Write a pseudocode that would ask for the monthly compute for the annual income tax based on the table "Income Tax Tables under TRAIN Law. Ensure that personal exemptions are deducted from the annual income tax. Please refer to the

Write a pseudocode that would ask for the monthly compute for the annual income tax based on the table "Income Tax Tables under TRAIN Law. Ensure that personal exemptions are deducted from the annual income tax. Please refer to the

Computer Networking: A Top-Down Approach (7th Edition)

7th Edition

ISBN:9780133594140

Author:James Kurose, Keith Ross

Publisher:James Kurose, Keith Ross

Chapter1: Computer Networks And The Internet

Section: Chapter Questions

Problem R1RQ: What is the difference between a host and an end system? List several different types of end...

Related questions

Question

Please help to solve this:

Thank you!

Transcribed Image Text:Vea Optiona

Y are vewing to See's semen

18m ago

O DISCORD

huh egeneral-chat-e, CHAT AREA)

aight just dm me na Ing

Description:

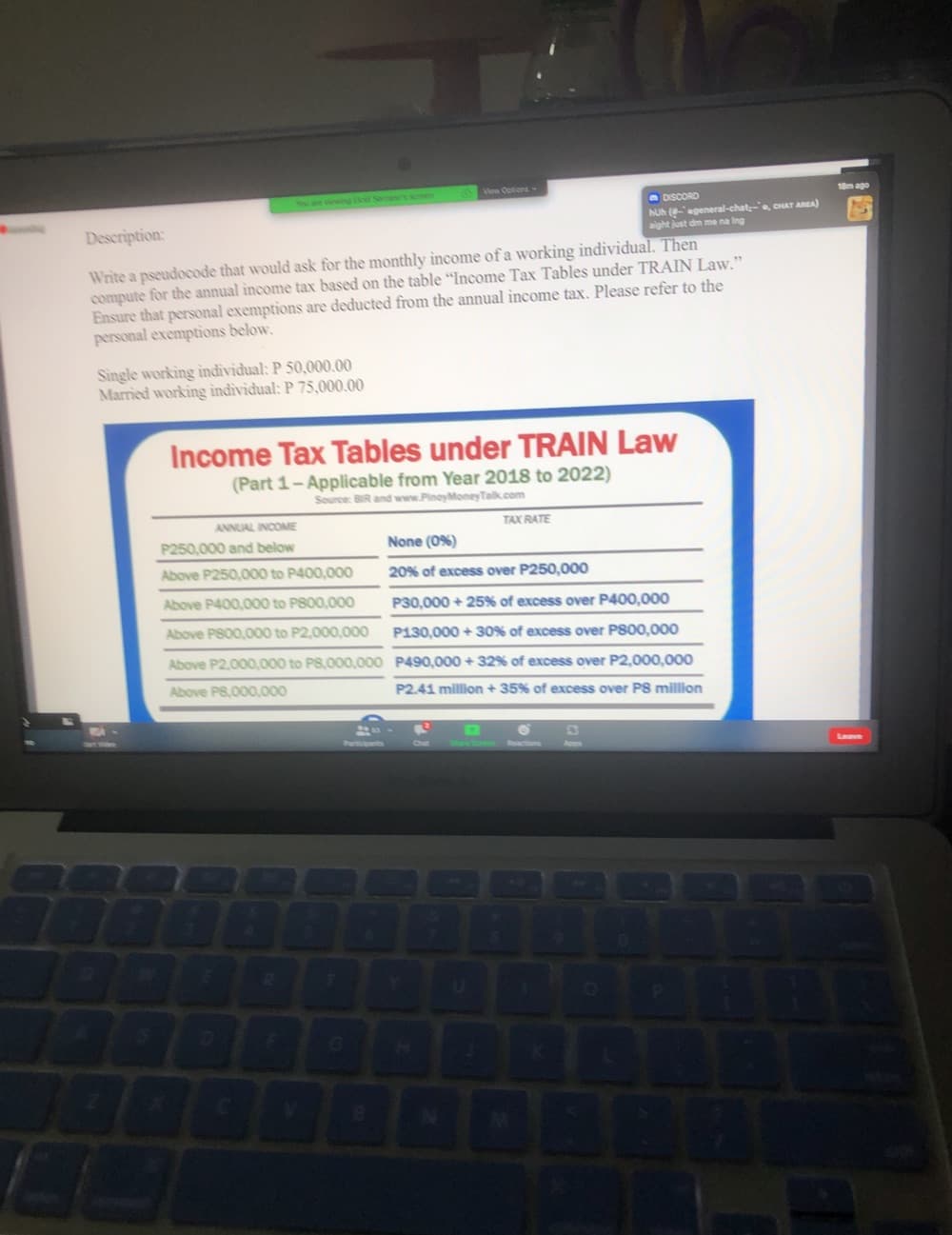

Write a pseudocode that would ask for the monthly income of a working individual. Then

compute for the annual income tax based on the table "Income Tax Tables under TRAIN Law."

Ensure that personal exemptions are deducted from the annual income tax. Please refer to the

personal exemptions below.

Single working iìndividual: P 50,000.00

Married working individual: P 75,000.00

Income Tax Tables under TRAIN Law

(Part 1-Applicable from Year 2018 to 2022)

Source: BIR and www.PinoyMoneyTalk.com

ANNUAL INCOME

TAX RATE

P250,000 and below

None (0%)

Above P250,000 to P400,000

20% of excess over P250,000

Above P400,000 to P800,000

P30,000 + 25% of excess over P400,000

Above P800,000 to P2,000,000

P130,000 + 30% of excess over P800,000

Above P2,000,000 to P8,000,000 P490,000 + 32% of excess over P2,000,000

Above P8,000,000

P2.41 million + 35% of excess over P8 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Computer Networking: A Top-Down Approach (7th Edi…

Computer Engineering

ISBN:

9780133594140

Author:

James Kurose, Keith Ross

Publisher:

PEARSON

Computer Organization and Design MIPS Edition, Fi…

Computer Engineering

ISBN:

9780124077263

Author:

David A. Patterson, John L. Hennessy

Publisher:

Elsevier Science

Network+ Guide to Networks (MindTap Course List)

Computer Engineering

ISBN:

9781337569330

Author:

Jill West, Tamara Dean, Jean Andrews

Publisher:

Cengage Learning

Computer Networking: A Top-Down Approach (7th Edi…

Computer Engineering

ISBN:

9780133594140

Author:

James Kurose, Keith Ross

Publisher:

PEARSON

Computer Organization and Design MIPS Edition, Fi…

Computer Engineering

ISBN:

9780124077263

Author:

David A. Patterson, John L. Hennessy

Publisher:

Elsevier Science

Network+ Guide to Networks (MindTap Course List)

Computer Engineering

ISBN:

9781337569330

Author:

Jill West, Tamara Dean, Jean Andrews

Publisher:

Cengage Learning

Concepts of Database Management

Computer Engineering

ISBN:

9781337093422

Author:

Joy L. Starks, Philip J. Pratt, Mary Z. Last

Publisher:

Cengage Learning

Prelude to Programming

Computer Engineering

ISBN:

9780133750423

Author:

VENIT, Stewart

Publisher:

Pearson Education

Sc Business Data Communications and Networking, T…

Computer Engineering

ISBN:

9781119368830

Author:

FITZGERALD

Publisher:

WILEY