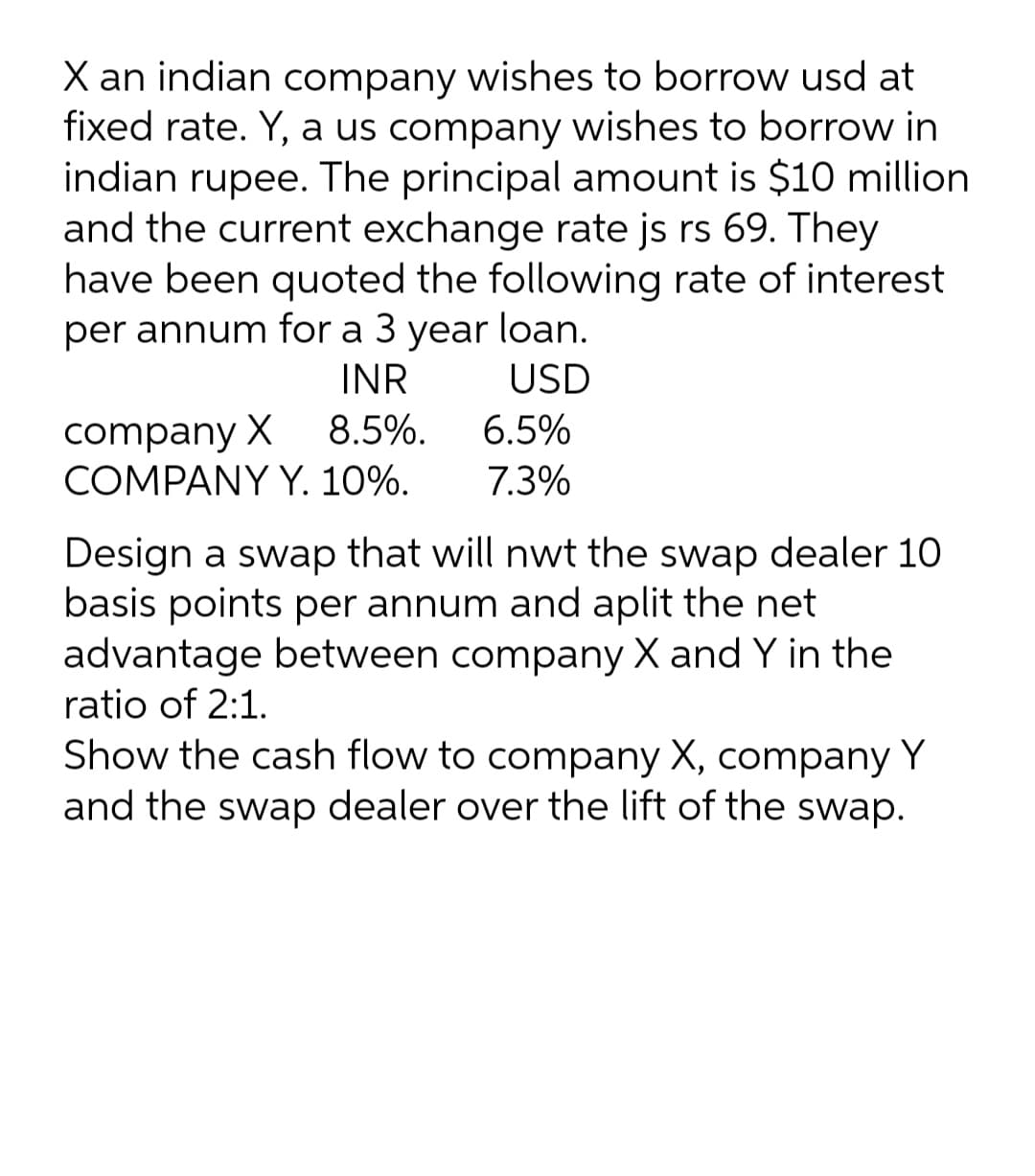

X an indian company wishes to borrow usd at fixed rate. Y, a us company wishes to borrow in indian rupee. The principal amount is $10 million and the current exchange rate js rs 69. They have been quoted the following rate of interest per annum for a 3 year loan. INR USD company X 8.5%. COMPANY Y. 10%. 6.5% 7.3% Design a swap that will nwt the swap dealer 10 basis points per annum and aplit the net advantage between company X and Y in the ratio of 2:1. Show the cash flow to company X, company Y and the swap dealer over the lift of the swap.

X an indian company wishes to borrow usd at fixed rate. Y, a us company wishes to borrow in indian rupee. The principal amount is $10 million and the current exchange rate js rs 69. They have been quoted the following rate of interest per annum for a 3 year loan. INR USD company X 8.5%. COMPANY Y. 10%. 6.5% 7.3% Design a swap that will nwt the swap dealer 10 basis points per annum and aplit the net advantage between company X and Y in the ratio of 2:1. Show the cash flow to company X, company Y and the swap dealer over the lift of the swap.

Chapter8: Relationships Among Inflation, Interest Rates, And Exchange Rates

Section: Chapter Questions

Problem 44QA

Related questions

Question

Transcribed Image Text:X an indian company wishes to borrow usd at

fixed rate. Y, a us company wishes to borrow in

indian rupee. The principal amount is $10 million

and the current exchange rate js rs 69. They

have been quoted the following rate of interest

loan.

per annum for a 3

year

INR

USD

company X

COMPANY Y. 10%.

8.5%.

6.5%

7.3%

Design a swap that will nwt the swap dealer 10

basis points per annum and aplit the net

advantage between company X and Y in the

ratio of 2:1.

Show the cash flow to company X, company Y

and the swap dealer over the lift of the swap.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you