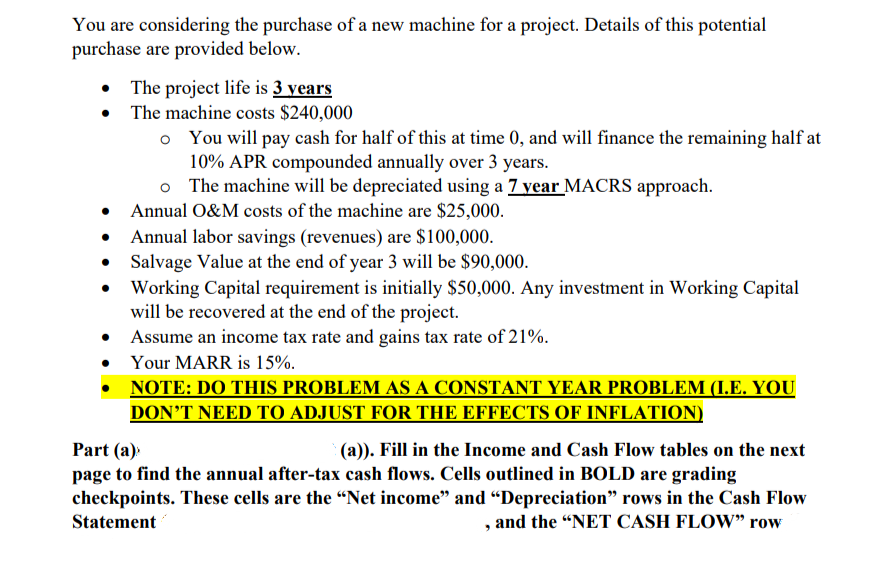

You are considering the purchase of a new machine for a project. Details of this potential purchase are provided below. • The project life is 3 years • The machine costs $240,000 o • • You will pay cash for half of this at time 0, and will finance the remaining half at 10% APR compounded annually over 3 years. o The machine will be depreciated using a 7 year MACRS approach. Annual O&M costs of the machine are $25,000. Annual labor savings (revenues) are $100,000. Salvage Value at the end of year 3 will be $90,000. Working Capital requirement is initially $50,000. Any investment in Working Capital will be recovered at the end of the project. • Assume an income tax rate and gains tax rate of 21%. • Your MARR is 15%. NOTE: DO THIS PROBLEM AS A CONSTANT YEAR PROBLEM (I.E. YOU DON'T NEED TO ADJUST FOR THE EFFECTS OF INFLATION) Part (a) (a)). Fill in the Income and Cash Flow tables on the next page to find the annual after-tax cash flows. Cells outlined in BOLD are grading checkpoints. These cells are the "Net income" and "Depreciation" rows in the Cash Flow Statement and the "NET CASH FLOW" row "

You are considering the purchase of a new machine for a project. Details of this potential purchase are provided below. • The project life is 3 years • The machine costs $240,000 o • • You will pay cash for half of this at time 0, and will finance the remaining half at 10% APR compounded annually over 3 years. o The machine will be depreciated using a 7 year MACRS approach. Annual O&M costs of the machine are $25,000. Annual labor savings (revenues) are $100,000. Salvage Value at the end of year 3 will be $90,000. Working Capital requirement is initially $50,000. Any investment in Working Capital will be recovered at the end of the project. • Assume an income tax rate and gains tax rate of 21%. • Your MARR is 15%. NOTE: DO THIS PROBLEM AS A CONSTANT YEAR PROBLEM (I.E. YOU DON'T NEED TO ADJUST FOR THE EFFECTS OF INFLATION) Part (a) (a)). Fill in the Income and Cash Flow tables on the next page to find the annual after-tax cash flows. Cells outlined in BOLD are grading checkpoints. These cells are the "Net income" and "Depreciation" rows in the Cash Flow Statement and the "NET CASH FLOW" row "

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 4CE: Manzer Enterprises is considering two independent investments: A new automated materials handling...

Related questions

Question

Transcribed Image Text:You are considering the purchase of a new machine for a project. Details of this potential

purchase are provided below.

• The project life is 3 years

The machine costs $240,000

o You will pay cash for half of this at time 0, and will finance the remaining half at

10% APR compounded annually over 3 years.

The machine will be depreciated using a 7 year MACRS approach.

Annual O&M costs of the machine are $25,000.

Annual labor savings (revenues) are $100,000.

Salvage Value at the end of year 3 will be $90,000.

Working Capital requirement is initially $50,000. Any investment in Working Capital

will be recovered at the end of the project.

Assume an income tax rate and gains tax rate of 21%.

Your MARR is 15%.

NOTE: DO THIS PROBLEM AS A CONSTANT YEAR PROBLEM (I.E. YOU

DON'T NEED TO ADJUST FOR THE EFFECTS OF INFLATION)

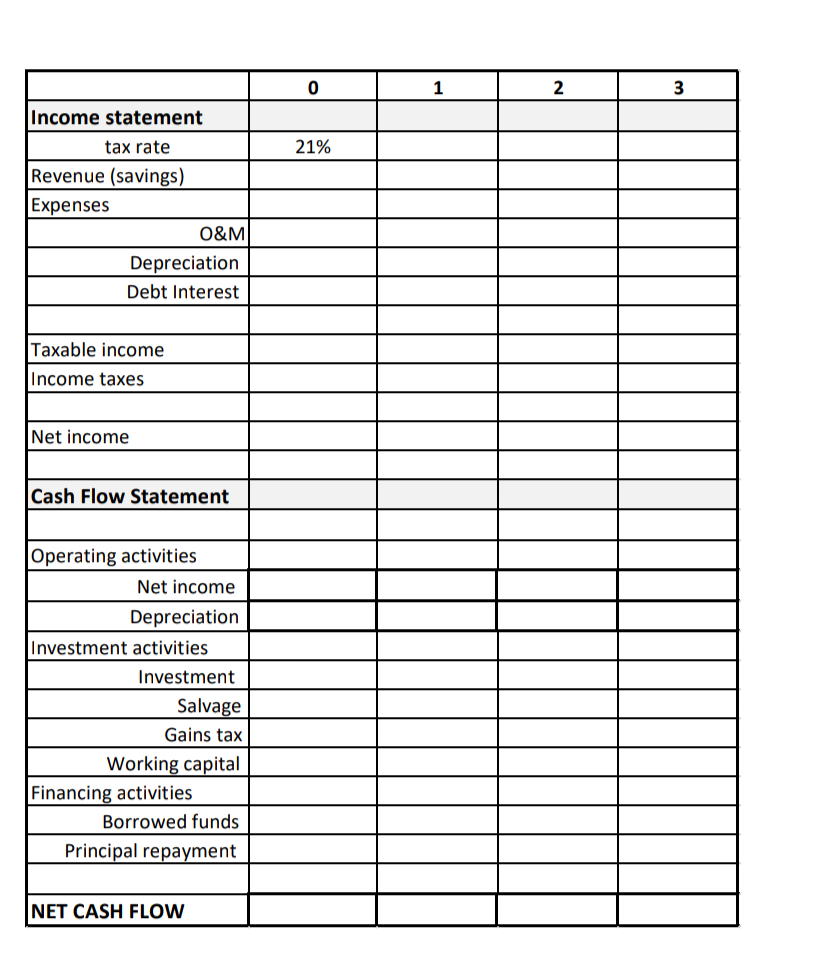

Part (a)

(a)). Fill in the Income and Cash Flow tables on the next

page to find the annual after-tax cash flows. Cells outlined in BOLD are grading

checkpoints. These cells are the "Net income" and "Depreciation" rows in the Cash Flow

Statement

and the "NET CASH FLOW" row

9

Transcribed Image Text:Income statement

tax rate

Revenue (savings)

Expenses

Depreciation

Debt Interest

Taxable income

Income taxes

Net income

Cash Flow Statement

Operating activities

O&M

Net income

Depreciation

Investment activities

Investment

Salvage

Gains tax

Working capital

Financing activities

Borrowed funds

Principal repayment

NET CASH FLOW

0

21%

1

2

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning