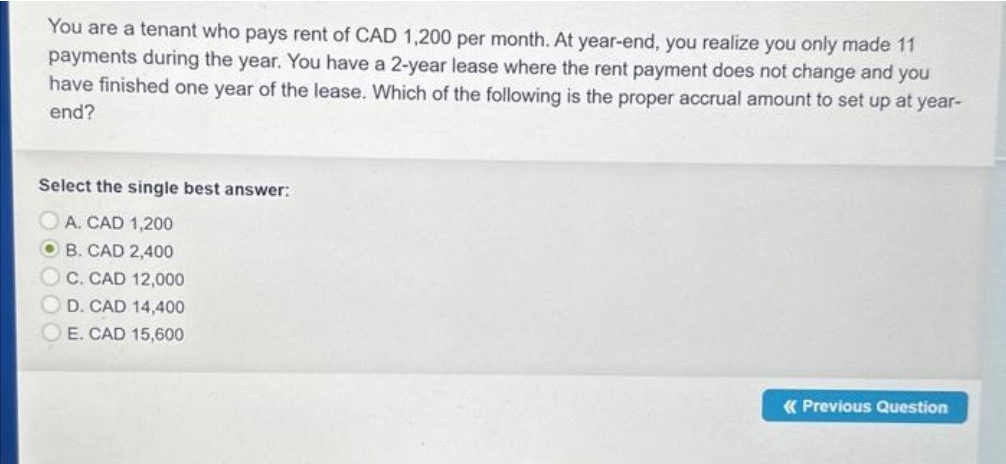

You are a tenant who pays rent of CAD 1,200 per month. At year-end, you realize you only made 11 payments during the year. You have a 2-year lease where the rent payment does not change and you have finished one year of the lease. Which of the following is the proper accrual amount to set up at year- end? Select the single best answer: A. CAD 1,200 B. CAD 2,400 C. CAD 12,000 D. CAD 14,400 E. CAD 15,600

Q: Castle Company’s pension fund projected that a significant number of its employees would take…

A: A risk-free bond that is issued by the government which also provides periodic interest payments to…

Q: Suppose a five-year, $1,000 bond with annual coupons has a price of $899.87 and a yield to maturity…

A: To determine the coupon rate, we need to determine the coupon payment first and then use the coupon…

Q: Today, a bond has a coupon rate of 13.6%, par value of $1000, YTM of 9.60%, and semi-annual coupons…

A:

Q: The coupon rate of a floating note that makes payments in June and December is expressed as…

A: The annual income an investor might anticipate while owning a specific bond is known as the coupon…

Q: Indicate whether each of the following statements is true or false. Support your answers with the…

A: 1) False Modigliani and Miller’s Proposition II assumes that the cost of debt remains constant even…

Q: A UK government bond has exactly three years to maturity. The bond makes semi-annual coupon payments…

A: Information provided for Kumatsu bond: Par Value “FV” = 100 Annual coupon “PMT” = 2.50 Number of…

Q: Consider a coupon bond with coupon payment=4.25, M=100, and n=2. Suppose ?1 = 4% and ?2 = 4.24%.…

A: To calculate the forward price using the forward rate approach, we can use the formula: Forward…

Q: You are interested in investing some money in a bond issue and have several choices. The first is a…

A: There are three bonds given for the investment and each of the three bonds offers a different yield…

Q: Q5. You are anticipating receiving a stream of regular monthly cash flows, with the first payment of…

A: The future value of a growing annuity is the expected value at a future point in time of a series of…

Q: Consider a bond that is currently priced at $1100. If the face value of the bond is $1000, coupon…

A: Bond refers to the debt securities which are issued by the government or corporation for raising the…

Q: Indicate whether the following statements is true or false. Provide the relevant explanations. In…

A: The cost of capital is the rate of return that investors require to invest in a company's…

Q: Find the simple interest. Principal Rate Time in Months $2000 4% 9 The simple interest is $ (Round…

A: Simple interest is a type of interest that is calculated only on the principal amount of a loan or…

Q: If closing costs of $1,900 are associated with the refinance of a mortgage that would reduce the…

A: Closing costs refer to the expenses that are incurred for the completion of the transaction of real…

Q: Company A just reported free cash flows of $24 million and expects FCF to grow at a constant rate of…

A: To calculate the price of one share of Company A's stock, we need to use the constant growth model,…

Q: An annuity has payments at the beginning of every three months starting today. The first payment is…

A: An annuity is a payment series that provides the holder with a periodic income in exchange for a…

Q: OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship will cost $499 million and…

A: OpenSeas Inc is evaluating the purchase of new cruise ship . The Ship cost $499 Million and will…

Q: a company bonds have a par face value of 1000 the bonds pay semi annual interest of 10% how much is…

A: Calculate the rate of return we consider the difference in the price and the amount of interest…

Q: Buttons share price on 2 September 2019 was 8.10 pence. Its share price at 1 September 2020 was…

A: Dividend is the part or share of profits which is being distributed to shareholders in return for…

Q: A BBB-rated corporate bond has a yield to maturity of 8.2%. A U.S. Treasury security has a yield to…

A: A treasury bill is a kind of debt security issued by the government and private companies for…

Q: The Global Advertising Company has a tax rate of 30%. The company can raise debt at a 12% interest…

A: Cost of Equity = [(Dividend x (1 - Flotation Cost)) / (Current Stock Price x (1 - Flotation Cost))]…

Q: Delta Products recently reported $4,250,000 of sales, $3,200,000 of operating costs other than…

A: sales = $4,250,000 Operating cost = $3,200,000 depreciation = $250,000 tax rate = 35% Purchase of…

Q: question: c) Suppose the initial £90,000 is raised by borrowing at the risk-free interest rate…

A: Net Present Value: . The calculation of Net present value involve considering the all gas inflow…

Q: Stock Y has a beta of 1.2 and an expected return of 11.5 percent. Stock Z has a beta of .80 and an…

A: Reward to risk ratio: Formula to be used Reward to risk ratio=Expected Return of Stock - Risk Free…

Q: The 2-month interest rates in Switzerland and the United States are, respectively, 1% and 2% per…

A: Interest rate parity Interest rate parity provides the relationship between spot exchange rate and…

Q: Do an essay on the following topic The Impact of ICT on the Financial Sector Effect on business…

A: The financial industry has undergone a revolution thanks to the advancements in information and…

Q: Frank deposited $8,500 into an account earning 4.5% interest compounded monthly. How much will…

A: We can determine the amount Frank will have in 5 years using the Future Value formula as below. This…

Q: A bond has a Macaulay duration of 7.50 and is priced to yield 5.5%. If interest rates go up so that…

A: The price of the bond refers to the price at which the bonds are to be traded between the buyers…

Q: Suppose that you have $1 million and the following two opportunities from which to construct a…

A: Expected rate of return of Portfolio: The total return that the investor anticipates under various…

Q: Should this person open a credit card account? If they do decide to open the new credit card…

A: Based on the information provided, it seems that Crystal has had some financial difficulties in the…

Q: Born On The 4th Of Supply Industrial Goods paid a quarterly dividend of $3.55 per share last…

A: The problem requires the valuation of the stock. It requires the use of a dividend discount model to…

Q: What would you recommend, as far as trading, when the short- term (say 5-day) moving average moves…

A: Moving average, A technical indicator that is used by the traders and investor to determine the…

Q: What is the lower bound for the price of a 7-month European call option on a non-dividend-paying…

A: A call option gives the right but not the obligation to buy at the strike price. The lower bound of…

Q: Explain what is meant by political ideologies?

A: Political ideologies are thinking systems that individuals subscribe to, which in turn shapes their…

Q: The ratio, Days Sales Outstanding (DSO) measures how quickly a company pays its vendors and…

A: In order to gain insights into profitability, liquidity, operational effectiveness, and solvency,…

Q: Suppose that you have the following two opportunities from which to construct a complete portfolio:…

A: A portfolio is a combination of various securities which consists of common stock, bonds, debt…

Q: A young executive is going to purchase a vacation property for investment purposes. She needs to…

A: The sum borrowed to meet the personal or business needs is recognized as mortgage. The loan is…

Q: Fit Corp, is expected to pay the following dividends over the next few years: $14 in year 1. $10 in…

A: Dividend in year 1 = d1 = $14 Dividend in year 2 = d2 = $10 Dividend in year 3 = d3 = $0 Dividend in…

Q: Which of the following are nontax characteristics of a qualified terminable interest property (QTIP)…

A: A Qualified Terminable Interest Property (QTIP) trust is a type of trust that allows a decedent to…

Q: 4) Find the weighted average cost of capital. Debt-to-equity ratio Pre-tax borrowing cost Marginal…

A: Weighted Average Cost of Capital is also known as WACC. It is the cost capital which includes the…

Q: A risky business project will only be considered by rational investors if they believe the projected…

A: Different business projects involve different risk levels. An aggressive expansion project might be…

Q: EA manufactures two computer games SWGOH and ZSOS. SWGOH selling price is $75 per unit and variable…

A: Variable costs are those costs which changes along with change in activity level. Contribution…

Q: LO2 The interest rate on a $100,000 loan is 6% compounded monthly. How much longer will it take to…

A: compound = monthly = 12 Present value = pv = $100,000 Interest rate = 6 / 12 = 0.5% Time in months =…

Q: As the required rate of return on an asset decreases 1. 11. III. Asset prices increase because the…

A: Step 1 An asset's anticipated rate of return is equal to the market interest rate; Actual Value is…

Q: 4. Feast Foods is interested in calculating its weighted average cost of capital. The company's CFO…

A: To calculate the WACC, we need to first determine the cost of debt, the cost of equity, and the…

Q: Suppose that there are many stocks in the security market and that the characteristics of stocks A…

A: Step 1 The risk-free rate is typically thought of as being equal to the interest earned on a…

Q: 2. Thor Industries finances its projects with 40% debts, 10% preferred stock and 50% common stock •…

A: To calculate the weighted average cost of capital (WACC) for Thor Industries, we need to calculate…

Q: mpany's overall capital structure the higher return required by its debtholders. B) In the…

A: The capital structure decision are said to be an important part of decisions . The proportion of…

Q: Credit standards are an important element of a firm's credit policy. What are credit standards, and…

A: Each firm deploys a credit policy that is used to provide goods and services at credit to the…

Q: An investor purchased stock on Sept 30th of the current year. When is the first day that this is…

A: For tax purposes, the holding period to determine if a stock investment is long-term or short-term…

Q: Square File’s assets are worth $220. It has $140 of zero-coupon debt outstanding that is due to be…

A: The present value of debt is the amount of money that the company owes to its creditors, discounted…

Please help me ......

Step by step

Solved in 2 steps

- Lorene, Inc., owns an apartment complex. The terms of Lorenes lease agreement require new tenants to pay the first and last months rent and a cleaning deposit at the inception of the lease. The cleaning deposit is returned when tenants move out and leave their apartment in good condition. If the apartment is not in good condition, Lorene hires a cleaning company and uses the tenants deposit to pay the cleaning bill, with any excess deposit returned. During the current year, Lorene receives monthly rents totaling 28,000, last months rent deposits from new tenants of 8,000, and cleaning deposits of 7,000. Lorene keeps 5,000 in cleaning deposits to pay the cleaning company bill on apartments that are not left in good shape (the 5,000 is the actual cost that is paid in cash to the cleaning company) and returns 4,000 in deposits. Lorenes expenses related to the rental property (other than the cleaning costs) are 14,000. What is Lorene, Inc.s gross income from the rental property if Lorene is a cash basis taxpayer? an accrual basis taxpayer?For his business, Nicholas leased equipment valued at $23 000. The terms of the lease required payments of $1800 every month. If the first payment is due nine months after the lease was signed and interest is 11% compounded monthly, what is the term of the lease?For his business, Nicholas leased equipment valued at $19,000. The terms of the lease required payments of $1550 every month. If the first payment is due eighteen months after the lease was signed and interest is 5% compounded semi-annually, what is the term of the lease? State your answer in years and months (from 0 to 11 months).

- You are leasing some furniture for your apartment. The monthly lease is for $395/month, payable at the beginning of the month. If your personal cost of capital is a 3% nominal annual rate, what is the present value of a one-year lease?Reginald is about to lease an apartment for 36 months. The landlord wants him to make the lease payments at the start of the month. The monthly payments are $1,000 per month. The landlord says he will allow Reg to prepay the rent for the entire lease with a discount. The one-time payment due at the beginning of the lease is $32,484. What is the implied monthly discount rate for the rent? If Reg is earning 1.1% on his savings monthly, should he pay by month or make the one-time payment?Veronica secured a lease on a machine by paying $1,800 as a down payment and then $750 at the beginning of every month for 6 years. The lease rate was 3.75% compounded monthly. What was the principal amount of the lease? What was the cost of the machine? What was the amount of interest paid over the term of the lease?

- Your car dealer is willing to lease you a new car for $190 a month for 36 months. Payments are due on the first day of each month starting with the day you sign the lease contract. If your cost of money is 5.2 percent, what is the current value of the lease? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)An apartment requires a 12-month lease. The terms of the lease require you to pay $1, 000 upfront when you move in (the first month's $500 rent, plus a $500 security deposit). You then must pay S 500 monthly per month, except at the end of the 12th month when you do not pay but receive your $500 security deposit back. What is the present value cost of this lease to you if your prevailing interest rate is the (absurdly large) 3.26% per month? (You can use a spreadsheet.)Apolonia Place is an office building that has recently been put up for sale. It is rented by one tenant who has ten years remaining on their lease. The rent for years 1-3 has been fixed at ¢300,000 per annum, the rent for years 4-6 is fixed at ¢420,000 per annum and the rent for years 7-10 has been fixed at ¢510,000 per annum. The rent is payable annually and in arrears. When the lease ends, it is forecast that the property will sell for ¢2 million. The property is currently being advertised for ¢2.7 million and the landlord has already paid an advertisement cost of ¢500,000. The risk on investment of this kind is currently 12%.Answer this (d) Your client, Mr. Yeboah, has approached you that he wants to purchase Apolonia Place and anticipates that he can use 5 years to recoup his investment. Prior to approaching you, Mr Yeboah had already paid ¢200,000 to another real estate agent as consultancy fee. Based on your calculations in a), b) and c), do you recommend that he buys the…

- Reginald is about to lease an apartment for 12 months. The landlord wants him to make the lease payments at the start of the month. The monthly payments are $1,300 per month. The landlord says he will allow Reg to prepay the rent for the entire lease with a discount. The one-time payment due at the beginning of the lease is $15,180. What is the implied monthly discount rate for the rent? If Reg is earning 0.3% on his savings monthly, should he pay by month or make the one-time payment? What is the implied monthly discount rate for the rent?If lease payments on an office call for $1,550 per month (paid at the beginning of the month) for 24 months, what is the current value of the lease to the landlord. Assume an annual discount rate of 15 percent. Ans.JJJ is renting a storefront. The lease is for 6 years, and the monthly rent is $3,000 until the lease ends. The first payment is due today. Calculate the present value of the entire stream of payments if the APR is 8%, continuously compounded.