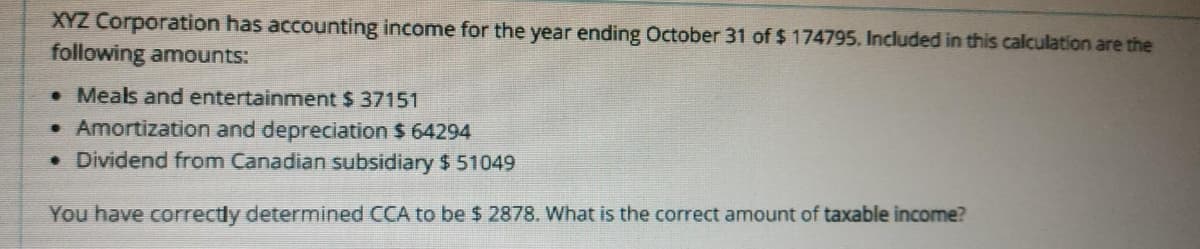

XYZ Corporation has accounting income for the year ending October 31 of $ 174795. Included in this calculation are the following amounts: • Meals and entertainment $ 37151 • Amortization and depreciation $ 64294 • Dividend from Canadian subsidiary $ 51049 You have correctly determined CCA to be $ 2878. What is the correct amount of taxable income?

Q: The following totals for the month of June were taken from the payroll register of Arcon Company: S...

A: Journal is the book of original entry in which all the transactions of the business are recorded ini...

Q: A subsidiary of AEP places in service electric generating and transmission equipment at a cost of $3...

A: Present value is the concept that states an amount of money today is worth more than that same amoun...

Q: Identify each of the preceding costs as either a product or a period cost. If the cost is a product ...

A: The question is based on the concept of Cost Accounting.

Q: Pro Accountants Inc. (PAI) had the following transactions in 2021: A total of $1,450,000 was billed ...

A: *As per Bartleby Policy, if the question are not related then answer first only. As per accrual basi...

Q: Lem Company pays time and a half for hours in excess of 40 hours per week. If an individual is paid ...

A: Normal labor rate = P60 per hour Bonus rate = P60 x 1.5 = P90 per hour

Q: Happy, Inc. produces a product requiring 8 pounds of material at P1.50 per pound. Happy, Inc. produc...

A: Variance is considered as the difference between budgeted value and actual results. The management u...

Q: Which of the following is an example of an indirect cost? Multiple Choice Cost of labor Cost of down...

A: Indirect Cost are expenses other than direct expenses are known as indirect expenses. These cannot ...

Q: What terms that must be included in the document prepared by the client

A: Engagement letter is the letter in which auditor defined the audit scope, its terms and other relate...

Q: At December 1, 2021, Concord Company's accounts receivable balance was $1740. During December, Conco...

A: Ending accounts receivable balance = Beginning accounts receivable balance + Credit sales during the...

Q: Materials used - 10,000 kg. Conversion cost P24,000 28,000 Product JKA JKB JKC JJD Sales Value per k...

A: Cost per kilo of JKA = Total costs allocated to JKA / Output for JKA Total costs to be allocated = M...

Q: AB Partnership’s operation for the year 2022 resulted in a profit of P240,000. Their profit sharing ...

A: Here the profit amount is given and we have to allocate this amount as per the terms provided here.

Q: Sales Revenue: $8,000 -Tax Rate: 25% - Interest Expense: $70 - SGA Expenses: $1,300 - Other Revenue:...

A: The income statement explains the financial performance of the company for a particular period of ti...

Q: The following information is related to Windsor Company for 2017. Retained earnings balance, Janu...

A: 1. Income Statement - This statement shows the income earned and loss incurred by the organization i...

Q: The following income statement was drawn from the records of Munoz, a merchandising firm: MUNOZ COMP...

A: Contribution Margin = Sales - Variable Costs Net Income = Contribution margin - Fixed costs Operatin...

Q: On January 1, 2022, A and B formed a partnership by contributing P200,000 and P180,000 respectively....

A: The question is related to Partnership Accounting. The details are given regarding capital introduce...

Q: Fruit Computer Corporation makes custom fruit shaped computers. It is currently producing 60 compute...

A: Cost volume profit analysis is the technique used by the management for decision-making. The methods...

Q: age value is $8,000 at the end of the project life. The firm pays taxes at a rate of 20% and has a M...

A: "Hi, as per our guidelines, we have solved the first three sub-parts. Please post unsolved sub-parts...

Q: Turner Excavation maintains a checking account and has decided to open a petty cash fund. The follow...

A: answers 1. Petty Cash Payments Record Date Voucher No Amount Deposit Amount Withdrawn ...

Q: A and G executed a partnership agreement that lists the following assets contributed at the partners...

A: A partnership is a agreement between two or more person/ parties to manage and operate a business an...

Q: On the formation of X Corp, Moustapha transfers land with a basis of $40,000 and a FMV of $60,000 in...

A: Tax Basis For Calculating the tax consequences of the assets or property which are taken consider th...

Q: During the year, the ABC partnership’s operations generated a loss. The partnership agreement provid...

A: Solution: Share of loss of partner A = P8,000 Salary and interest to Partner A = P2,000 + P15,000 = ...

Q: You are 45 years old. You want to retire at age 65 (20 years) with $1,000,000. You can invest your...

A: Amount need after 20 years (F) = $1000,000 Interest rate = 6% Monthly interest rate (i) = 6%/12 = 0....

Q: An employee has total gross wages of $7,000, Federal Unemployment Expense, and State Unemployment Ex...

A: Solution A journal is a company's official book in which all business transaction are recorded in ch...

Q: ne 2021, at the following costs per pair: Materials, P80; Labor, P50; and Overhead (125% of direct l...

A: ln cost accounting, the cost are allocated to the product to reach out at the profit. there can be ...

Q: Marvin’s Kitchen Supply delivers restaurant supplies throughout the city. The firm adds 10 percent t...

A: a. City Diner Le Chien Chaud Delivery charge $88,000 x 10% $98,000 x 10% $8,800 $9,800

Q: Accounting On October 1, 2019, Paul Inc. acquired 80% of Sam Co. by paying $500,000 cash. At that da...

A:

Q: Periodic Inventory by Three Methods The units of an tem available for sale during the year were as f...

A: The inventory can be valued using various methods as LIFO, FIFO and average method. Using LIFO metho...

Q: A and B entered into a partnership on April 1, 2020 by investing the following assets: A – Cash P30...

A:

Q: Transactions for Buyer and Seller Shore Co. sold merchandise to Blue Star Co. on account, $111,500, ...

A: Net Sales = Sales - Sales discount Sales discount = 2% Net sales = 100 - 2 = 98% Inventory purchase ...

Q: PROBLEM 2. Outlast Company's projected profit for the coming year follows: Per Unit Total P200,000 (...

A: The margin of safety is calculated as difference between current sales and break even sales. The br...

Q: You are not required to monitor the investments held through your spouse's pension plan if those inv...

A: Pension plan is the plan which a person takes so that their old age life will be comfortable in term...

Q: Punongbayan and Araullo formed a partnership. The following were contributed by the partners and lia...

A: Total capital of the partnership = Total assets - Total liabilities

Q: Which of the following is not an advantage of the corporate form of business organization? a) unlim...

A: Introduction:- Corporation is a Legal entity. Shareholders are the owners of the organisation.

Q: 2 Purchased $5,600 of merchandise from Lyon Company with credit terms of 2/15, n/60, invoice dated A...

A: The journal entries are prepared to record day to day transactions of the business.

Q: Following is relevant information for Snowdon Sandwich Shop, a small business that serves sandwiches...

A: Contribution margin = Sales - Variable costs Net Operating Income = Contribution margin - Fixed cost...

Q: -X, Y, and Z formed a partnership on Jnauary 1, 2021, and contributed P150,O0; P200,000; P300,000, r...

A: Months X capital Y capital Z Capital January 150000 200000 300000 February 150000 20000...

Q: The net income of Zia company for the year ended December 31, 2018 amounted to P5,600,000. Determin...

A: The non cumulative preference dividend is not cumulated for any past year dividend undeclared.

Q: ABC Corporation reports the following information for 2020. Based on these figures, what is ABC's in...

A: Inventory turnover = Cost of goods sold / Average inventory where, Average inventory = (beginning in...

Q: Q: What would be the direct labor ? (I got 109,000 , but it was wrong) Q: Assume that the company m...

A: Cost of goods manufactured refers to those total cost of goods or inventory which is used by the com...

Q: AB Partnership's operation for the year 2022 resulted in a profit of P240,000. Their profit sharing ...

A: Profit after salaries = Total profit - Salaries to partner A - Salaries to partner B Bonus to Partne...

Q: X, Y, Z share profits and losses in the ratio of 20%, 30%, 50%, respectively. During the year, their...

A: Formula used for calculating share in Total profit: Y share in Profits = Total Profit amount x Y pro...

Q: Trial Balance to be correced Account Titles Cash in Bank Debit Credit 25,000 ccounts Receivable uppl...

A: Trial Balance: After posting the ledgers the balances of those accounts are posted in Trial balance....

Q: the implementation of a new system would have a payback period of 5 years while gaining Php 175,000 ...

A: 1)Payback period is a period which shows how much time a project takes to recover the initial invest...

Q: management con $6,000. Payroll for the month of May is as follows: FICA Social Securi federal inco...

A: A

Q: Pharoah Corporation issued 117,000 shares of $19 par value, cumulative, 7% preferred stock on Januar...

A: Preferred Stock = Number of shares * Par Value Paid in capital in excess of par - Preferred stock = ...

Q: Q.4 Whethera company uses process costing or job-order costing depends on its industry. A number of ...

A: Job costing refers to the method of costing which is used while calculating the cost of a special or...

Q: PROBLEM 8. The Color Company manufactures and sells two products. The selling prices and variable co...

A: Break even point means where there is no profit no loss. Variable cost means the cost which vary w...

Q: Which of the following accounts would not appear in the Balance Sheet columns of the end-of-period s...

A: Service revenue is P&L account and it is transferred to P&L in order to calculate the final ...

Q: X Company pays time and a half for hours in excess of 40 hours per week. If an individual is paid P6...

A: Direct labor includes regular payment of labor and also overtime payment.The over time rate are base...

Q: Winger Corporation was organized in March. It is authorized to issue 500,000 shares of $100 par valu...

A: There are three golden rules in accounting for recording the transaction : Debit what comes in , C...

Step by step

Solved in 2 steps

- Rogers Co., a U.S. multinational corporation, owns 100% of Orange Co., a CFC. Orange Co. has net tested income of $211,000, qualified business asset investments of $429,000, and no specified business interest expense. a. What is Rogers Co.’s GILTI for the year? $fill in the blank 1 b. By how much do Orange Co.’s operations impact Rogers Co.’s U.S. taxable income? $fill in the blank 2CL LLC is a manufacturing business and reported taxable income of $40,000,000 before interest expense, taxes, depreciation, and amortization (“tax EBITDA”), plus $1,500,000 of separately stated investment income. CL incurred interest expense of $1,000,000 in connection with this investment income and $14,000,000 in connection with its trade or business. How much interest expense can CL deduct? How is the interest expense reported on CL’s Schedule K? What action, if any, is needed by the LLC members?CL LLC is a manufacturing business and reported taxable income of $40,000,000 before interest expense, taxes, depreciation, and amortization (“tax EBITDA”), plus $1,500,000 of separately stated investment income. CL incurred interest expense of $1,000,000 in connection with this investment income and $14,000,000 in con-nection with its trade or business. a.How much interest expense can CL deduct? b.How is the interest expense reported on CL’s Schedule K? c.What action, if any, is needed by the LLC members? d.How would your answers to parts (a) through (c) change if CL’s tax EBITDA was $4,000,000 (plus $150,000 of investment income), its average annual gross receipts for all prior tax years was $10,000,000 or less, and the interest expense amounts were $100,000 (investment) and $1,400,000 (business)?

- MEME Corporation’s Retained Earnings at December 31, 2021 amounted to P2,000,000. On that date, the corporation declared and distributed its investment property which was acquired at a historical cost P300,000 and has a fair market value of P450,000 on December 31, 2021. On the date of declaration and distribution, by what amount should Retained Earnings be charged?The following information is available for the 2019 year end for Blend Corp Canadian source investment income $125000 Active business income (no associate companies) $225000 Private company dividend received (not part of Canadian source investment income) $43000 Non eligible dividend refund for 2018 $25000 Taxable non eligible dividend paid in 2019 $55000 Blend corp is a Canadian controlled private corporation with 31 December year end. For 2019, Blend corp has opening balance in its non eligible refundable dividend tax on hand account of $37500. Blend corp has no eligible refundable dividend tax on hand. Blend corp has aggregated investment income of less than $50000 in the preceding year and the taxable capital employed in Canada in preceding year was less than $10000000. Required: Calculate net income for tax purposes and taxable income for Blend Corp for the year…X Corporation opted to deduct OSD. The following are the results of its operation: Net sales -P3,450,000; Cost of Sales – P2,100,000; Dividend from Y Corporation, a domestic corporation – P150,000; Gain on sale of Building – P200,000; Selling Expenses – P70,000; Administrative Expenses – P30,000. What is the taxable net income? A. P 930,000 B. P 1,020,000 C. P 870,000 D. P 810,000

- Ocean Ltd is the parent entity to the wholly owned subsidiaries of River Ltd, Creek Ltd, and Puddle Ltd. During the year ended 30 June 2022 the following transactions occurred within Ocean Ltd group. The perpetual inventory system has been adopted by all entities in the Ocean Ltd group and the tax rate is 30% for all accounting periods. On 01 July 2021 Ocean Ltd sold an item of equipment to Creek Ltd for $850,000 cash. The original cost of the equipment was $950,000. Ocean Ltd adopted an accounting policy whereby equipment was being depreciated on a straight line basis over its useful life of 8 years. The carrying amount of the equipment in Ocean Ltd financial statements at the date of sale was $520,000. Subsequent to the transfer, Creek Ltd depreciated the equipment on a straight line basis over its remaining useful life of 3 years. Required: Fill in the missing amount for the following accounts that will appear in the consolidated adjusting journal…X Corporation opted to deduct OSD. The following are the results of its operation: Net sales -P3,450,000; Cost of Sales – P2,100,000; Dividend from Y Corporation, a domestic corporation – P150,000; Gain on sale of Building – P200,000; Selling Expenses – P70,000; Administrative Expenses – P30,000. What is the taxable net income? P 930,000 P 1,020,000 P 870,000 P 810,000A subsidiary sold goods costing P1.2 million to its parent for P1.4 million. All of the inventory is held by the parent at year-end. The subsidiary is 80% owned and the parent and subsidiary operate in different tax jurisdictions. The parent pays taxation at 30% and the subsidiary pays taxation at 30%. Calculate any deferred tax asset that arises on the sale of the inventory to the parent. a. P 60,000 c. P48,000 b. P200,000 d. P80,000

- Asempa Ltd disposed of its entire holding in Daakye Ltd on 30the September 2013 for GH¢ 12 million, on which date the net assets of Daakye Ltd was GH¢9.6 million. It is the policy of measuring NCI at acquisition at proportionate of the fair value of identifiable net asset and no goodwill is impaired as at 30th September 2013. Tax is charged at 25%. Required Calculate the profit or loss on disposal for: (i) Asempa Ltd’s individual financial statements (ii) Consolidated financial statementsMEME Corporation’s Retained Earnings at December 31, 2021 amounted to P2,000,000. On that date, the corporation declared and distributed its investment property which was acquired at a historical cost P300,000 and has a fair market value of P450,000 on December 31, 2021. On the date of declaration and distribution, by what amount should Retained Earnings be charged? A. P300,000 B. P150,000 C. None D. P450,000HOME Ltd. is a Canadian-controlled private corporation operating a small land-development business. In the start of 2020, the company acquired a license to manufacture pre-fab homes and began operations immediately. Financial information for the 2020 taxation year is outlined below: 1. HOME 's profit before income taxes for the year ended November 30, 2020, was $245,000, as follows: Income from land development and pre-fab home manufacturing $248,000 Loss of sale of properties (3,000) $245,000 The loss on sale of property resulted from two transactions. On October 1, 2020, HOME sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000). Also, during the year, HOME sold some of its vehicles (class 10) for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement. (NOTE: capital gains are only 50% taxable). 2. The 2019 corporate tax…