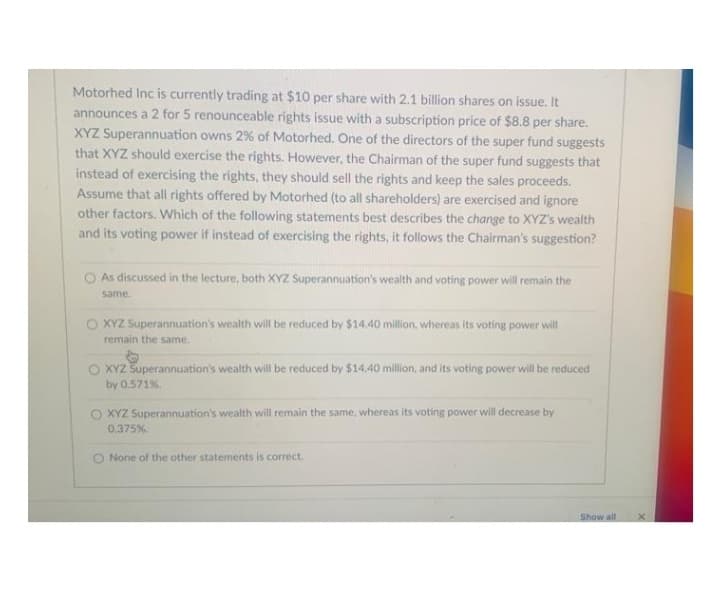

Motorhed Inc is currently trading at $10 per share with 2.1 billion shares on issue. It announces a 2 for 5 renounceable rights issue with a subscription price of $8.8 per share. XYZ Superannuation owns 2% of Motorhed. One of the directors of the super fund suggests that XYZ should exercise the rights. However, the Chairman of the super fund suggests that instead of exercising the rights, they should sell the rights and keep the sales proceeds. Assume that all rights offered by Motorhed (to all shareholders) are exercised and ignore other factors. Which of the following statements best describes the change to XYZ's wealth and its voting power if instead of exercising the rights, it follows the Chairman's suggestion? O As discussed in the lecture, both XYZ Superannuation's wealth and voting power will remain the same. O XYZ Superannuation's wealth will be reduced by $14.40 million, whereas its voting power will remain the same. O XYZ Superannuation's wealth will be reduced by $14.40 million, and its voting power will be reduced by 0.571%. O XYZ Superannuation's wealth will remain the same, whereas its voting power will decrease by 0.375%. None of the other statements is correct.

Motorhed Inc is currently trading at $10 per share with 2.1 billion shares on issue. It announces a 2 for 5 renounceable rights issue with a subscription price of $8.8 per share. XYZ Superannuation owns 2% of Motorhed. One of the directors of the super fund suggests that XYZ should exercise the rights. However, the Chairman of the super fund suggests that instead of exercising the rights, they should sell the rights and keep the sales proceeds. Assume that all rights offered by Motorhed (to all shareholders) are exercised and ignore other factors. Which of the following statements best describes the change to XYZ's wealth and its voting power if instead of exercising the rights, it follows the Chairman's suggestion? O As discussed in the lecture, both XYZ Superannuation's wealth and voting power will remain the same. O XYZ Superannuation's wealth will be reduced by $14.40 million, whereas its voting power will remain the same. O XYZ Superannuation's wealth will be reduced by $14.40 million, and its voting power will be reduced by 0.571%. O XYZ Superannuation's wealth will remain the same, whereas its voting power will decrease by 0.375%. None of the other statements is correct.

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 12P

Related questions

Question

M2

Transcribed Image Text:Motorhed Inc is currently trading at $10 per share with 2.1 billion shares on issue. It

announces a 2 for 5 renounceable rights issue with a subscription price of $8.8 per share.

XYZ Superannuation owns 2 % of Motorhed. One of the directors of the super fund suggests

that XYZ should exercise the rights. However, the Chairman of the super fund suggests that

instead of exercising the rights, they should sell the rights and keep the sales proceeds.

Assume that all rights offered by Motorhed (to all shareholders) are exercised and ignore

other factors. Which of the following statements best describes the change to XYZ's wealth

and its voting power if instead of exercising the rights, it follows the Chairman's suggestion?

As discussed in the lecture, both XYZ Superannuation's wealth and voting power will remain the

same.

O XYZ Superannuation's wealth will be reduced by $14.40 million, whereas its voting power will

remain the same.

O XYZ Superannuation's wealth will be reduced by $14.40 million, and its voting power will be reduced

by 0.571%.

O XYZ Superannuation's wealth will remain the same, whereas its voting power will decrease by

0.375%.

O None of the other statements is correct.

Show all

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT