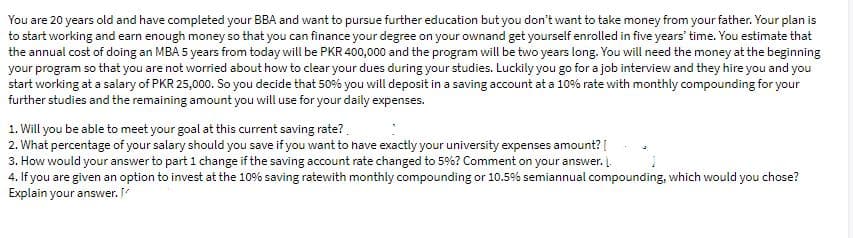

You are 20 years old and have completed your BBA and want to pursue further education but you don't want to take money from your father. Your plan is to start working and earn enough money so that you can finance your degree on your ownand get yourself enrolled in five years' time. You estimate that the annual cost of doing an MBA 5 years from today will be PKR 400,000 and the program will be two years long. You will need the money at the beginning your program so that you are not worried about how to clear your dues during your studies. Luckily you go for a job interview and they hire you and you start working at a salary of PKR 25,000. So you decide that 509% you will deposit in a saving account at a 10% rate with monthly compounding for your further studies and the remaining amount you will use for your daily expenses. 1. Will you be able to meet your goal at this current saving rate?. 2. What percentage of your salary should you save if you want to have exactly your university expenses amount? { 3. How would your answer to part 1 change if the saving account rate changed to 5%? Comment on your answer. . 4. If you are given an option to invest at the 10% saving ratewith monthly compounding or 10.5% semiannual compounding, which would you chose? Explain your answer.

You are 20 years old and have completed your BBA and want to pursue further education but you don't want to take money from your father. Your plan is to start working and earn enough money so that you can finance your degree on your ownand get yourself enrolled in five years' time. You estimate that the annual cost of doing an MBA 5 years from today will be PKR 400,000 and the program will be two years long. You will need the money at the beginning your program so that you are not worried about how to clear your dues during your studies. Luckily you go for a job interview and they hire you and you start working at a salary of PKR 25,000. So you decide that 509% you will deposit in a saving account at a 10% rate with monthly compounding for your further studies and the remaining amount you will use for your daily expenses. 1. Will you be able to meet your goal at this current saving rate?. 2. What percentage of your salary should you save if you want to have exactly your university expenses amount? { 3. How would your answer to part 1 change if the saving account rate changed to 5%? Comment on your answer. . 4. If you are given an option to invest at the 10% saving ratewith monthly compounding or 10.5% semiannual compounding, which would you chose? Explain your answer.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:You are 20 years old and have completed your BBA and want to pursue further education but you don't want to take money from your father. Your plan is

to start working and earn enough money so that you can finance your degree on your ownand get yourself enrolled in five years' time. You estimate that

the annual cost of doing an MBA 5 years from today will be PKR 400,000 and the program will be two years long. You will need the money at the beginning

your program so that you are not worried about how to clear your dues during your studies. Luckily you go for a job interview and they hire you and you

start working at a salary of PKR 25,000. So you decide that 509% you will deposit in a saving account at a 10% rate with monthly compounding for your

further studies and the remaining amount you will use for your daily expenses.

1. Will you be able to meet your goal at this current saving rate?.

2. What percentage of your salary should you save if you want to have exactly your university expenses amount? {

3. How would your answer to part 1 change if the saving account rate changed to 5%? Comment on your answer. .

4. If you are given an option to invest at the 10% saving ratewith monthly compounding or 10.5% semiannual compounding, which would you chose?

Explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT