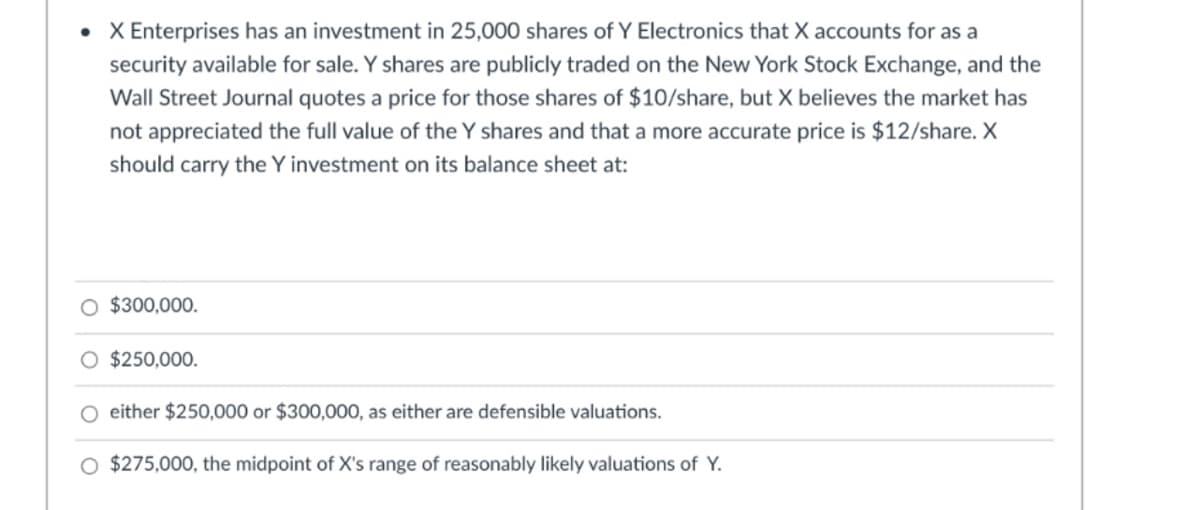

• X Enterprises has an investment in 25,000 shares of Y Electronics that X accounts for as a security available for sale. Y shares are publicly traded on the New York Stock Exchange, and the Wall Street Journal quotes a price for those shares of $10/share, but X believes the market has not appreciated the full value of the Y shares and that a more accurate price is $12/share. X should carry the Y investment on its balance sheet at: O $300,000. O $250,000. O either $250,000 or $300,000, as either are defensible valuations. O $275,000, the midpoint of X's range of reasonably likely valuations of Y.

• X Enterprises has an investment in 25,000 shares of Y Electronics that X accounts for as a security available for sale. Y shares are publicly traded on the New York Stock Exchange, and the Wall Street Journal quotes a price for those shares of $10/share, but X believes the market has not appreciated the full value of the Y shares and that a more accurate price is $12/share. X should carry the Y investment on its balance sheet at: O $300,000. O $250,000. O either $250,000 or $300,000, as either are defensible valuations. O $275,000, the midpoint of X's range of reasonably likely valuations of Y.

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:• X Enterprises has an investment in 25,000 shares of Y Electronics that X accounts for as a

security available for sale. Y shares are publicly traded on the New York Stock Exchange, and the

Wall Street Journal quotes a price for those shares of $10/share, but X believes the market has

not appreciated the full value of the Y shares and that a more accurate price is $12/share. X

should carry the Y investment on its balance sheet at:

O $300,000.

$250,000.

O either $250,000 or $300,000, as either are defensible valuations.

O $275,000, the midpoint of X's range of reasonably likely valuations of Y.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning