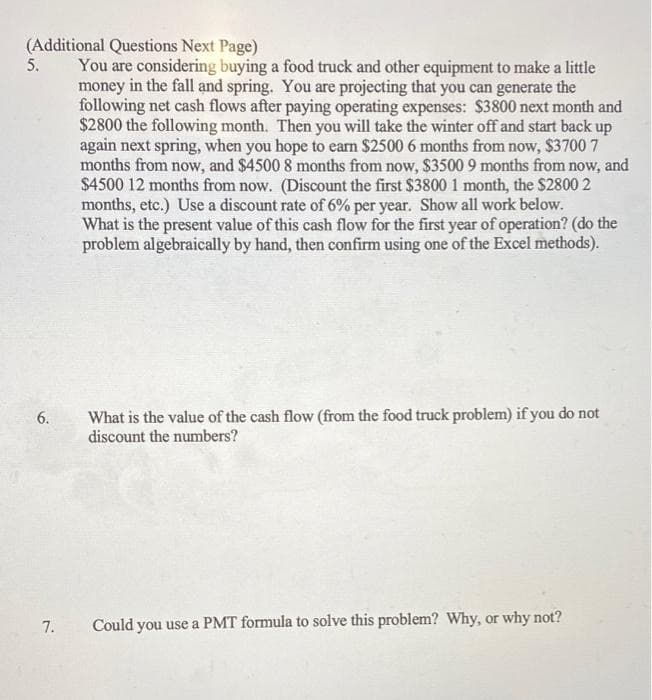

You are considering buying a food truck and other equipment to make a little money in the fall and spring. You are projecting that you can generate the following net cash flows after paying operating expenses: $3800 next month and $2800 the following month. Then you will take the winter off and start back up again next spring, when you hope to earn $2500 6 months from now, $3700 7 months from now, and $4500 8 months from now, $3500 9 months from now, and $4500 12 months from now. (Discount the first $3800 1 month, the $2800 2 months, etc.) Use a discount rate of 6% per year. Show all work below. What is the present value of this cash flow for the first year of operation? (do the problem algebraically by hand, then confirm using one of the Excel methods). 5. What is the value of the cash flow (from the food truck problem) if you do not discount the numbers? 6. 7. Could you use a PMT formula to solve this problem? Why, or why not?

You are considering buying a food truck and other equipment to make a little money in the fall and spring. You are projecting that you can generate the following net cash flows after paying operating expenses: $3800 next month and $2800 the following month. Then you will take the winter off and start back up again next spring, when you hope to earn $2500 6 months from now, $3700 7 months from now, and $4500 8 months from now, $3500 9 months from now, and $4500 12 months from now. (Discount the first $3800 1 month, the $2800 2 months, etc.) Use a discount rate of 6% per year. Show all work below. What is the present value of this cash flow for the first year of operation? (do the problem algebraically by hand, then confirm using one of the Excel methods). 5. What is the value of the cash flow (from the food truck problem) if you do not discount the numbers? 6. 7. Could you use a PMT formula to solve this problem? Why, or why not?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter14: Real Options

Section: Chapter Questions

Problem 3MC: Tropical Sweets is considering a project that will cost $70 million and will generate expected cash...

Related questions

Question

Transcribed Image Text:(Additional Questions Next Page)

5.

You are considering buying a food truck and other equipment to make a little

money in the fall and spring. You are projecting that you can generate the

following net cash flows after paying operating expenses: $3800 next month and

$2800 the following month. Then you will take the winter off and start back up

again next spring, when you hope to earn $2500 6 months from now, $3700 7

months from now, and $4500 8 months from now, $3500 9 months from now, and

$4500 12 months from now. (Discount the first $3800 1 month, the $2800 2

months, etc.) Use a discount rate of 6% per year. Show all work below.

What is the present value of this cash flow for the first year of operation? (do the

problem algebraically by hand, then confirm using one of the Excel methods).

What is the value of the cash flow (from the food truck problem) if you do not

discount the numbers?

7.

Could you use a PMT formula to solve this problem? Why, or why not?

6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning