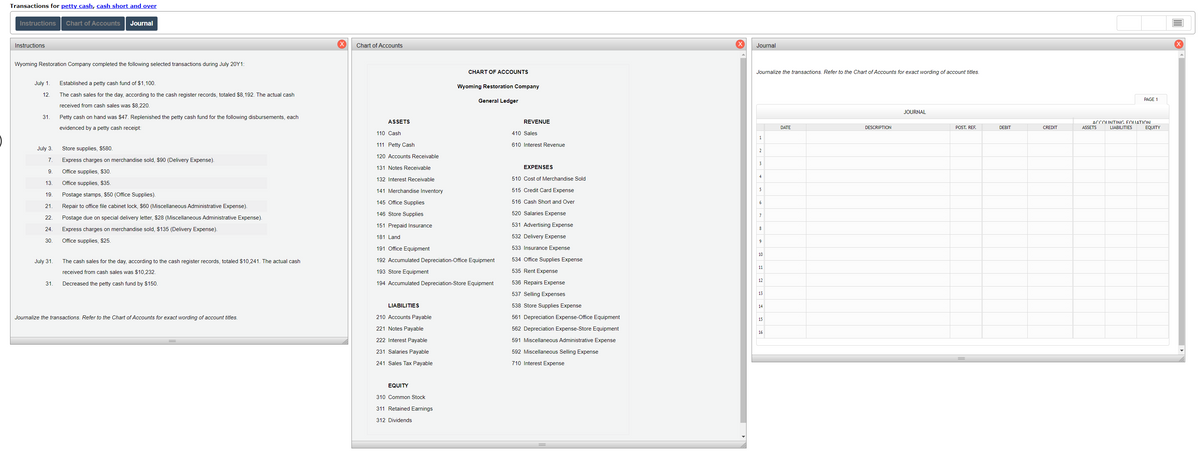

Wyoming Restoration Company completed the following selected transactions during July 20Y1: July 1. Established a petty cash fund of $1,100. 12. The cash sales for the day, according to the cash register records, totaled $8,192. The actual cash received from cash sales was $8,220. 31. Petty cash on hand was $47. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt: July 3. Store supplies, $580. 7. Express charges on merchandise sold, $90 (Delivery Expense). 9. Office supplies, $30. 13. Office supplies, $35. 19. Postage stamps, $50 (Office Supplies). 21. Repair to office file cabinet lock, $60 (Miscellaneous Administrative Expense). 22. Postage due on special delivery letter, $28 (Miscellaneous Administrative Expense). 24. Express charges on merchandise sold, $135 (Delivery Expense). 30. Office supplies, $25. July 31. The cash sales for the day, according to the cash register records, totaled $10,241. The actual cash received from cash sales was $10,232. 31. Decreased the petty cash fund by $150. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles.

Wyoming Restoration Company completed the following selected transactions during July 20Y1:

July 1. Established a petty cash fund of $1,100.

12. The cash sales for the day, according to the cash register records, totaled $8,192. The actual cash received from cash sales was $8,220.

31. Petty cash on hand was $47. Replenished the petty cash fund for the following disbursements, each evidenced by a petty cash receipt:

July 3. Store supplies, $580.

7. Express charges on merchandise sold, $90 (Delivery Expense).

9. Office supplies, $30.

13. Office supplies, $35.

19. Postage stamps, $50 (Office Supplies).

21. Repair to office file cabinet lock, $60 (Miscellaneous Administrative Expense).

22. Postage due on special delivery letter, $28 (Miscellaneous Administrative Expense).

24. Express charges on merchandise sold, $135 (Delivery Expense).

30. Office supplies, $25.

July 31. The cash sales for the day, according to the cash register records, totaled $10,241. The actual cash received from cash sales was $10,232.

31. Decreased the petty cash fund by $150.

Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images