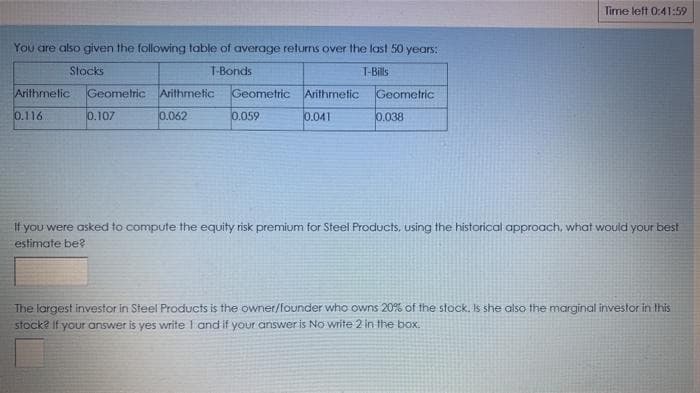

You are also given the following table of average returns over the last 50 years: Stocks T-Bonds T-Bills Arithmelic Geometric Arithmetic Geometric Arithmetic Geometric 0.116 0.107 0.062 0.059 0.041 0.038 It you were asked to compute the equity risk premium for Steel Products, using the historical approach, what would your best estimate be? The largest investor in Steel Products is the owner/founder who owns 20% of the stock, Is she also the marginal investor in this stock? If your answer is yes write I and if your answer is No write 2 in the box.

You are also given the following table of average returns over the last 50 years: Stocks T-Bonds T-Bills Arithmelic Geometric Arithmetic Geometric Arithmetic Geometric 0.116 0.107 0.062 0.059 0.041 0.038 It you were asked to compute the equity risk premium for Steel Products, using the historical approach, what would your best estimate be? The largest investor in Steel Products is the owner/founder who owns 20% of the stock, Is she also the marginal investor in this stock? If your answer is yes write I and if your answer is No write 2 in the box.

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:Tirme left 0:41:59

You are also given the following table of average returns over the last 50 years:

Stocks

T-Bonds

T-Bills

Arithmetic

Geometric

Arithmetic

Geometric Arithmetic

Geometric

0.116

0.107

0.062

0.059

0.041

0.038

If

you were asked to compute the equity risk premium for Steel Products, using the historical approach, what would your best

estimate be?

The largest investor in Steel Products is the owner/founder who owns 20% of the stock. Is she also the marginal investor in this

stock? If your answer is yes write I and if your answer is No write 2 in the box.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning