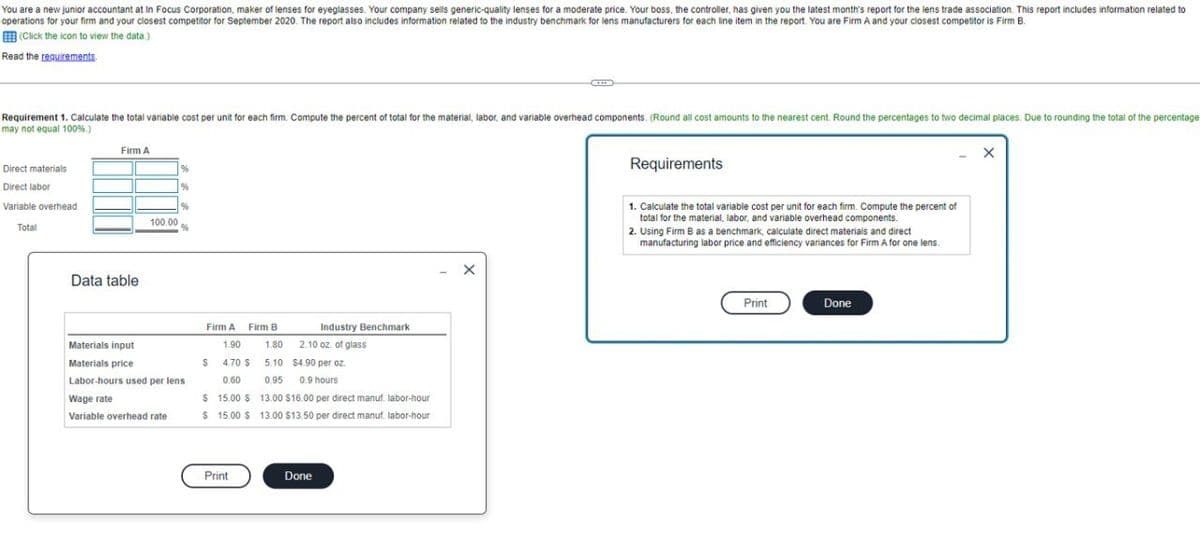

You are a new junior accountant at In Focus Corporation, maker of lenses for eyeglasses. Your company sells generic-quality lenses for a moderate price. Your boss, the controller, has given you the latest month's report for the lens trade association. This report includes information related to operations for your firm and your closest competitor for September 2020. The report also includes information related to the industry benchmark for lens manufacturers for each line item in the report. You are Firm A and your closest competitor is Firm B. (Click the icon to view the data.) Read the requirements Requirement 1. Calculate the total variable cost per unit for each firm. Compute the percent of total for the material, labor, and variable overhead components. (Round all cost amounts to the nearest cent. Round the percentages to two decimal places. Due to rounding the total of the percenta may not equal 100%.) Firm A Direct materials Direct labor Variable overhead Total Data table 100.00 Firm A Firm B Industry Benchmark Materials input 1.90 1.80 Materials price $ Labor-hours used per lens 4.70 $ 0.60 Wage rate $15.00 $ 2.10 oz. of glass 5.10 $4.90 per oz. 0.95 0.9 hours 13.00 $16.00 per direct manuf. labor-hour Variable overhead rate $ 15.00 $ 13.00 $13.50 per direct manuf. labor-hour Print Done Requirements 1. Calculate the total variable cost per unit for each firm. Compute the percent of total for the material, labor, and variable overhead components. 2. Using Firm B as a benchmark, calculate direct materials and direct manufacturing labor price and efficiency variances for Firm A for one lens. Print Done

You are a new junior accountant at In Focus Corporation, maker of lenses for eyeglasses. Your company sells generic-quality lenses for a moderate price. Your boss, the controller, has given you the latest month's report for the lens trade association. This report includes information related to operations for your firm and your closest competitor for September 2020. The report also includes information related to the industry benchmark for lens manufacturers for each line item in the report. You are Firm A and your closest competitor is Firm B. (Click the icon to view the data.) Read the requirements Requirement 1. Calculate the total variable cost per unit for each firm. Compute the percent of total for the material, labor, and variable overhead components. (Round all cost amounts to the nearest cent. Round the percentages to two decimal places. Due to rounding the total of the percenta may not equal 100%.) Firm A Direct materials Direct labor Variable overhead Total Data table 100.00 Firm A Firm B Industry Benchmark Materials input 1.90 1.80 Materials price $ Labor-hours used per lens 4.70 $ 0.60 Wage rate $15.00 $ 2.10 oz. of glass 5.10 $4.90 per oz. 0.95 0.9 hours 13.00 $16.00 per direct manuf. labor-hour Variable overhead rate $ 15.00 $ 13.00 $13.50 per direct manuf. labor-hour Print Done Requirements 1. Calculate the total variable cost per unit for each firm. Compute the percent of total for the material, labor, and variable overhead components. 2. Using Firm B as a benchmark, calculate direct materials and direct manufacturing labor price and efficiency variances for Firm A for one lens. Print Done

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 2TP: You are a management accountant for Time Treasures Company, whose company has recently signed an...

Related questions

Question

please answer this with must explanation , computation , for each steps and each parts answer in text form

Transcribed Image Text:You are a new junior accountant at in Focus Corporation, maker of lenses for eyeglasses. Your company sells generic-quality lenses for a moderate price. Your boss, the controller, has given you the latest month's report for the lens trade association. This report includes information related to

operations for your firm and your closest competitor for September 2020. The report also includes information related to the industry benchmark for lens manufacturers for each line item in the report. You are Firm A and your closest competitor is Firm B.

(Click the icon to view the data.)

Read the requirements.

Requirement 1. Calculate the total variable cost per unit for each firm. Compute the percent of total for the material, labor, and variable overhead components. (Round all cost amounts to the nearest cent. Round the percentages to two decimal places. Due to rounding the total of the percentage

may not equal 100%.)

Firm A

Direct materials

Direct labor

Variable overhead

Total

Data table

100.00

Firm A Firm B

Materials input

1.90

1.80

Industry Benchmark

2.10 oz. of glass

Materials price

$

Labor-hours used per lens

Wage rate

$

15.00 $

4.70 $ 5.10 $4.90 per oz.

0.60 0.95 0.9 hours

13.00 $16.00 per direct manuf. labor-hour

Variable overhead rate

$ 15.00 $

13.00 $13.50 per direct manuf. labor-hour

Print

Done

Requirements

1. Calculate the total variable cost per unit for each firm. Compute the percent of

total for the material, labor, and variable overhead components.

2. Using Firm B as a benchmark, calculate direct materials and direct

manufacturing labor price and efficiency variances for Firm A for one lens.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College