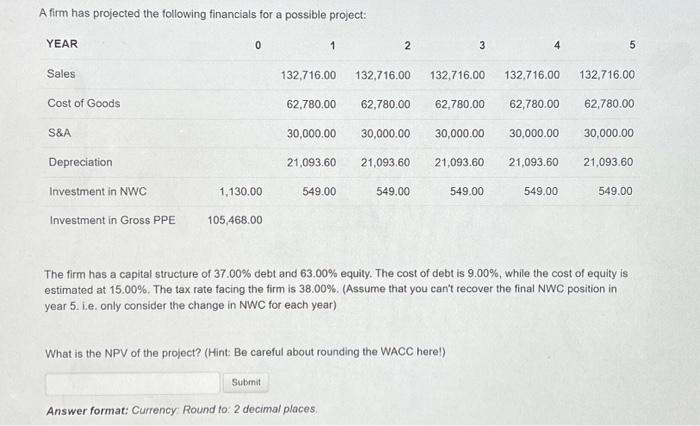

YEAR Sales Cost of Goods S&A Depreciation Investment in NWC Investment in Gross PPE 0 1,130.00 105,468.00 1 2 21,093.60 21,093.60 549.00 3 132,716.00 132,716.00 132,716.00 132,716.00 62,780.00 62,780.00 62,780.00 62,780.00 30,000.00 30,000.00 30,000.00 30,000.00 30,000.00 21,093.60 21,093.60 549.00 549.00 4 132,716.00 62,780.00 549.00 21,093.60 549.00 The firm has a capital structure of 37.00% debt and 63.00% equity. The cost of debt is 9.00%, while the cost of equity is estimated at 15.00 %. The tax rate facing the firm is 38.00%. (Assume that you can't recover the final NWC position in year 5. i.e. only consider the change in NWC for each year)

YEAR Sales Cost of Goods S&A Depreciation Investment in NWC Investment in Gross PPE 0 1,130.00 105,468.00 1 2 21,093.60 21,093.60 549.00 3 132,716.00 132,716.00 132,716.00 132,716.00 62,780.00 62,780.00 62,780.00 62,780.00 30,000.00 30,000.00 30,000.00 30,000.00 30,000.00 21,093.60 21,093.60 549.00 549.00 4 132,716.00 62,780.00 549.00 21,093.60 549.00 The firm has a capital structure of 37.00% debt and 63.00% equity. The cost of debt is 9.00%, while the cost of equity is estimated at 15.00 %. The tax rate facing the firm is 38.00%. (Assume that you can't recover the final NWC position in year 5. i.e. only consider the change in NWC for each year)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.3.2P

Related questions

Question

Transcribed Image Text:A firm has projected the following financials for a possible project:

YEAR

Sales

Cost of Goods

S&A

Depreciation

Investment in NWC

Investment in Gross PPE

0

1,130.00

105,468.00

1

132,716.00

Submit

549.00

2

62,780.00 62,780.00

30,000.00 30,000.00 30,000.00

21,093.60 21,093.60 21,093.60

Answer format: Currency: Round to: 2 decimal places.

3

132,716.00 132,716.00 132,716.00

549.00

What is the NPV of the project? (Hint: Be careful about rounding the WACC here!)

4

62,780,00 62,780.00 62,780.00

30,000.00

549.00

21,093.60

549.00

5

132,716.00

The firm has a capital structure of 37.00% debt and 63.00% equity. The cost of debt is 9.00%, while the cost of equity is

estimated at 15.00%. The tax rate facing the firm is 38.00%. (Assume that you can't recover the final NWC position in

year 5. i.e. only consider the change in NWC for each year)

30,000.00

21,093.60

549.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub