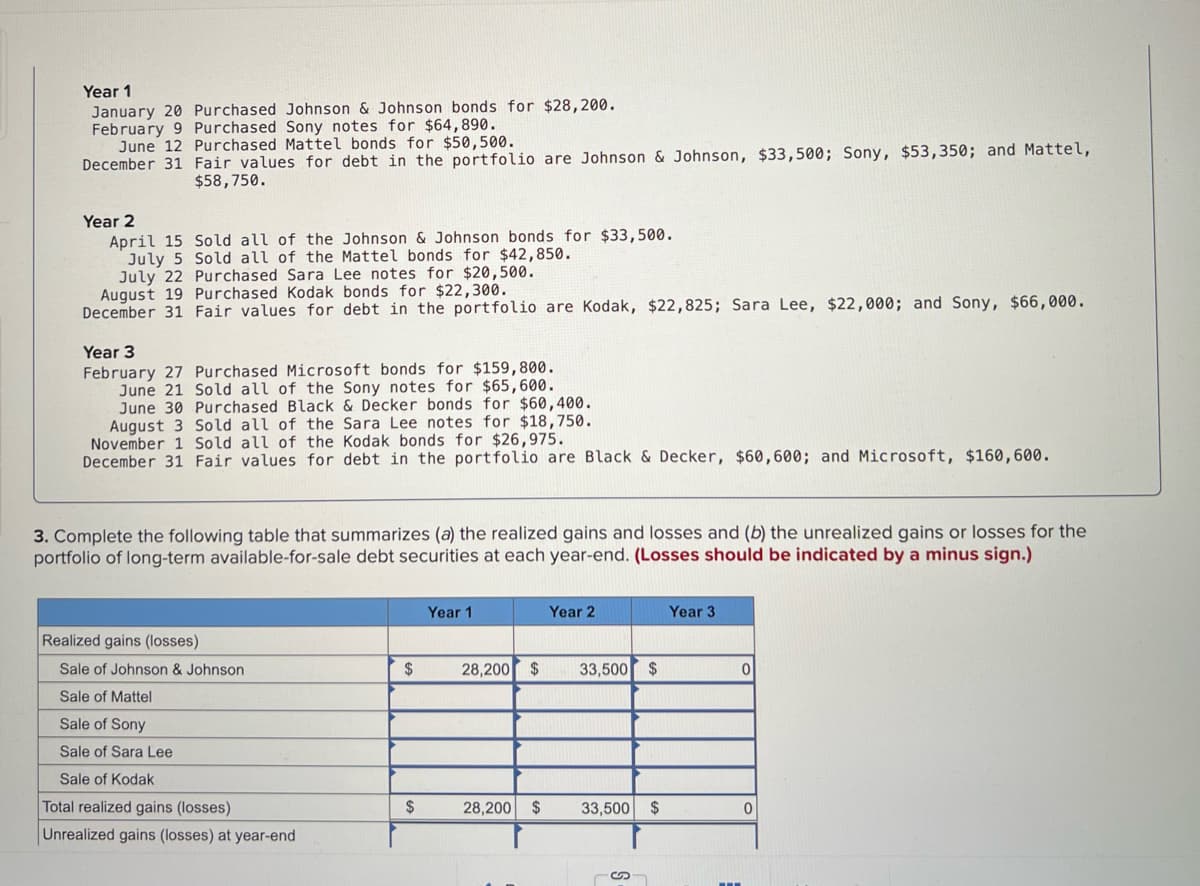

Year 1 January 20 Purchased Johnson & Johnson bonds for $28,200. February 9 Purchased Sony notes for $64,890. June 12 Purchased Mattel bonds for $50,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $33,500; Sony, $53,350; and Mattel, $58,750. Year 2 April 15 July 5 July 22 Sold all of the Johnson & Johnson bonds for $33,500. Sold all of the Mattel bonds for $42,850. Purchased Sara Lee notes for $20,500. August 19 Purchased Kodak bonds for $22,300. December 31 Fair values for debt in the portfolio are Kodak, $22,825; Sara Lee, $22,000; and Sony, $66,000. Year 3 February 27 Purchased Microsoft bonds for $159,800. June 21 Sold all of the Sony notes for $65,600. June 30 Purchased Black & Decker bonds for $60,400. August 3 Sold all of the Sara Lee notes for $18,750. November 1 Sold all of the Kodak bonds for $26,975. December 31 Fair values for debt in the portfolio are Black & Decker, $60,600; and Microsoft, $160,600. 3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end. (Losses should be indicated by a minus sign.)

Year 1 January 20 Purchased Johnson & Johnson bonds for $28,200. February 9 Purchased Sony notes for $64,890. June 12 Purchased Mattel bonds for $50,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $33,500; Sony, $53,350; and Mattel, $58,750. Year 2 April 15 July 5 July 22 Sold all of the Johnson & Johnson bonds for $33,500. Sold all of the Mattel bonds for $42,850. Purchased Sara Lee notes for $20,500. August 19 Purchased Kodak bonds for $22,300. December 31 Fair values for debt in the portfolio are Kodak, $22,825; Sara Lee, $22,000; and Sony, $66,000. Year 3 February 27 Purchased Microsoft bonds for $159,800. June 21 Sold all of the Sony notes for $65,600. June 30 Purchased Black & Decker bonds for $60,400. August 3 Sold all of the Sara Lee notes for $18,750. November 1 Sold all of the Kodak bonds for $26,975. December 31 Fair values for debt in the portfolio are Black & Decker, $60,600; and Microsoft, $160,600. 3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the portfolio of long-term available-for-sale debt securities at each year-end. (Losses should be indicated by a minus sign.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

Transcribed Image Text:Year 1

January 20 Purchased Johnson & Johnson bonds for $28,200.

February 9

Purchased Sony notes for $64,890.

June 12

Purchased Mattel bonds for $50,500.

December 31 Fair values for debt in the portfolio are Johnson & Johnson, $33,500; Sony, $53,350; and Mattel,

$58,750.

Year 2

April 15 Sold all of the Johnson & Johnson bonds for $33,500.

July 5 Sold all of the Mattel bonds for $42,850.

July 22 Purchased Sara Lee notes for $20,500.

August 19 Purchased Kodak bonds for $22,300.

December 31

Fair values for debt in the portfolio are Kodak, $22,825; Sara Lee, $22,000; and Sony, $66,000.

Year 3

February 27 Purchased Microsoft bonds for $159,800.

June 21 Sold all of the Sony notes for $65,600.

June 30 Purchased Black & Decker bonds for $60,400.

August 3 Sold all of the Sara Lee notes for $18,750.

November 1 Sold all of the Kodak bonds for $26,975.

December 31 Fair values for debt in the portfolio are Black & Decker, $60,600; and Microsoft, $160,600.

3. Complete the following table that summarizes (a) the realized gains and losses and (b) the unrealized gains or losses for the

portfolio of long-term available-for-sale debt securities at each year-end. (Losses should be indicated by a minus sign.)

Year 1

Year 2

Year 3

Realized gains (losses)

Sale of Johnson & Johnson

Sale of Mattel

Sale of Sony

Sale of Sara Lee

Sale of Kodak

Total realized gains (losses)

Unrealized gains (losses) at year-end

$

$

28,200 $

28,200 $

33,500 $

33,500 $

S

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,