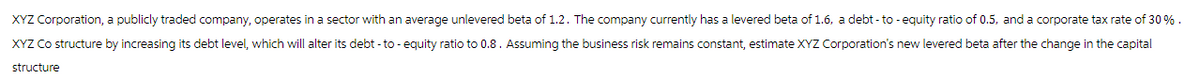

XYZ Corporation, a publicly traded company, operates in a sector with an average unlevered beta of 1.2. The company currently has a levered beta of 1.6, a debt-to -equity ratio of 0.5, and a corporate tax rate of 30%. XYZ Co structure by increasing its debt level, which will alter its debt-to-equity ratio to 0.8. Assuming the business risk remains constant, estimate XYZ Corporation's new levered beta after the change in the capital structure

Q: A U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate…

A: The variance of a portfolio measures the dispersion or spread of the portfolio's returns around its…

Q: To calculate a terminal value, one divides the next period's cash flow by the spread between the and…

A: You are absolutely right. The formula you described is one way to calculate the terminal value of a…

Q: Tom wishes to purchase a property that's been valued at $370,000. He has 20% of this amount…

A: A loan is a type of financial agreement whereby a lender gives a borrower access to funds in…

Q: Suppose that sales and profits of Oly Enterprises are growing at a rate of 30% per year. At the end…

A: The value of stock if constant growth rate is to be considered, can be found by using DDM model…

Q: C File Home Insert Draw Design Transitions Animations Slide Show Record Review View Help Ginger…

A: With the time value of money considered at a 11% annual interest rate, we can calculate the present…

Q: 100 Half the statec

A: Given:Bond Price: $98Bond Principal: $100Time to Maturity: 2 yearsAnnual Coupon: $1The bond pays…

Q: Bond X is noncallable and has 20 years to maturity, an 8% annual coupon, and a $1,000 par value.…

A: Bond price will be the aggregate of present value of all coupon payments and present value of face…

Q: Ryan wants to retire in 10 years when he turns 65 but has determined he will need $1,000,000 to quit…

A: We need to use future value and future value of ordinary annuity formula to calculate value of of…

Q: Cullumber Mechanical Inc.'s first dividend of $1.60 per share is expected to be paid six years from…

A: The constant growth model is a stock valuation method used in finance to determine a stock's…

Q: The current level of a stock is S0 = 100. A forward contract on 1 share of this stock matures after…

A: Arbitrage refers to the practice of taking advantage of price differences between identical or…

Q: Flotation costs and the cost of debt Currently, Warren Industries can sell 20-year, $1,000-par-value…

A: Flotation cost is the cost of selling the bonds in the market through intermediaries involved in the…

Q: The data below are taken from the annual reports of four companies. ● Year ending: Units: Income…

A: The objective of this question is to compute the components of the cash flow diagram for each of the…

Q: udents. For example, the school might run two courses in a month and have a total of 62 students…

A: Given:Fixed Cost per Month:Instructor wages: $2,930Utilities: $1,230Campus rent: $5,200Insurance:…

Q: You want to buy a car, and a local bank will lend you $40,000. The loan will be fully amortized over…

A: An amortization schedule is a table or chart that provides a detailed breakdown of each periodic…

Q: The stock market is currently returning 12%. The 10 year treasury bond is currently yielding 1%. The…

A: Market return = rm = 12%Risk free Rate = rf = 1%Beta = b = 0.5

Q: You have a loan outstanding. It requires making nine annual payments of $4,000 each at the end of…

A: A loan refers to a contract between two parties where money is forwarded by one party to the other…

Q: Jasmine won a prize: the right to receive 36 payments of $100 per month with the first payment one…

A: TVM refers to the concept that considers the effect of money's interest-earning capacity, which…

Q: Baskin Corp. has just paid a quarterly dividend of $0.35. Analysts expect dividends to grow by 4.5%…

A: By using the dividend discount model, the value of the stock today can be found by using the current…

Q: The Meddle Group paid a dividend of $6.00 last year. The company plans to keep the dividend of $6.00…

A: Dividend = $6.00Require rate of return = 7.5% = 0.075

Q: and an interest ra is expected to grow by 4.5 percent and the interest rate is expected to be…

A: Two factor modelExpected rate of return = Risk-free rate + Growth in factor 1 * Beta of Factor 1 +…

Q: a. b. C. a. b. Annual Rate C. 10% 12% 12% Annual Rate 12% 12% 8% Number of Years Invested Number of…

A: The future value refers to the compounded value of the future cash flow at a given interest…

Q: Ford Motor Company is considering an early retirement buyout package for some employees. The package…

A: The current worth of the amount that will be paid after a certain period considering the interest…

Q: u are trying to pick the least expensive car for your new delivery service. You have two choices:…

A: EAC stands for Equivalent Annual Cost. It refers to the cost that is spent on owning, operating, and…

Q: a pharmacy takes up its spring time shipment of sunglasses to provide of cost and a profit of 70% of…

A: The objective of the question is to find out the maximum markdown rate that the pharmacy can apply…

Q: Shado, Incorporated, is considering an investment of $451,000 in an asset with an economic life of…

A: Cash flow refers to the movement of cash remaining after deducting all the expenses, interest,…

Q: blems option of company has decided to end it's pension program. The company has given employees t…

A: Lump sump amount=$350000Monthly amount=$3000Interest rate=8%Period=20 years

Q: We are evaluating a project that costs $1,080,000, has a life of 10 years, and has no salvage value.…

A: Initial cost = $1,080,000Useful life = 10 yearsSelling price per unit = $50Variable cost per unit =…

Q: . calculate the net present value of the following: Project A requires an initial investment of…

A: The objective of this question is to calculate the net present value (NPV) of Project A. The NPV is…

Q: Use the table for the question(s) below. Name Gannet McClatchy Media General New York Times 2423 Lee…

A: The objective of the question is to estimate the share price of a newspaper publishing firm using…

Q: CX Enterprises has the following expected dividends: $1.15 in one year, $1.25 in two years, and…

A: Stock refers to ownership shares in a business.A company's ownership is split up into shares, each…

Q: You are holding a 5-year bond with a 6% annual coupon rate, an 8% yield to maturity and a $1,000 par…

A: Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital.…

Q: A proposed 3-year project has expected annual cash infows of $550, $1,600, and $ 2,900, for Years 1…

A: NPV is one of the capital budgeting techniques used for checking the feasibility of a project. When…

Q: Sunbird Theatre Inc. owns and operates movies theaters throughout Florida and Georgia. Sunbird…

A: A business may pay out annual dividends to its shareholders on a regular basis from its earnings.…

Q: Bonita Incorporated has announced an annual dividend of $5.10. The firm has zero growth and the…

A: Variables in the question:Current annual dividend=$5.10Growth=ZeroRequired rate of…

Q: 1. Create and share a detaileddescription of a business thathas selected to offer itsemployees a…

A: The objective of the question is to create a hypothetical business that offers its employees a Keogh…

Q: Risk-adjusted discount rates—Basic Country Wallpapers is considering investing in one of three…

A: The objective of the question is to calculate the net present value (NPV) of three different…

Q: Congratulations - you have secured your first job after graduating from Isenberg. Your employer is…

A: The objective of the question is to find the unknown annuity amount for the second option that would…

Q: On the issue date, you bought a 15 year maturity, 6.55% semi - annual coupon bond. The bond then…

A: The objective of the question is to calculate the realized rate of return for a 7-year holding…

Q: Consider a bond with a face value of $1,000 that sells for an initial price of $700. It will pay no…

A: An investor lends money to a borrower, usually a government or business, through the purchase of a…

Q: Boomer Products, Inc. manufactures "no-Inhale" cigarettes. As its target customers age and pass on,…

A: Growth Rate = g = -4%Current Dividend = d0 = $2.50Required Rate of Return = r = 12%

Q: Your portfolio consists of 95 shares of CSH and 55 shares of EJH, which you just bought at $21.68…

A: Shares of CSH = 95Shares of EJH = 55Original price of CSH = $21.68Original price of EJH = $31.95To…

Q: A 10% coupon bond with annualpayments and 10 years tomaturity is callable in three yearsat a call…

A: Coupon Rate: 10%Par Value: $1,000Call Price: $1,100Years to Call: 3Current Bond Price: $975

Q: Please don't provide handwriting solution

A: The objective of the question is to find out how many times larger the second economy will be than…

Q: hat is the amount of the annual interest tax shield for a firm with $5 million in debt that pays 10%…

A: Value of Debt = d = $5 millionInterest Rate = r = 10%Tax Rate = t = 40%

Q: Show all your work. The bonds issued by XYZ CO. currently sell for $1,020. They have a 8-year…

A: Current Price of Bond = pv = $1020Time = t = 8Annual Coupon = c = $75Face Value = fv = $1000

Q: You want to take a dream vackation that will cost $10, 000. Corrently, you have $6,000. If you…

A: Here,Cost of Vacation (FV) is $10,000Current Savings (PV) is $6,000Interest Rate is 8%

Q: A 10% cupon, annual payme bond maturing in 10 years, is expected to make all coupon

A: Price of bond is the present value of coupon payments plus present value of par value of the bond.

Q: Suppose a bank enters a repurchase agreement in which it agrees to buy Treasury securities from a…

A: Yield on repo can be found by using the following formula:

Q: Nancy Jackson is interested in buying a five-year zero coupon bond with a face value of $1,000. She…

A: The question is based on the concept to calculate market value of a bond, using following function…

Q: What is the current value of a $1,000 bond with a 6% annual coupon rate (paid annually) that matures…

A: I have multiplied formula by -1 because bond price is that amount that we pay, so payment goes from…

klp.3

Unlock instant AI solutions

Tap the button

to generate a solution

Click the button to generate

a solution

- A company had WACC (weighted average cost of capital) equal to 8. % If the company pays off mortgage bonds with an interest rate of 4% and issues an equal amount of new stock considered to be relatively risky by the market, which of the following is true? a. residual income will increase. b. ROI will decrease. c. WACC will increase. d. WACC will decrease.ABC Inc. is a publicly traded company that is at its target leverage ratio. The firm’s equity has a market value of $80 million, and its debt has a market value of $20 million. The firm has an equity beta of 2, the risk-free rate is 4%, and the expected return on the market is 10%. A new company, XYZ Corp., which will operate in the exact same line of business as ABC Inc. is about to start up. The new firm’s target debt to equity ratio will be 1, and a bond pricing expert informs them that the yield to maturity on the bonds they propose to issue will be 6%. Assume that the tax rate for both firms is 25%. What will be the after-tax WACC for XYZ Corp.? pls show workProkter and Gramble (PKGR) has historically maintained a debt-equity ratio of approximately 0.19. Its current stock price is $54 per share, with 2.4 billion shares outstanding. The firm enjoys very stable demand for its products, and consequently it has a low equity beta of 0.475 and can borrow at 4.6%, just 20 basis points over the risk-free rate of 4.4%. The expected return of the market is 9.6%, and PKGR's tax rate is 21%. a. This year, PKGR is expected to have free cash flows of $6.2 billion. What constant expected growth rate of free cash flow is consistent with its current stock price? b. PKGR believes it can increase debt without any serious risk of distress or other costs. With a higher debt-equity ratio of 0.475, it believes its borrowing costs will rise only slightly to 4.9%. If PKGR announces that it will raise its debt-equity ratio to 0.475 through a leveraged recap, determine the increase or decrease in the stock price that would result from the…

- AllCity, Inc., is financed 42% with debt, 5% with preferred stock, and 53% with common stock. Its pretax cost of debt is 5.7%, its preferred stock pays an annual dividend of $2.51 and is priced at $27. It has an equity beta of 1.11. Assume the risk-free rate is 2.2%, the market risk premium is 7.3% and AlICity's tax rate is 25%. What is its after-tax WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield. The WACC is __ % ? (Round to two decimal places.)Globex Corp. currently has a capital structure consisting of 35% debt and 65% equity. However, Globex Corp.’s CFO has suggested that the firm increase its debt ratio to 50%. The current risk-free rate is 3%, the market risk premium is 7.5%, and Globex Corp.’s beta is 1.25. If the firm’s tax rate is 25%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: US Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%, and its tax rate is 25%. It currently has a levered beta of 1.25. The risk-free rate is 3%, and the risk premium on the market is 7.5%. US Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm’s level of debt will cause its before-tax cost of debt to increase to 8%. First, solve for US Robotics Inc.’s unlevered beta. Use US Robotics Inc.’s unlevered beta…AllCity, Inc., is financed 37% with debt, 11% with preferred stock, and 52% with common stock. Its pretax cost of debt is 6.3%, its preferred stock pays an annual dividend of $2.46 and is priced at $35. It has an equity beta of 1.19. Assume the risk-free rate is 1.9%, the market risk premium is 6.9% and AllCity's tax rate is 25%. What is its after-tax WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield

- Company Zero is a non-listed private company with total equity of P10 million and debt of P4.5 million. The tax rate is 30%, risk-free rate is 6%. Company One is a publicly listed company which is in the same industry, product line and risk profile as Company Zero. It has a beta of 1.5, equity of P15 million and total debt of P6 million. Tax rate is 35%. The expected return of on a market portfolio is 12% and the risk-free return is 8%. a. Compute the beta for Company Zero. b. Compute the risk premium and the required return for Company One market portfolio.AllCity, Inc., is financed 42% with debt, 7% with preferred stock, and 51% with common stock. Its cost of debt is 5.8%, its preferred stock pays an annual dividend of $2.49 and is priced at $31. It has an equity beta of 1.18. Assume the risk-free rate is 2.4%, the market risk premium is 6.9% and AllCity's tax rate is 35%. What is its after-tax WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield.Spam Corp. is financed entirely by common stock and has a beta of .95. The firm is expected to generate a level, perpetual stream of earnings and dividends. The stock has a price-earnings ratio of 7.40 and a cost of equity of 13.51%. The company's stock is selling for $62. Now the firm decides to repurchase half of its shares and substitute an equal value of debt. The debt is risk-free, with an interest rate of 5.5%. The company is exempt from corporate income taxes. Assume MM is correct a. Calculate the cost of equity after the refinancing. (Enter your answer as a percent rounded to 2 decimal places.) b. Calculate the overall cost of capital (WACC) after the refinancing. (Enter your answer as a percent rounded to 2 decimal places.) c. Calculate the price-earnings ratio after the refinancing. (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. Calculate the stock price after the refinancing. e. Calculate the stock's beta after the refinancing. with…

- Hackworth Co. is a privately owned firm with few investors. Investors forecast their earnings per share (EPS) to reach $3 this coming year. The average price-to-earnings (P/E) ratio for similar companies in the S&P 500 is 10. What is the estimated intrinsic value of Hackworth Co.’s stock per share? Market multiple analysis is also used to calculate the value of a company, which is further used to calculate the intrinsic value per share of the firm. Suppose you have the information given in the following table for Company X. Year 1 Year 2 EBITDA $7,650 $9,150 Total value of equity $76,500 $82,500 Total firm value $99,450 $132,000 What is value of the entity multiple of Company X in Year 1?Eccles Inc., a zero growth firm, has an expected EBIT of $100,000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%.Refer to the data for Eccles Incorporated. Assume that the firm's gain from leverage according to the Miller model is $126,667. If the effective personal tax rate on stock income is TS = 20%, what is the implied personal tax rate on debt income?Prokter and Gramble (PKGR) has historically maintained a debt-equity ratio of approximately 0.16. Its current stock price is $45 per share, with 2.3 billion shares outstanding. The firm enjoys very stable demand for its products, and consequently it has a low equity beta of 0.4 and can borrow at 4.0%, just 20 basis points over the risk-free rate of 3.8%. The expected return of the market is 9.6%, and PKGR's tax rate is 22%. a. This year, PKGR is expected to have free cash flows of $5.5 billion. What constant expected growth rate of free cash flow is consistent with its current stock price? b. PKGR believes it can increase debt without any serious risk of distress or other costs. With a higher debt-equity ratio of 0.4, it believes its borrowing costs will rise only slightly to 4.3%. If PKGR announces that it will raise its debt-equity ratio to 0.4 through a leveraged recap, determine the increase or decrease in the stock price that would result from the anticipated tax savings. a. This…