Wren, Inc., a nonpublic company, retains Ying and Company CPA to audit its financial statements and internal control. Sarah Smith, the senior on the audit prepared the following first draft of an unmodified report:

Wren, Inc., a nonpublic company, retains Ying and Company CPA to audit its financial statements and internal control. Sarah Smith, the senior on the audit prepared the following first draft of an unmodified report:

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter13: Auditing Debt, Equity, And Long-term Liabilities Requiring Management Estimates

Section: Chapter Questions

Problem 15RQSC

Related questions

Question

Transcribed Image Text:O LO 2-4

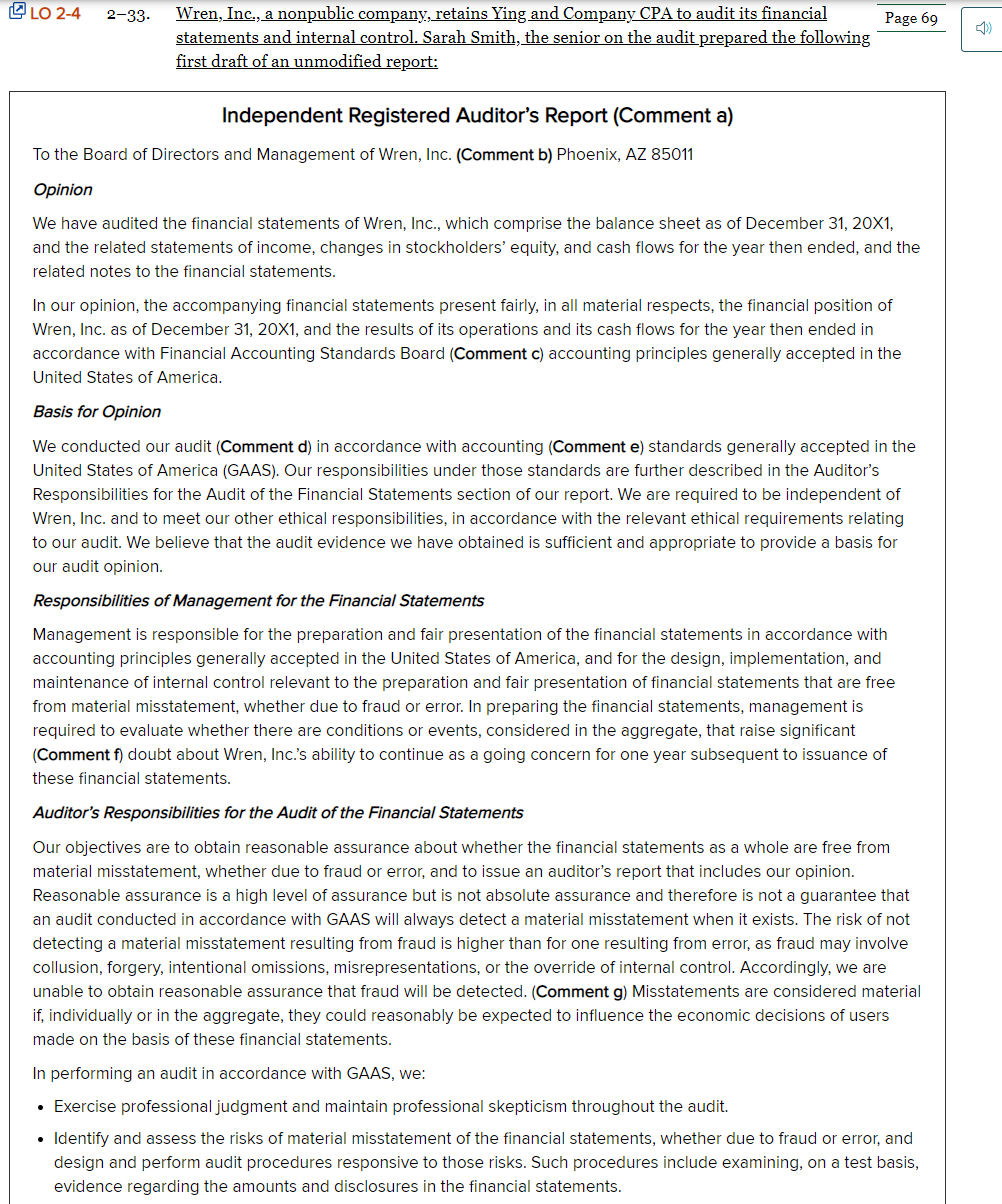

Wren, Inc., a nonpublic company, retains Ying and Company CPA to audit its financial

statements and internal control. Sarah Smith, the senior on the audit prepared the following

first draft of an unmodified report:

2-33.

Page 69

Independent Registered Auditor's Report (Comment a)

To the Board of Directors and Management of Wren, Inc. (Comment b) Phoenix, AZ 85011

Opinion

We have audited the financial statements of Wren, Inc., which comprise the balance sheet as of December 31, 20X1,

and the related statements of income, changes in stockholders' equity, and cash flows for the year then ended, and the

related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of

Wren, Inc. as of December 31, 20X1, and the results of its operations and its cash flows for the year then ended in

accordance with Financial Accounting Standards Board (Comment c) accounting principles generally accepted in the

United States of America.

Basis for Opinion

We conducted our audit (Comment d) in accordance with accounting (Comment e) standards generally accepted in the

United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor's

Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of

Wren, Inc. and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating

to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for

our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with

accounting principles generally accepted in the United States of America, and for the design, implementation, and

maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free

from material misstatement, whether due to fraud or error. In preparing the financial statements, management is

required to evaluate whether there are conditions or events, considered in the aggregate, that raise significant

(Comment f) doubt about Wren, Inc.'s ability to continue as a going concern for one year subsequent to issuance of

these financial statements.

Auditor's Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion.

Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that

an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not

detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve

collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Accordingly, we are

unable to obtain reasonable assurance that fraud will be detected. (Comment g) Misstatements are considered material

if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users

made on the basis of these financial statements.

In performing an audit in accordance with GAAS, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and

design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis,

evidence regarding the amounts and disclosures in the financial statements.

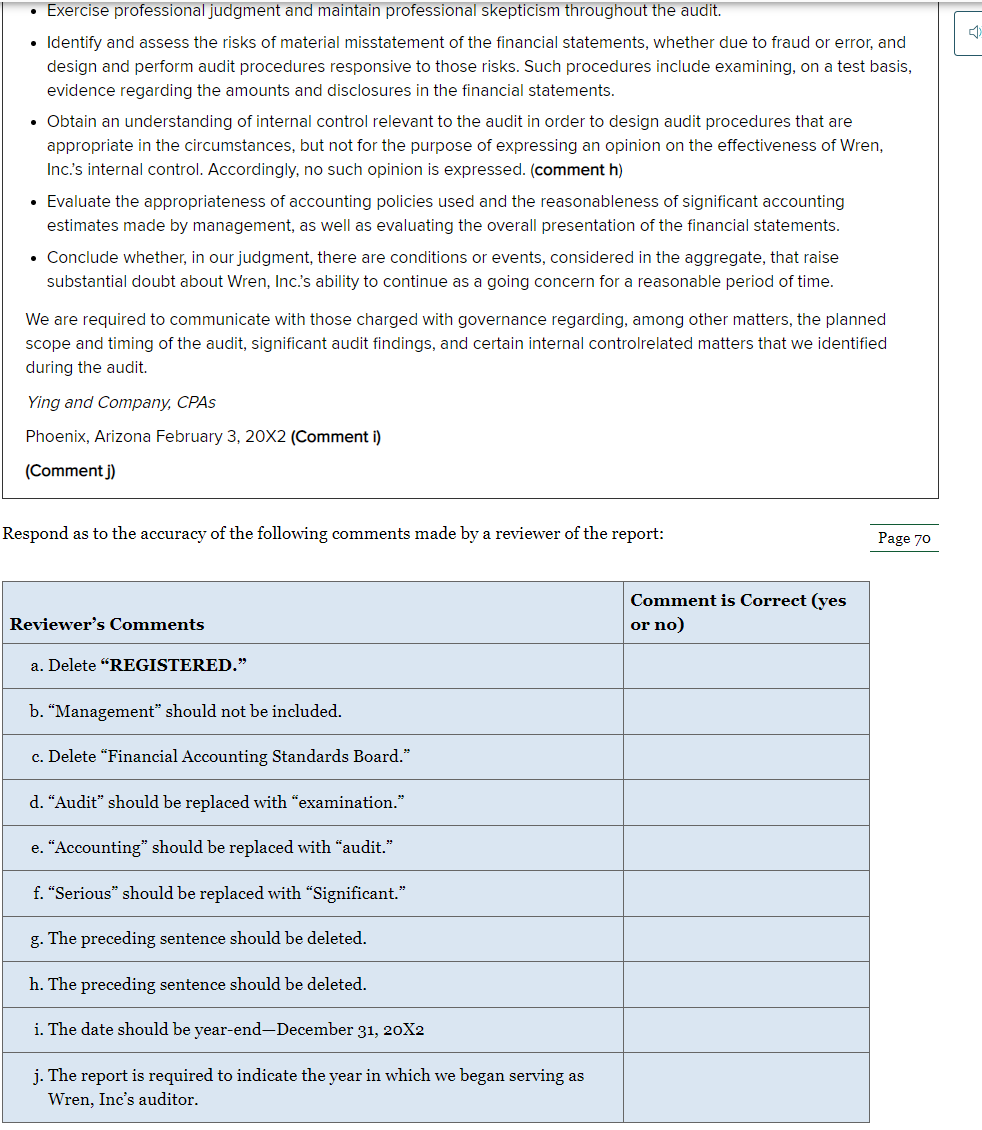

Transcribed Image Text:• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and

design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis,

evidence regarding the amounts and disclosures in the financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Wren,

Inc's internal control. Accordingly, no such opinion is expressed. (comment h)

• Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluating the overall presentation of the financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise

substantial doubt about Wren, Inc's ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned

scope and timing of the audit, significant audit findings, and certain internal controlrelated matters that we identified

during the audit.

Ying and Company, CPAS

Phoenix, Arizona February 3, 20X2 (Comment i)

(Comment j)

Respond as to the accuracy of the following comments made by a reviewer of the report:

Page 70

Comment is Correct (yes

Reviewer's Comments

or no)

a. Delete "REGISTERED."

b. “Management" should not be included.

c. Delete “Financial Accounting Standards Board."

d. “Audit" should be replaced with “examination."

e. “Accounting" should be replaced with "audit."

f. “Serious" should be replaced with “Significant."

g. The preceding sentence should be deleted.

h. The preceding sentence should be deleted.

i. The date should be year-end-December 31, 20X2

j. The report is required to indicate the year in which we began serving as

Wren, Inc's auditor.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub