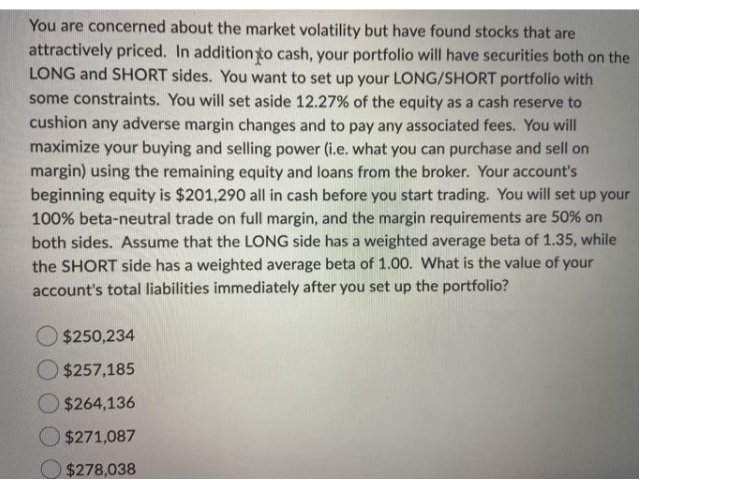

You are concerned about the market volatility but have found stocks that are attractively priced. In addition to cash, your portfolio will have securities both on the LONG and SHORT sides. You want to set up your LONG/SHORT portfolio with some constraints. You will set aside 12.27% of the equity as a cash reserve to cushion any adverse margin changes and to pay any associated fees. You will maximize your buying and selling power (i.e. what you can purchase and sell on margin) using the remaining equity and loans from the broker. Your account's beginning equity is $201,290 all in cash before you start trading. You will set up your 100% beta-neutral trade on full margin, and the margin requirements are 50% on both sides. Assume that the LONG side has a weighted average beta of 1.35, while the SHORT side has a weighted average beta of 1.00. What is the value of your account's total liabilities immediately after you set up the portfolio? O $250,234 $257,185 $264,136 $271,087 $278,038

You are concerned about the market volatility but have found stocks that are attractively priced. In addition to cash, your portfolio will have securities both on the LONG and SHORT sides. You want to set up your LONG/SHORT portfolio with some constraints. You will set aside 12.27% of the equity as a cash reserve to cushion any adverse margin changes and to pay any associated fees. You will maximize your buying and selling power (i.e. what you can purchase and sell on margin) using the remaining equity and loans from the broker. Your account's beginning equity is $201,290 all in cash before you start trading. You will set up your 100% beta-neutral trade on full margin, and the margin requirements are 50% on both sides. Assume that the LONG side has a weighted average beta of 1.35, while the SHORT side has a weighted average beta of 1.00. What is the value of your account's total liabilities immediately after you set up the portfolio? O $250,234 $257,185 $264,136 $271,087 $278,038

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 7MC: You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand...

Related questions

Question

Transcribed Image Text:You are concerned about the market volatility but have found stocks that are

attractively priced. In additionto cash, your portfolio will have securities both on the

LONG and SHORT sides. You want to set up your LONG/SHORT portfolio with

some constraints. You will set aside 12.27% of the equity as a cash reserve to

cushion any adverse margin changes and to pay any associated fees. You will

maximize your buying and selling power (i.e. what you can purchase and sell on

margin) using the remaining equity and loans from the broker. Your account's

beginning equity is $201,290 all in cash before you start trading. You will set up your

100% beta-neutral trade on full margin, and the margin requirements are 50% on

both sides. Assume that the LONG side has a weighted average beta of 1.35, while

the SHORT side has a weighted average beta of 1.00. What is the value of your

account's total liabilities immediately after you set up the portfolio?

O $250,234

$257,185

$264,136

$271,087

$278,038

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning