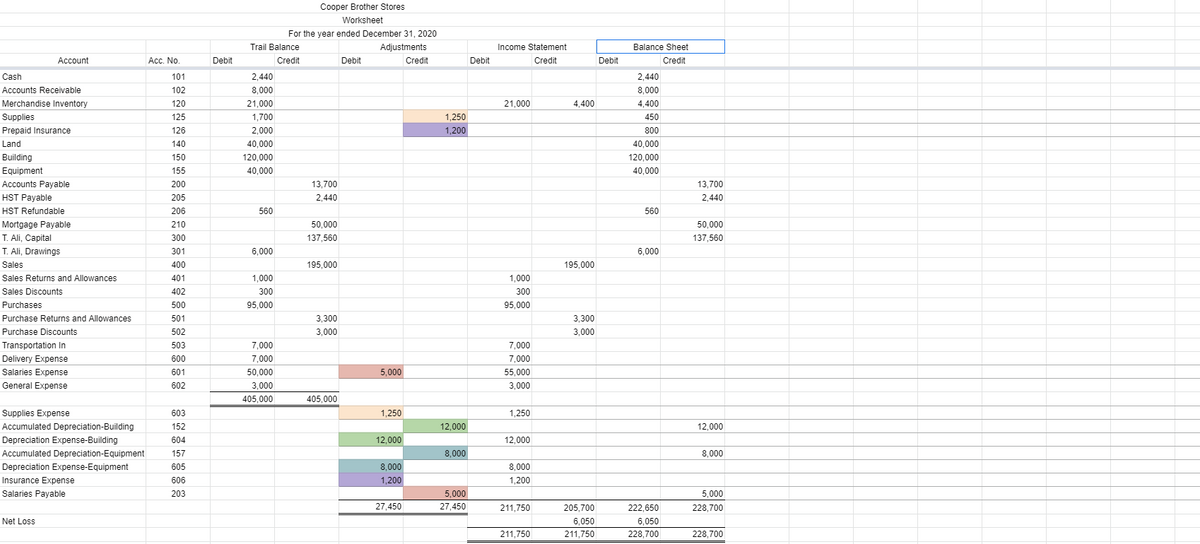

Worksheet For the year ended December 31, 2020 Trail Balance Adjustments Income Statement Balance Sheet Account Acc. No. Debit Credit Debit Credit Debit Credit Debit Credit 101 2,440 2,440 unts Receivable nandise Inventory les id Insurance 102 8,000 8,000 120 21,000 21,000 4,400 4,400 125 1,700 1,250 450 126 2,000 1,200 800 140 40,000 40,000 ng ment unts Payable Рayable Refundable 150 120,000 120,000 155 40,000 40,000 200 13,700 13,700 205 2,440 2,440 206 560 560 age Payable 210 50,000 50,000 Сaptal 300 137,560 137,560 Drawings 301 6,000 6,000 400 195,000 195,000 Returns and Allowances 401 1,000 1,000 Discounts 402 300 300 ases 500 95,000 95,000 ase Returns and Allowances 501 3,300 3,300 ase Discounts portation in ery Expense es Expense ral Expense 502 3,000 3,000 503 7,000 7,000 600 7,000 7,000 601 50,000 5,000 55,000 602 3,000 3,000 405,000 405.000 les Expense mulated Depreciation-Building 603 1,250 1,250 152 12,000 12,000 eciation Expense-Building 604 12,000 12,000 mulated Depreciation-Equipment eciation Expense-Equipment ance Expense es Payable 157 8,000 8,000 605 8,000 8,000 606 1,200 1,200 203 5,000 5,000 27,450 27,450 211,750 205,700 222,650 228,700 oss 6,050 6,050 211 750 211 750 228 700 228 700

Worksheet For the year ended December 31, 2020 Trail Balance Adjustments Income Statement Balance Sheet Account Acc. No. Debit Credit Debit Credit Debit Credit Debit Credit 101 2,440 2,440 unts Receivable nandise Inventory les id Insurance 102 8,000 8,000 120 21,000 21,000 4,400 4,400 125 1,700 1,250 450 126 2,000 1,200 800 140 40,000 40,000 ng ment unts Payable Рayable Refundable 150 120,000 120,000 155 40,000 40,000 200 13,700 13,700 205 2,440 2,440 206 560 560 age Payable 210 50,000 50,000 Сaptal 300 137,560 137,560 Drawings 301 6,000 6,000 400 195,000 195,000 Returns and Allowances 401 1,000 1,000 Discounts 402 300 300 ases 500 95,000 95,000 ase Returns and Allowances 501 3,300 3,300 ase Discounts portation in ery Expense es Expense ral Expense 502 3,000 3,000 503 7,000 7,000 600 7,000 7,000 601 50,000 5,000 55,000 602 3,000 3,000 405,000 405.000 les Expense mulated Depreciation-Building 603 1,250 1,250 152 12,000 12,000 eciation Expense-Building 604 12,000 12,000 mulated Depreciation-Equipment eciation Expense-Equipment ance Expense es Payable 157 8,000 8,000 605 8,000 8,000 606 1,200 1,200 203 5,000 5,000 27,450 27,450 211,750 205,700 222,650 228,700 oss 6,050 6,050 211 750 211 750 228 700 228 700

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 12E: Retail Inventory Method The following data were available from Hegge Department Stores records for...

Related questions

Question

can you please create an income statement and a classified

Transcribed Image Text:Cooper Brother Stores

Worksheet

For the year ended December 31, 2020

Trail Balance

Adjustments

Income Statement

Balance Sheet

Account

Асс. No.

Debit

Credit

Debit

Credit

Debit

Credit

Debit

Credit

Cash

101

2,440

2,440

Accounts Receivable

102

8,000

8,000

Merchandise Inventory

120

21,000

21,000

4,400

4,400

Supplies

125

1,700

1,250

450

Prepaid Insurance

126

2,000

1,200

800

Land

140

40,000

40,000

Building

150

120,000

120,000

Equipment

155

40,000

40,000

Accounts Payable

200

13,700

13,700

HST Payable

205

2,440

2,440

HST Refundable

206

560

560

Mortgage Payable

210

50,000

50,000

T. Ali, Capital

T. Ali, Drawings

300

137,560

137,560

301

6,000

6,000

Sales

400

195,000

195,000

Sales Returns and Allowances

401

1,000

1,000

Sales Discounts

402

300

300

Purchases

500

95,000

95,000

Purchase Returns and Allowances

501

3,300

3,300

Purchase Discounts

502

3,000

3,000

Transportation In

503

7,000

7,000

Delivery Expense

600

7,000

7,000

Salaries Expense

601

50,000

5,000

55,000

General Expense

602

3,000

3,000

405,000

405.000

Supplies Expense

603

1,250

1,250

Accumulated Depreciation-Building

152

12,000

12,000

Depreciation Expense-Building

604

12,000

12,000

Accumulated Depreciation-Equipment

157

8,000

8,000

Depreciation Expense-Equipment

605

8,000

8,000

Insurance Expense

606

1,200

1,200

Salaries Payable

203

5,000

5,000

27,450

27,450

211,750

205,700

222,650

228,700

Net Loss

6,050

6,050

211,750

211,750

228,700

228,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College