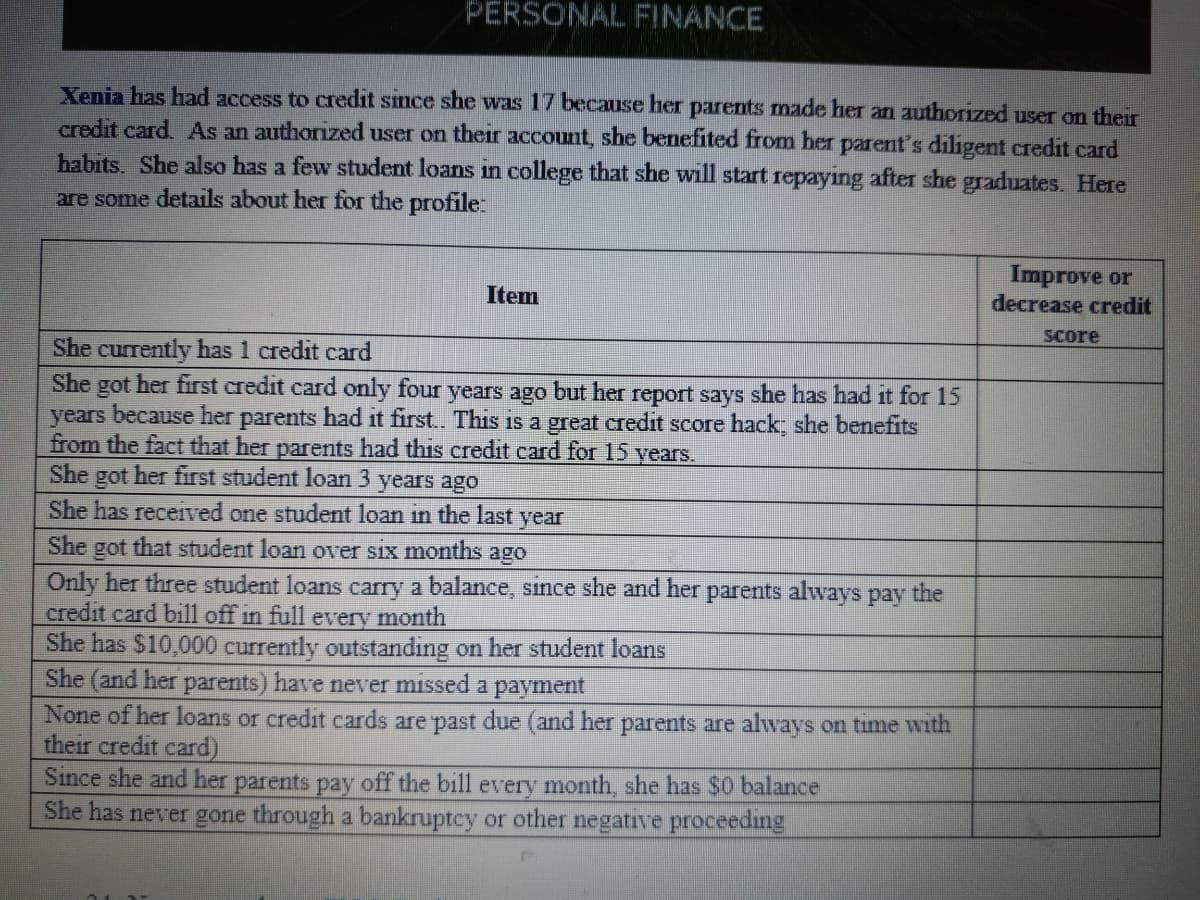

Xenia has had access to credit since she was 17 because her parents made her an authorized user on their credit card. As an authorized user on their account, she benefited from her parent's diligent credit card habits. She also has a few student loans in college that she will start repaying after she graduates. Here are some details about her for the profile:

Xenia has had access to credit since she was 17 because her parents made her an authorized user on their credit card. As an authorized user on their account, she benefited from her parent's diligent credit card habits. She also has a few student loans in college that she will start repaying after she graduates. Here are some details about her for the profile:

Chapter6: Building And Maintaining Good Credit

Section: Chapter Questions

Problem 2FPC

Related questions

Question

I need help with this chart please

Transcribed Image Text:PERSONAL FINANCE

Xenia has had access to credit since she was 17 because her parents made her an authorized user on their

credit card. As an authorized user on their account, she benefited from her parent's diligent credit card

habits. She also has a few student loans in college that she will start repaying after she graduates. Here

are some details about her for the profile

Improve or

decrease credit

Item

Score

She currently has 1 credit card

She

her first credit card only four years ago but her report says she has had it for 15

got

years because her parents had it first. This is a great credit score hack she benefits

from the fact that her parents had this credit card for 15 years.

got her first student loan 3 years ago

She

She has received one student loan in the last year

She got that student loan over six months ago

Only her three student loans carry a balance, since she and her parents always pay the

credit card bill off in full every month

She has $10,000 currently outstanding on her student loans

She (and her parents) have never missed a payment

None of her loans or credit cards are past due (and her parents are always on time with

their credit card)

Since she and her parents pay off the bill every month, she has $0 balance

She has never gone through a bankruptey or other negative proceeding

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning