xercise letion of Hat A company pays $912,000 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $72,000 cash to access the mine, which is estimated to hold 120,000 tons of iron. The estimated value of the land after the iron is removed is $24,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Prepare the January 1 entry to record the cost of the iron mine. 2. Prepare the December 31 year-end adjusting entry if 26,000 tons of iron are mined but only 22,000 tons are sold the first year. Answer is not complete. No Date General Journal Debit Credit 1 Jan 01 Accumulated depreciation-Iron Mine 984,000 O 984,000 2 Dec 31 Accumulated depletion-Iron Mine 192,000 x 192,000 X

xercise letion of Hat A company pays $912,000 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $72,000 cash to access the mine, which is estimated to hold 120,000 tons of iron. The estimated value of the land after the iron is removed is $24,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1. Prepare the January 1 entry to record the cost of the iron mine. 2. Prepare the December 31 year-end adjusting entry if 26,000 tons of iron are mined but only 22,000 tons are sold the first year. Answer is not complete. No Date General Journal Debit Credit 1 Jan 01 Accumulated depreciation-Iron Mine 984,000 O 984,000 2 Dec 31 Accumulated depletion-Iron Mine 192,000 x 192,000 X

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 38BE

Related questions

Concept explainers

Question

8 ex 20

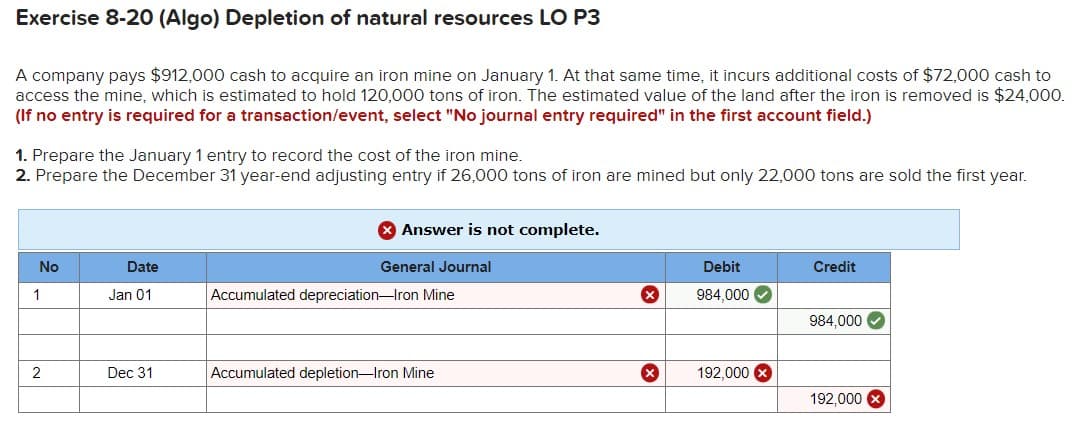

Transcribed Image Text:Exercise 8-20 (Algo) Depletion of natural resources LO P3

A company pays $912,000 cash to acquire an iron mine on January 1. At that same time, it incurs additional costs of $72,000 cash to

access the mine, which is estimated to hold 120,000 tons of iron. The estimated value of the land after the iron is removed is $24,000.

(If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

1. Prepare the January 1 entry to record the cost of the iron mine.

2. Prepare the December 31 year-end adjusting entry if 26,000 tons of iron are mined but only 22,000 tons are sold the first year.

Answer is not complete.

No

Date

General Journal

Debit

Credit

1

Jan 01

Accumulated depreciation-Iron Mine

984,000 O

984,000

2

Dec 31

Accumulated depletion-Iron Mine

192,000 x

192,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning