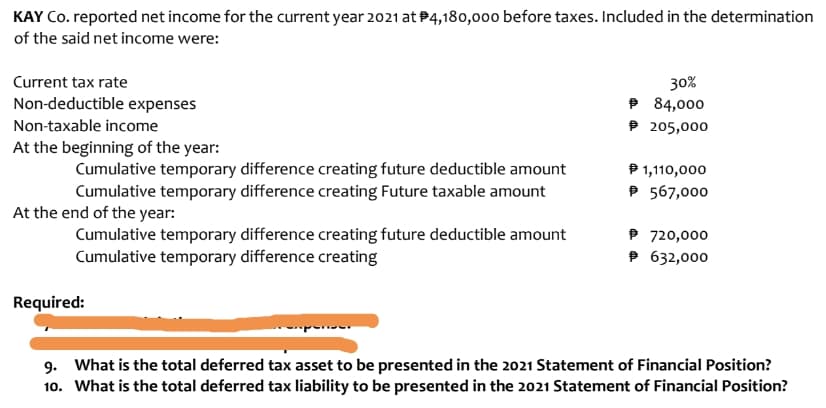

KAY Co. reported net income for the current year 2021 at P4,180,000 before taxes. Included in the determination of the said net income were: 30% P 84,000 P 205,000 Current tax rate Non-deductible expenses Non-taxable income At the beginning of the year: Cumulative temporary difference creating future deductible amount Cumulative temporary difference creating Future taxable amount P 1,110,000 P 567,000 At the end of the year: Cumulative temporary difference creating future deductible amount Cumulative temporary difference creating P 720,000 P 632,000 Required: 9. What is the total deferred tax asset to be presented in the 2021 Statement of Financial Position? 10. What is the total deferred tax liability to be presented in the 2021 Statement of Financial Position?

KAY Co. reported net income for the current year 2021 at P4,180,000 before taxes. Included in the determination of the said net income were: 30% P 84,000 P 205,000 Current tax rate Non-deductible expenses Non-taxable income At the beginning of the year: Cumulative temporary difference creating future deductible amount Cumulative temporary difference creating Future taxable amount P 1,110,000 P 567,000 At the end of the year: Cumulative temporary difference creating future deductible amount Cumulative temporary difference creating P 720,000 P 632,000 Required: 9. What is the total deferred tax asset to be presented in the 2021 Statement of Financial Position? 10. What is the total deferred tax liability to be presented in the 2021 Statement of Financial Position?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9P: Interperiod Tax Allocation Peterson Company has computed its pretax financial income to be 66,000 in...

Related questions

Question

Transcribed Image Text:KAY Co. reported net income for the current year 2021 at P4,180,000 before taxes. Included in the determination

of the said net income were:

30%

P 84,000

P 205,000

Current tax rate

Non-deductible expenses

Non-taxable income

At the beginning of the year:

Cumulative temporary difference creating future deductible amount

Cumulative temporary difference creating Future taxable amount

P 1,110,000

P 567,000

At the end of the year:

Cumulative temporary difference creating future deductible amount

Cumulative temporary difference creating

P 720,000

P 632,000

Required:

9. What is the total deferred tax asset to be presented in the 2021 Statement of Financial Position?

10. What is the total deferred tax liability to be presented in the 2021 Statement of Financial Position?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning