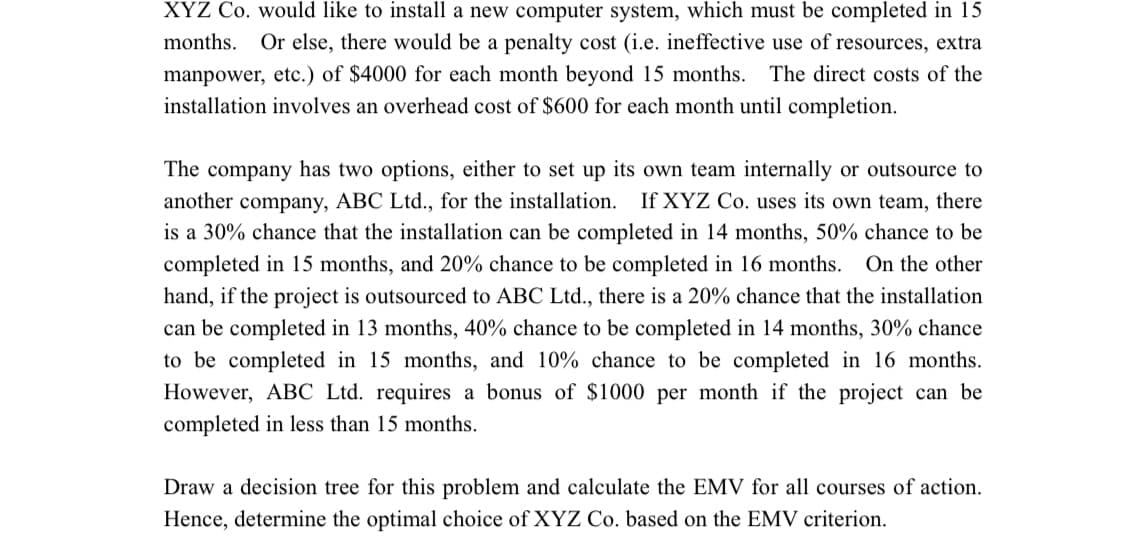

XYZ Co. would like to install a new computer system, which must be completed in 15 months. Or else, there would be a penalty cost (i.e. ineffective use of resources, extra manpower, etc.) of $4000 for each month beyond 15 months. The direct costs of the installation involves an overhead cost of $600 for each month until completion. The company has two options, either to set up its own team internally or outsource to another company, ABC Ltd., for the installation. If XYZ Co. uses its own team, there is a 30% chance that the installation can be completed in 14 months, 50% chance to be completed in 15 months, and 20% chance to be completed in 16 months. On the other hand, if the project is outsourced to ABC Ltd., there is a 20% chance that the installation can be completed in 13 months, 40% chance to be completed in 14 months, 30% chance to be completed in 15 months, and 10% chance to be completed in 16 months. However, ABC Ltd. requires a bonus of $1000 per month if the project can be completed in less than 15 months. Draw a decision tree for this problem and calculate the EMV for all courses of action. Hence, determine the optimal choice of XYZ Co. based on the EMV criterion.

XYZ Co. would like to install a new computer system, which must be completed in 15 months. Or else, there would be a penalty cost (i.e. ineffective use of resources, extra manpower, etc.) of $4000 for each month beyond 15 months. The direct costs of the installation involves an overhead cost of $600 for each month until completion. The company has two options, either to set up its own team internally or outsource to another company, ABC Ltd., for the installation. If XYZ Co. uses its own team, there is a 30% chance that the installation can be completed in 14 months, 50% chance to be completed in 15 months, and 20% chance to be completed in 16 months. On the other hand, if the project is outsourced to ABC Ltd., there is a 20% chance that the installation can be completed in 13 months, 40% chance to be completed in 14 months, 30% chance to be completed in 15 months, and 10% chance to be completed in 16 months. However, ABC Ltd. requires a bonus of $1000 per month if the project can be completed in less than 15 months. Draw a decision tree for this problem and calculate the EMV for all courses of action. Hence, determine the optimal choice of XYZ Co. based on the EMV criterion.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 21P

Related questions

Question

Photo attached

Transcribed Image Text:XYZ Co. would like to install a new computer system, which must be completed in 15

months. Or else, there would be a penalty cost (i.e. ineffective use of resources, extra

manpower, etc.) of $4000 for each month beyond 15 months. The direct costs of the

installation involves an overhead cost of $600 for each month until completion.

The company has two options, either to set up its own team internally or outsource to

another company, ABC Ltd., for the installation. If XYZ Co. uses its own team, there

is a 30% chance that the installation can be completed in 14 months, 50% chance to be

completed in 15 months, and 20% chance to be completed in 16 months. On the other

hand, if the project is outsourced to ABC Ltd., there is a 20% chance that the installation

can be completed in 13 months, 40% chance to be completed in 14 months, 30% chance

to be completed in 15 months, and 10% chance to be completed in 16 months.

However, ABC Ltd. requires a bonus of $1000 per month if the project can be

completed in less than 15 months.

Draw a decision tree for this problem and calculate the EMV for all courses of action.

Hence, determine the optimal choice of XYZ Co. based on the EMV criterion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,