You are employed as a sales representative throughout 2020, with plus a commission on all your sales. Your commissions income in employer reimburses you for your hotel, meals, and airline costs. A promotion expenses are your expense as the employer will not pro reimbursement for these expenses. You use your own car for work. You receive an allowance for using $1,500 each month. The ending balance UCC of Class 10 is $16,0 2019.You estimate that for 2020 the total costs associated with driv Operating Costs Financing Costs Total $10,600 1,800 $12,400

You are employed as a sales representative throughout 2020, with plus a commission on all your sales. Your commissions income in employer reimburses you for your hotel, meals, and airline costs. A promotion expenses are your expense as the employer will not pro reimbursement for these expenses. You use your own car for work. You receive an allowance for using $1,500 each month. The ending balance UCC of Class 10 is $16,0 2019.You estimate that for 2020 the total costs associated with driv Operating Costs Financing Costs Total $10,600 1,800 $12,400

Chapter6: Business Expenses

Section: Chapter Questions

Problem 38P

Related questions

Question

100%

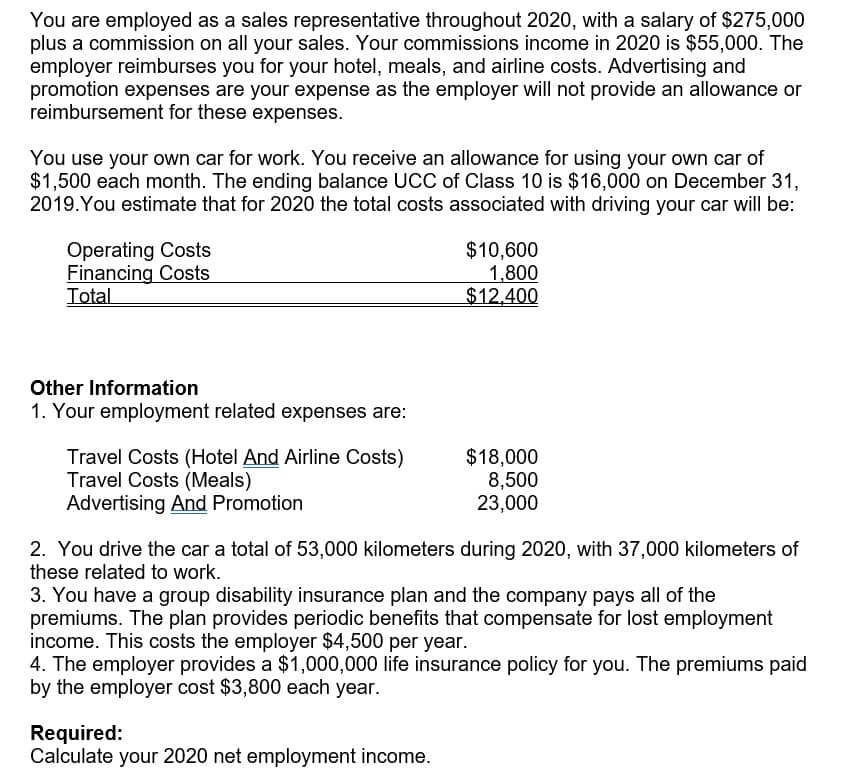

Transcribed Image Text:You are employed as a sales representative throughout 2020, with a salary of $275,000

plus a commission on all your sales. Your commissions income in 2020 is $55,000. The

employer reimburses you for your hotel, meals, and airline costs. Advertising and

promotion expenses are your expense as the employer will not provide an allowance or

reimbursement for these expenses.

You use your own car for work. You receive an allowance for using your own car of

$1,500 each month. The ending balance UCC of Class 10 is $16,000 on December 31,

2019.You estimate that for 2020 the total costs associated with driving your car wilIl be:

Operating Costs

Financing Costs

Total

$10,600

1,800

$12,400

Other Information

1. Your employment related expenses are:

Travel Costs (Hotel And Airline Costs)

Travel Costs (Meals)

Advertising And Promotion

$18,000

8,500

23,000

2. You drive the car a total of 53,000 kilometers during 2020, with 37,000 kilometers of

these related to work.

3. You have a group disability insurance plan and the company pays all of the

premiums. The plan provides periodic benefits that compensate for lost employment

income. This costs the employer $4,500 per year.

4. The employer provides a $1,000,000 life insurance policy for you. The premiums paid

by the employer cost $3,800 each year.

Required:

Calculate your 2020 net employment income.

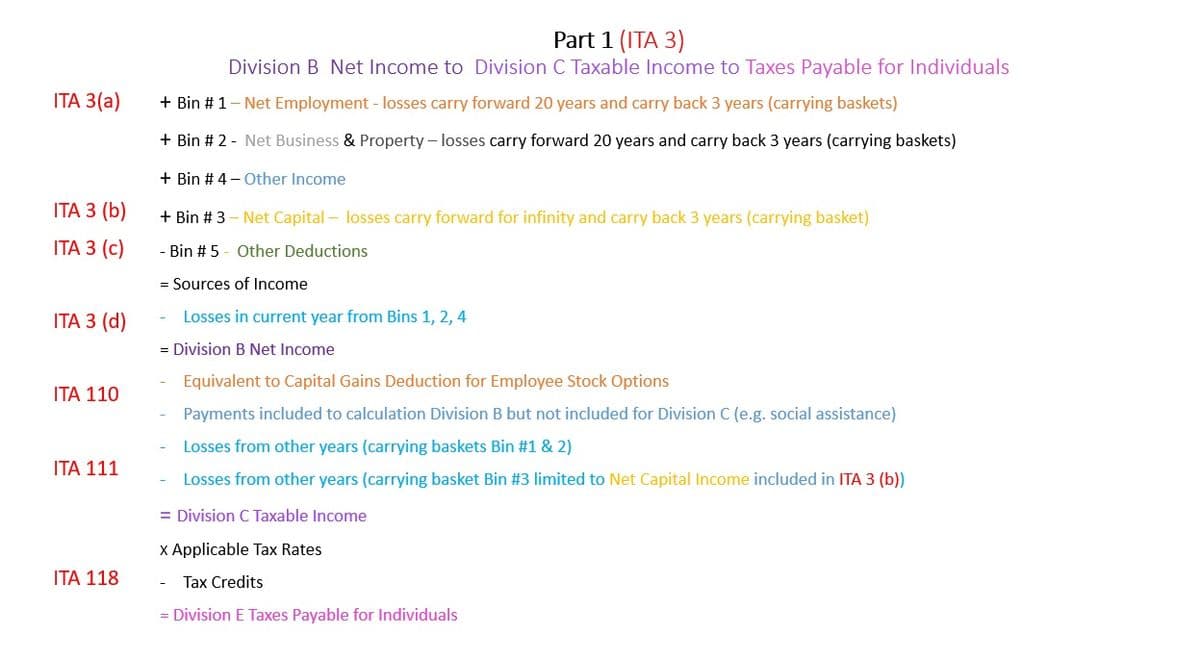

Transcribed Image Text:Part 1 (ITA 3)

Division B Net Income to Division C Taxable Income to Taxes Payable for Individuals

ITA 3(a)

+ Bin # 1- Net Employment - losses carry forward 20 years and carry back 3 years (carrying baskets)

+ Bin # 2 - Net Business & Property – losses carry forward 20 years and carry back 3 years (carrying baskets)

+ Bin # 4 - Other Income

ITA 3 (b)

+ Bin # 3

Net Capital – losses carry forward for infinity and carry back 3 years (carrying basket)

ITA 3 (c)

Bin # 5 - Other Deductions

= Sources of Income

ITА З (d)

Losses in current year from Bins 1, 2, 4

= Division B Net Income

Equivalent to Capital Gains Deduction for Employee Stock Options

ITA 110

Payments included to calculation Division B but not included for Division C (e.g. social assistance)

Losses from other years (carrying baskets Bin #1 & 2)

ΙΤΑ 111

Losses from other years (carrying basket Bin #3 limited to Net Capital Income included in ITA 3 (b))

= Division C Taxable Income

x Applicable Tax Rates

ΙΤΑ 118

Tax Credits

= Division E Taxes Payable for Individuals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT