Year 0 Income Statement 320,000 Sales Costs Except Depreciation (150,000) EBITDA 170,000 (15,000) 155,000 (3,000) Depreciation EBIT Interest Expense (net) Pretax Income 152,000 Income Tax (53,200) 98,800 Net Income Balance Sheet Year 0 Assets Cash and Equivalents 25,000 Accounts Receivable 12,000 Inventories 5,000 Total Current Assets 42,000 Property, Plant and Equipment 120

Year 0 Income Statement 320,000 Sales Costs Except Depreciation (150,000) EBITDA 170,000 (15,000) 155,000 (3,000) Depreciation EBIT Interest Expense (net) Pretax Income 152,000 Income Tax (53,200) 98,800 Net Income Balance Sheet Year 0 Assets Cash and Equivalents 25,000 Accounts Receivable 12,000 Inventories 5,000 Total Current Assets 42,000 Property, Plant and Equipment 120

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2RE: Refer to RE5-1. Prepare a single-step income statement for Brandt Corporation for the current year.

Related questions

Question

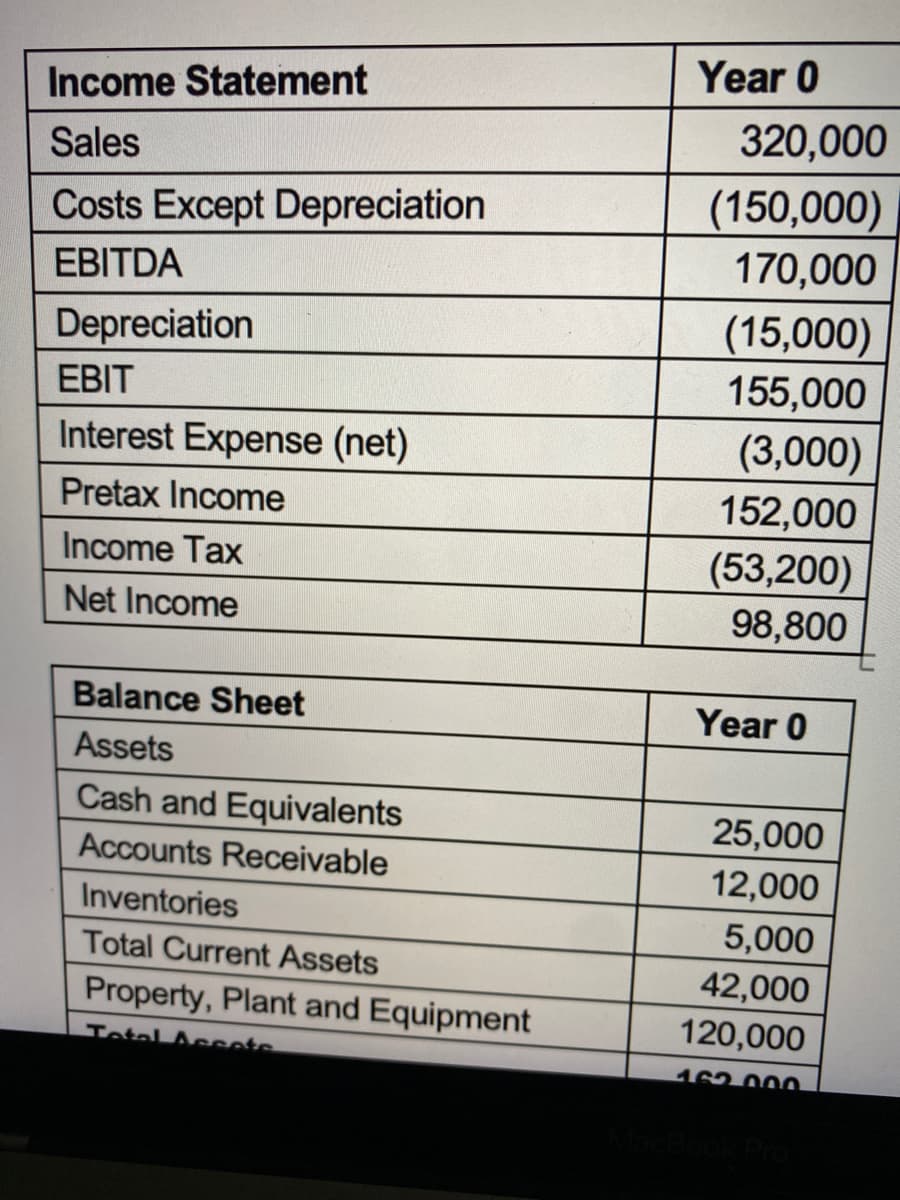

Noah’s ark video games expects sales to grow by 25% next year. Assume that it pays out 95% of its net income. Using the following statements and the percent of sales method, forecast depreciation

Transcribed Image Text:Year 0

Income Statement

320,000

Sales

(150,000)

170,000

Costs Except Depreciation

EBITDA

(15,000)

155,000

Depreciation

EBIT

Interest Expense (net)

(3,000)

Pretax Income

152,000

(53,200)

98,800

Income Tax

Net Income

Balance Sheet

Year 0

Assets

Cash and Equivalents

25,000

Accounts Receivable

12,000

Inventories

5,000

Total Current Assets

42,000

Property, Plant and Equipment

120,000

Totel Assete

462 00o

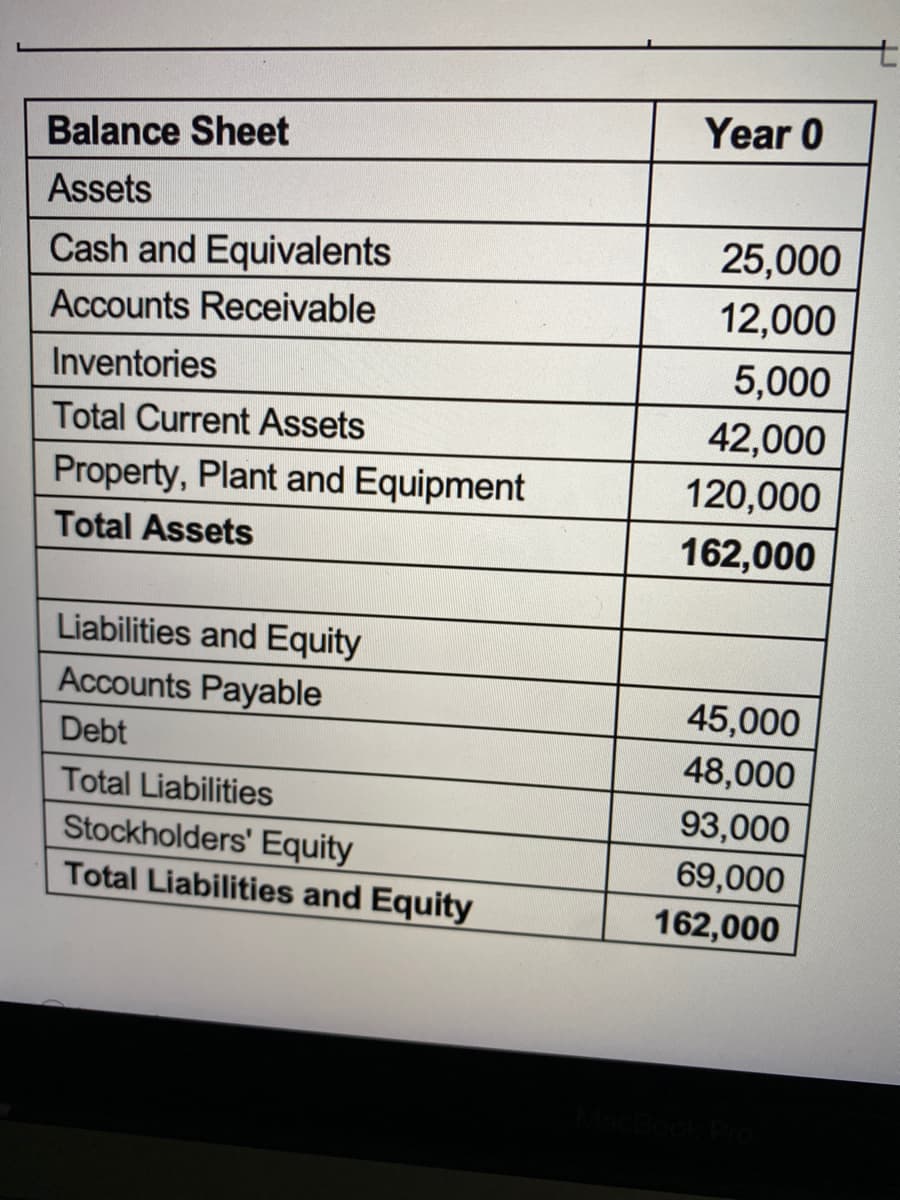

Transcribed Image Text:Year 0

Balance Sheet

Assets

Cash and Equivalents

25,000

Accounts Receivable

12,000

Inventories

5,000

Total Current Assets

42,000

Property, Plant and Equipment

120,000

Total Assets

162,000

Liabilities and Equity

Accounts Payable

45,000

Debt

48,000

Total Liabilities

93,000

Stockholders' Equity

Total Liabilities and Equity

69,000

162,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT