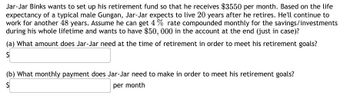

Jar-Jar Binks wants to set up his retirement fund so that he receives $3550 per month. Based on the life expectancy of a typical male Gungan, Jar-Jar expects to live 20 years after he retires. He'll continue to work for another 48 years. Assume he can get 4% rate compounded monthly for the savings/investments during his whole lifetime and wants to have $50, 000 in the account at the end (just in case)? (a) What amount does Jar-Jar need at the time of retirement in order to meet his retirement goals? $ (b) What monthly payment does Jar-Jar need to make in order to meet his retirement goals? $ per month

Jar-Jar Binks wants to set up his retirement fund so that he receives $3550 per month. Based on the life expectancy of a typical male Gungan, Jar-Jar expects to live 20 years after he retires. He'll continue to work for another 48 years. Assume he can get 4% rate compounded monthly for the savings/investments during his whole lifetime and wants to have $50, 000 in the account at the end (just in case)? (a) What amount does Jar-Jar need at the time of retirement in order to meet his retirement goals? $ (b) What monthly payment does Jar-Jar need to make in order to meet his retirement goals? $ per month

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Your question does not match the subject you selected. Please ask a question in one of the 30+ subjects available. We've credited a question to your account.

Your Question:

Transcribed Image Text:Jar-Jar Binks wants to set up his retirement fund so that he receives $3550 per month. Based on the life

expectancy of a typical male Gungan, Jar-Jar expects to live 20 years after he retires. He'll continue to

work for another 48 years. Assume he can get 4% rate compounded monthly for the savings/investments

during his whole lifetime and wants to have $50, 000 in the account at the end (just in case)?

(a) What amount does Jar-Jar need at the time of retirement in order to meet his retirement goals?

$

(b) What monthly payment does Jar-Jar need to make in order to meet his retirement goals?

$

per month

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning