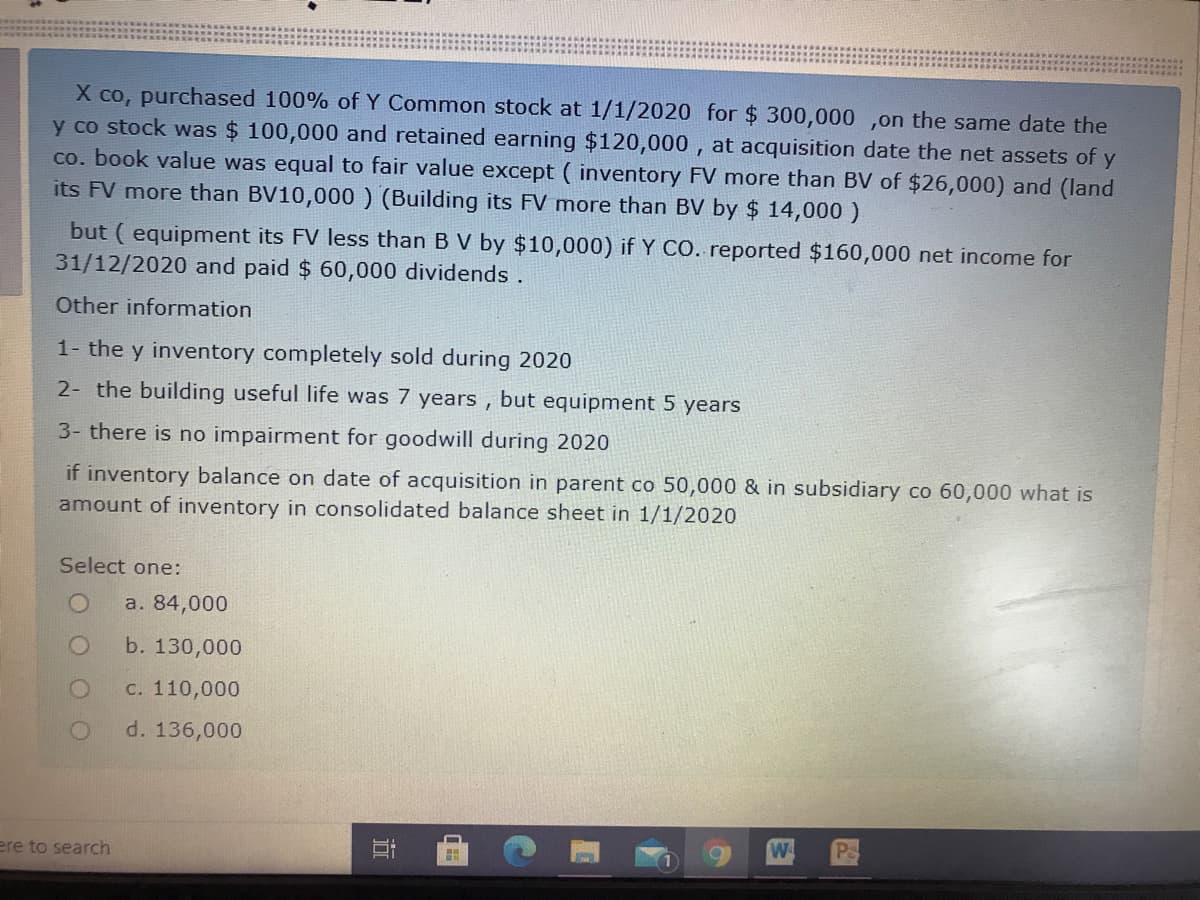

X co, purchased 100% of Y Common stock at 1/1/2020 for $ 300,000 ,on the same date the y co stock was $ 100,000 and retained earning $120,000 , at acquisition date the net assets of y co. book value was equal to fair value except ( inventory FV more than BV of $26,000) and (land its FV more than BV10,000 ) (Building its FV more than BV by $ 14,000 ) but ( equipment its FV less than B V by $10,000) if Y CO. reported $160,000 net income for 31/12/2020 and paid $ 60,000 dividends. Other information 1- the y inventory completely sold during 2020 2- the building useful life was 7 years, but equipment 5 years 3- there is no impairment for goodwill during 2020 if inventory balance on date of acquisition in parent co 50,000 & in subsidiary co 60,000 what is amount of inventory in consolidated balance sheet in 1/1/2020 Select one: a. 84,000 b. 130,000 C. 110,000 d. 136,000

X co, purchased 100% of Y Common stock at 1/1/2020 for $ 300,000 ,on the same date the y co stock was $ 100,000 and retained earning $120,000 , at acquisition date the net assets of y co. book value was equal to fair value except ( inventory FV more than BV of $26,000) and (land its FV more than BV10,000 ) (Building its FV more than BV by $ 14,000 ) but ( equipment its FV less than B V by $10,000) if Y CO. reported $160,000 net income for 31/12/2020 and paid $ 60,000 dividends. Other information 1- the y inventory completely sold during 2020 2- the building useful life was 7 years, but equipment 5 years 3- there is no impairment for goodwill during 2020 if inventory balance on date of acquisition in parent co 50,000 & in subsidiary co 60,000 what is amount of inventory in consolidated balance sheet in 1/1/2020 Select one: a. 84,000 b. 130,000 C. 110,000 d. 136,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 24E

Related questions

Question

Transcribed Image Text:X co, purchased 100% of Y Common stock at 1/1/2020 for $ 300,000 ,on the same date the

y co stock was $ 100,000 and retained earning $120,000 , at acquisition date the net assets of y

co. book value was equal to fair value except ( inventory FV more than BV of $26,000) and (land

its FV more than BV10,000 ) (Building its FV more than BV by $ 14,000 )

but ( equipment its FV less than B V by $10,000) if Y CO. reported $160,000 net income for

31/12/2020 and paid $ 60,000 dividends.

Other information

1- the y inventory completely sold during 2020

2- the building useful life was 7 years ,

but

equipment 5 years

3- there is no impairment for goodwill during 2020

if inventory balance on date of acquisition in parent co 50,000 & in subsidiary co 60,000 what is

amount of inventory in consolidated balance sheet in 1/1/2020

Select one:

a. 84,000

b. 130,000

C. 110,000

d. 136,000

ere to search

近

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning