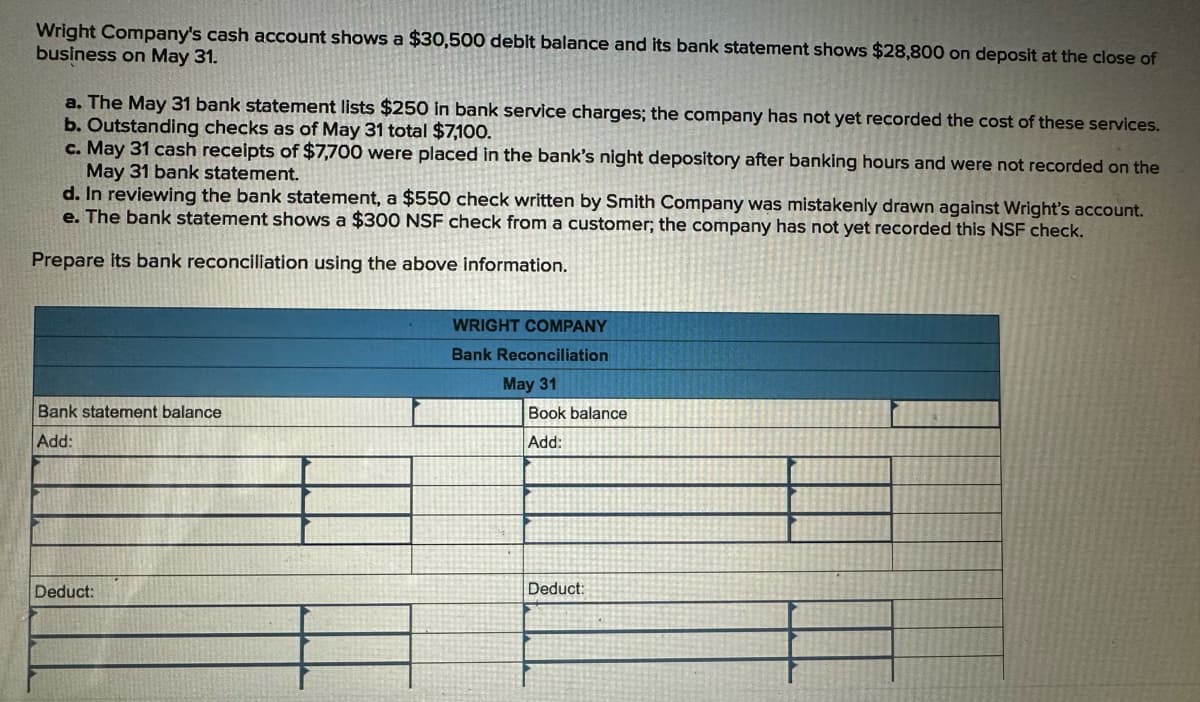

Wright Company's cash account shows a $30,500 debit balance and its bank statement shows $28,800 on deposit at the close of business on May 31. a. The May 31 bank statement lists $250 in bank service charges; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $7,100. c. May 31 cash receipts of $7,700 were placed in the bank's night depository after banking hours and were not recorded on the May 31 bank statement. d. In reviewing the bank statement, a $550 check written by Smith Company was mistakenly drawn against Wright's account. e. The bank statement shows a $300 NSF check from a customer; the company has not yet recorded this NSF check. Prepare its bank reconciliation using the above information. Bank statement balance Add: Deduct: WRIGHT COMPANY Bank Reconciliation May 31 Book balance Add: Deduct:

Wright Company's cash account shows a $30,500 debit balance and its bank statement shows $28,800 on deposit at the close of business on May 31. a. The May 31 bank statement lists $250 in bank service charges; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $7,100. c. May 31 cash receipts of $7,700 were placed in the bank's night depository after banking hours and were not recorded on the May 31 bank statement. d. In reviewing the bank statement, a $550 check written by Smith Company was mistakenly drawn against Wright's account. e. The bank statement shows a $300 NSF check from a customer; the company has not yet recorded this NSF check. Prepare its bank reconciliation using the above information. Bank statement balance Add: Deduct: WRIGHT COMPANY Bank Reconciliation May 31 Book balance Add: Deduct:

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

Please provide graph answer

Transcribed Image Text:Wright Company's cash account shows a $30,500 debit balance and its bank statement shows $28,800 on deposit at the close of

business on May 31.

a. The May 31 bank statement lists $250 in bank service charges; the company has not yet recorded the cost of these services.

b. Outstanding checks as of May 31 total $7,100.

c. May 31 cash receipts of $7,700 were placed in the bank's night depository after banking hours and were not recorded on the

May 31 bank statement.

d. In reviewing the bank statement, a $550 check written by Smith Company was mistakenly drawn against Wright's account.

e. The bank statement shows a $300 NSF check from a customer; the company has not yet recorded this NSF check.

Prepare its bank reconciliation using the above information.

Bank statement balance

Add:

Deduct:

WRIGHT COMPANY

Bank Reconciliation

May 31

Book balance

Add:

Deduct:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College