years to pay for his college tuition. He says that he typically earns around $300 per day, and all he has t do is drive around in his car for 12 hours a day. He says if I do this everyday, I can make $9,000 per month, isn't that great? My rent is only $1,000 per month, and my tuition costs $6,000 per year. I'm set! As an analyst, you naturally start to ask him questions. For example: How many miles is he driving? He tells you he's been driving roughly 1000 miles per week. How much is he spending on gas? He's not sur but he tells you that he's been getting roughly 20 miles per gallon, and gas typically costs him $5.00 per gallon. What about maintenance on his car? He says that the manufacturer recommends that he change the oil and filters on his car every 10000 miles and typically costs him $100. Is your friend considering everything necessary to determine if this a good plan or not?

years to pay for his college tuition. He says that he typically earns around $300 per day, and all he has t do is drive around in his car for 12 hours a day. He says if I do this everyday, I can make $9,000 per month, isn't that great? My rent is only $1,000 per month, and my tuition costs $6,000 per year. I'm set! As an analyst, you naturally start to ask him questions. For example: How many miles is he driving? He tells you he's been driving roughly 1000 miles per week. How much is he spending on gas? He's not sur but he tells you that he's been getting roughly 20 miles per gallon, and gas typically costs him $5.00 per gallon. What about maintenance on his car? He says that the manufacturer recommends that he change the oil and filters on his car every 10000 miles and typically costs him $100. Is your friend considering everything necessary to determine if this a good plan or not?

Chapter8: Vehicle And Other Major Purchases

Section: Chapter Questions

Problem 1FPC

Related questions

Question

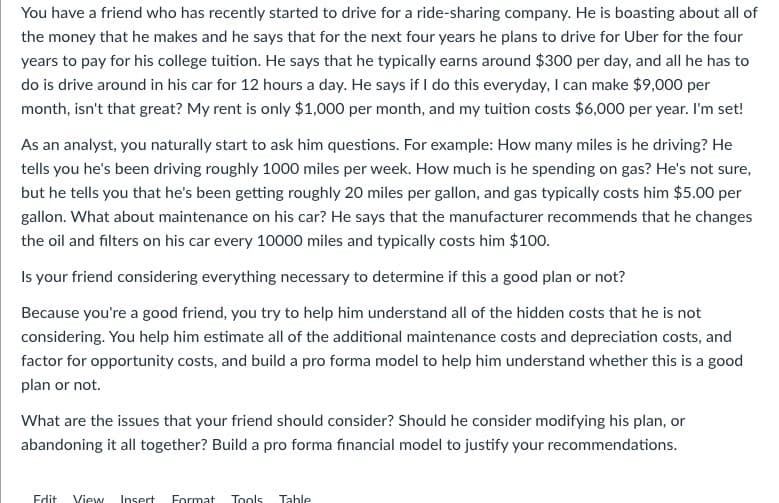

Transcribed Image Text:You have a friend who has recently started to drive for a ride-sharing company. He is boasting about all of

the money that he makes and he says that for the next four years he plans to drive for Uber for the four

years to pay for his college tuition. He says that he typically earns around $300 per day, and all he has to

do is drive around in his car for 12 hours a day. He says if I do this everyday, I can make $9,000 per

month, isn't that great? My rent is only $1,000 per month, and my tuition costs $6,000 per year. I'm set!

As an analyst, you naturally start to ask him questions. For example: How many miles is he driving? He

tells you he's been driving roughly 1000 miles per week. How much is he spending on gas? He's not sure,

but he tells you that he's been getting roughly 20 miles per gallon, and gas typically costs him $5.00 per

gallon. What about maintenance on his car? He says that the manufacturer recommends that he changes

the oil and filters on his car every 10000 miles and typically costs him $100.

Is your friend considering everything necessary to determine if this a good plan or not?

Because you're a good friend, you try to help him understand all of the hidden costs that he is not

considering. You help him estimate all of the additional maintenance costs and depreciation costs, and

factor for opportunity costs, and build a pro forma model to help him understand whether this is a good

plan or not.

What are the issues that your friend should consider? Should he consider modifying his plan, or

abandoning it all together? Build a pro forma financial model to justify your recommendations.

Edit View Insert Format Tools Table

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning