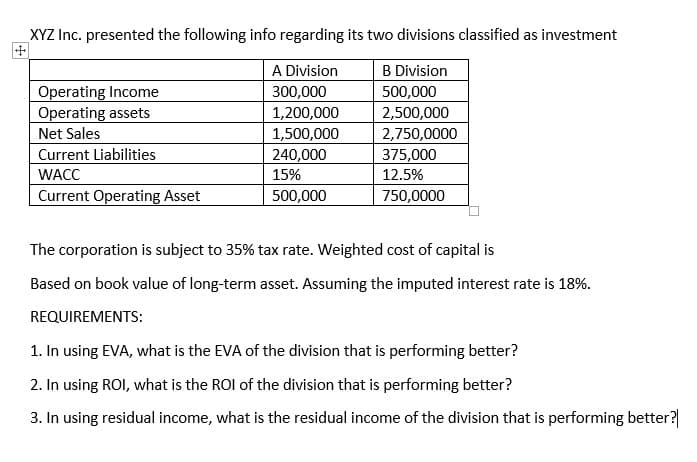

XYZ Inc. presented the following info regarding its two divisions classified as investment A Division B Division Operating Income Operating assets 300,000 500,000 1,200,000 1,500,000 2,500,000 2,750,0000 375,000 Net Sales Current Liabilities 240,000 15% WACC 12.5% Current Operating Asset 500,000 750,0000 The corporation is subject to 35% tax rate. Weighted cost of capital is Based on book value of long-term asset. Assuming the imputed interest rate is 18%. REQUIREMENTS: 1. In using EVA, what is the EVA of the division that is performing better? 2. In using ROI, what is the ROI of the division that is performing better? 3. In using residual income, what is the residual income of the division that is performing better?|

XYZ Inc. presented the following info regarding its two divisions classified as investment A Division B Division Operating Income Operating assets 300,000 500,000 1,200,000 1,500,000 2,500,000 2,750,0000 375,000 Net Sales Current Liabilities 240,000 15% WACC 12.5% Current Operating Asset 500,000 750,0000 The corporation is subject to 35% tax rate. Weighted cost of capital is Based on book value of long-term asset. Assuming the imputed interest rate is 18%. REQUIREMENTS: 1. In using EVA, what is the EVA of the division that is performing better? 2. In using ROI, what is the ROI of the division that is performing better? 3. In using residual income, what is the residual income of the division that is performing better?|

Chapter12: Balanced Scorecard And Other Performance Measures

Section: Chapter Questions

Problem 3PA: Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net...

Related questions

Question

Transcribed Image Text:XYZ Inc. presented the following info regarding its two divisions classified as investment

B Division

Operating Income

Operating assets

A Division

300,000

1,200,000

500,000

2,500,000

2,750,0000

375,000

Net Sales

1,500,000

240,000

Current Liabilities

WACC

15%

12.5%

Current Operating Asset

500,000

750,0000

The corporation is subject to 35% tax rate. Weighted cost of capital is

Based on book value of long-term asset. Assuming the imputed interest rate is 18%.

REQUIREMENTS:

1. In using EVA, what is the EVA of the division that is performing better?

2. In using ROI, what is the ROI of the division that is performing better?

3. In using residual income, what is the residual income of the division that is performing better?|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub