year. • Purchased building to be held as investment property for P4,000,000. Direct costs incurred amounted to P80,000. Costs of day-to-day servicing for the asset totaled P20,000. • Constructed building to be used as investment property. Total costs incurred include the following: • Materials, labor, and overhead Start-up costs Operating losses • Abnormal amounts of wasted materials during P8,000,000 400,000 200,000 construction 80,000 • Land acquired with currently undetermined future use by issuing note payable with face amount of P4,000,000 and a present value of P3,200,000. • Building acquired through finance lease to be rented out under various operating leases. The fair value of the building is P2,120,000 and the present value of minimum lease payments is P2,000,000. • Land to be used as investment property was acquired through exchange. Fair value of asset given up in exchange for the land is P12,000,000. Fair value of the land received is P14,400,000. Additional cash paid for the land received is P2,000,000. The exchange has commercial substance. How much is the total cost of investment property on initial recognition? Show your computation.

year. • Purchased building to be held as investment property for P4,000,000. Direct costs incurred amounted to P80,000. Costs of day-to-day servicing for the asset totaled P20,000. • Constructed building to be used as investment property. Total costs incurred include the following: • Materials, labor, and overhead Start-up costs Operating losses • Abnormal amounts of wasted materials during P8,000,000 400,000 200,000 construction 80,000 • Land acquired with currently undetermined future use by issuing note payable with face amount of P4,000,000 and a present value of P3,200,000. • Building acquired through finance lease to be rented out under various operating leases. The fair value of the building is P2,120,000 and the present value of minimum lease payments is P2,000,000. • Land to be used as investment property was acquired through exchange. Fair value of asset given up in exchange for the land is P12,000,000. Fair value of the land received is P14,400,000. Additional cash paid for the land received is P2,000,000. The exchange has commercial substance. How much is the total cost of investment property on initial recognition? Show your computation.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 79.3C

Related questions

Question

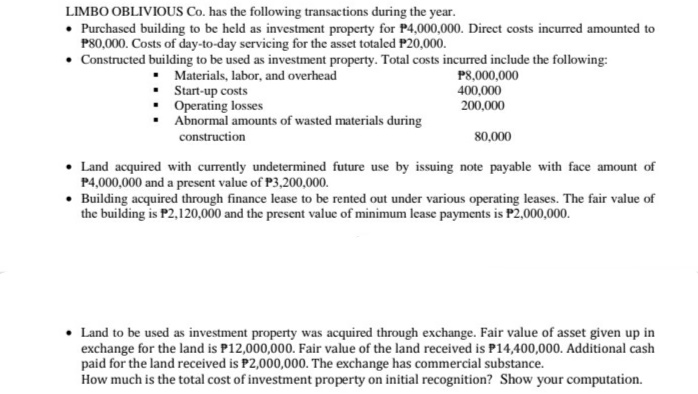

Transcribed Image Text:LIMBO OBLIVIOUS Co. has the following transactions during the year.

• Purchased building to be held as investment property for P4,000,000. Direct costs incurred amounted to

P80,000. Costs of day-to-day servicing for the asset totaled P20,000.

• Constructed building to be used as investment property. Total costs incurred include the following:

Materials, labor, and overhead

• Start-up costs

• Operating losses

Abnormal amounts of wasted materials during

P8,000,000

400,000

200,000

construction

80,000

• Land acquired with currently undetermined future use by issuing note payable with face amount of

P4,000,000 and a present value of P3,200,000.

• Building acquired through finance lease to be rented out under various operating leases. The fair value of

the building is P2,120,000 and the present value of minimum lcase payments is P2,000,000.

Land to be used as investment property was acquired through exchange. Fair value of asset given up in

exchange for the land is P12,000,000. Fair value of the land received is P14,400,000. Additional cash

paid for the land received is P2,000,000. The exchange has commercial substance.

How much is the total cost of investment property on initial recognition? Show your computation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,