Congratulations, you just had a baby! The baby already takes after you and shows amazing business acumen. You want your baby to get an undergraduate degree and work for 3 years and then quit their job to get a Cox MBA twenty-five years from now. The issue is that this is a 2-year program with a current annual cost of $50,000 and this cost is expected to grow 3.5% annually over the next 25 and 26 years. You wish to save up for your baby’s future MBA costs using a tax-sheltered investment account expected to earn 6.5% compounded annually to make it easier for the baby to quit her job and get her MBA. Please answer the following questions. What are the expected future costs of each year of baby’s Cox MBA 25 and 26 years from now (assume the cost will continue to increase from year 1 to year 2 of the program)? How much would you have to deposit today in a single lump sum deposit in order to fund the baby’s future expected MBA costs (assume your investment account will continue to earn 6.5% between years 1 and 2 of the program)? The deposit in the previous question is a huge chunk of change. Instead, you decide it might be best to fund your baby’s MBA with a series of 25 equal annual deposits beginning today. What does this annual deposit need to be given the 6.5% expected annual compound return?

Congratulations, you just had a baby! The baby already takes after you and shows amazing business acumen. You want your baby to get an undergraduate degree and work for 3 years and then quit their job to get a Cox MBA twenty-five years from now. The issue is that this is a 2-year program with a current annual cost of $50,000 and this cost is expected to grow 3.5% annually over the next 25 and 26 years. You wish to save up for your baby’s future MBA costs using a tax-sheltered investment account expected to earn 6.5% compounded annually to make it easier for the baby to quit her job and get her MBA. Please answer the following questions.

- What are the expected future costs of each year of baby’s Cox MBA 25 and 26 years from now (assume the cost will continue to increase from year 1 to year 2 of the program)?

- How much would you have to deposit today in a single lump sum deposit in order to fund the baby’s future expected MBA costs (assume your investment account will continue to earn 6.5% between years 1 and 2 of the program)?

- The deposit in the previous question is a huge chunk of change. Instead, you decide it might be best to fund your baby’s MBA with a series of 25 equal annual deposits beginning today. What does this annual deposit need to be given the 6.5% expected annual compound return?

1.

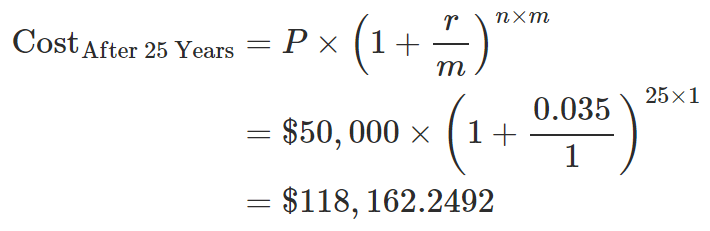

Calculate the future cost of MBA 25 years from now (Cost After 25 Years) by the compound interest formula. Here, 'P' refers to the principal amount which is $50,000, 'r' refers to the growth rate which is 3.50%, 'n' refers to the time (in years) which is 25 years and 'm' refers to the number of compounding periods which 1, due to annual compounding.

Thus, the future cost of MBA 25 years from now will be $118,162.2492.

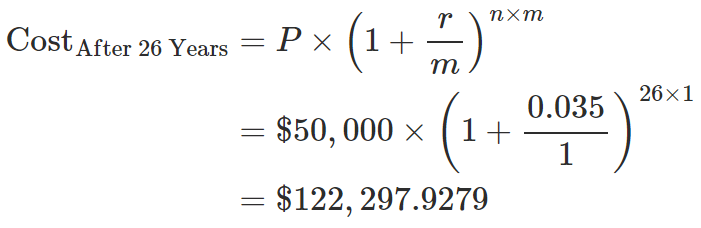

Calculate the future cost of MBA 26 years from now (Cost After 26 Years) by the compound interest formula. Here, 'P' refers to the principal amount which is $50,000, 'r' refers to the growth rate which is 3.50%, 'n' refers to the time (in years) which is 26 years and 'm' refers to the number of compounding periods which 1, due to annual compounding.

Thus, the future cost of MBA 26 years from now will be $122,297.9279.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images