Multiple In 2019, Mr. Pacino was employed as account officer in a non-life insurance company. account totaled P4.2 million. He is likewise entitled to representation allowance of He received P8,000 basic monthly salary. In addition, he gets 5% of gross premium as commission on policies issued under his account. In 2019, gross premiums under his P1,000 a month. . How much is to be included as gross income in 2019? a. P96,000 b. Р306,000 с. Р318,000 d. exempt

Multiple In 2019, Mr. Pacino was employed as account officer in a non-life insurance company. account totaled P4.2 million. He is likewise entitled to representation allowance of He received P8,000 basic monthly salary. In addition, he gets 5% of gross premium as commission on policies issued under his account. In 2019, gross premiums under his P1,000 a month. . How much is to be included as gross income in 2019? a. P96,000 b. Р306,000 с. Р318,000 d. exempt

Chapter6: Business Expenses

Section: Chapter Questions

Problem 50P

Related questions

Question

Transcribed Image Text:commission on policies issued under his account. In 2019, gross premiums under his

account totaled P4.2 million. He is likewise entitled to representation allowance of

NAME:

SCORE:

SECTION:

PROFESSOR:

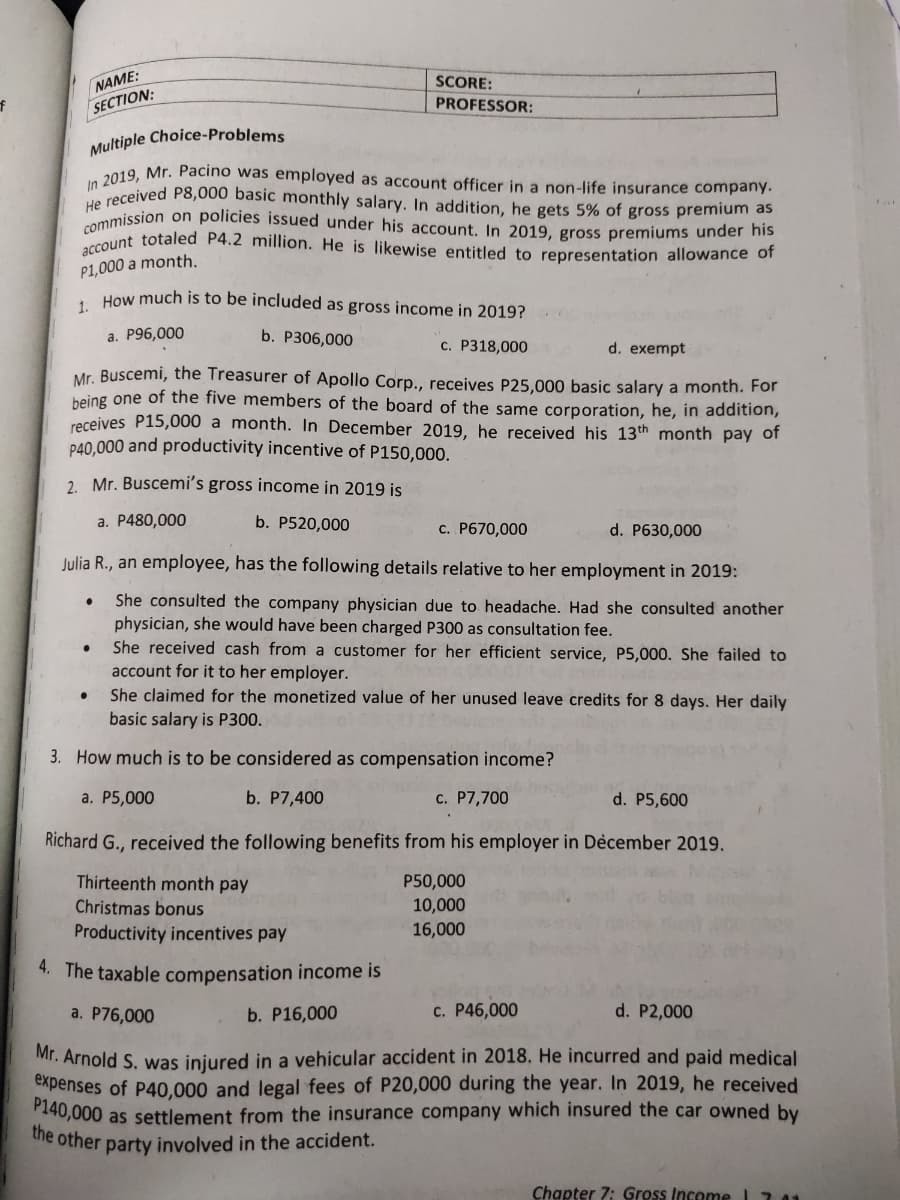

Multiple Choice-Problems

2019, Mr. Pacino was employed as account officer in a non-life insurance company.

a received P8,000 basic monthly salary. In addition, he gets 5% of gross premium as

P1,000 a month.

How much is to be included as gross income in 2019?

a. P96,000

b. P306,000

c. P318,000

d. exempt

Mr. Buscemi, the Treasurer of Apollo Corp., receives P25,000 basic salary a month. For

being one of the five members of the board of the same corporation, he, in addition,

receives P15,000 a month. In December 2019, he received his 13th month pay of

P40,000 and productivity incentive of P150,000.

2. Mr. Buscemi's gross income in 2019 is

a. P480,000

b. P520,000

c. P670,000

d. P630,000

Julia R., an employee, has the following details relative to her employment in 2019:

She consulted the company physician due to headache. Had she consulted another

physician, she would have been charged P300 as consultation fee.

She received cash from a customer for her efficient service, P5,000. She failed to

account for it to her employer.

She claimed for the monetized value of her unused leave credits for 8 days. Her daily

basic salary is P300.

3. How much is to be considered as compensation income?

а. P5,000

b. P7,400

c. P7,700

d. P5,600

Richard G., received the following benefits from his employer in Dècember 2019.

Thirteenth month pay

P50,000

Christmas bonus

10,000

Productivity incentives pay

16,000

4. The taxable compensation income is

a. P76,000

b. P16,000

c. P46,000

d. P2,000

Mr. Arnold S. was iniured in a vehicular accident in 2018. He incurred and paid medical

expenses of P40,000 and legal fees of P20,000 during the year. In 2019, he received

140,000 as settlement from the insurance company which insured the car owned by

ie other party involved in the accident.

Chapter 7: Gross Income l711

Transcribed Image Text:10. The gross income of Ms. J, is

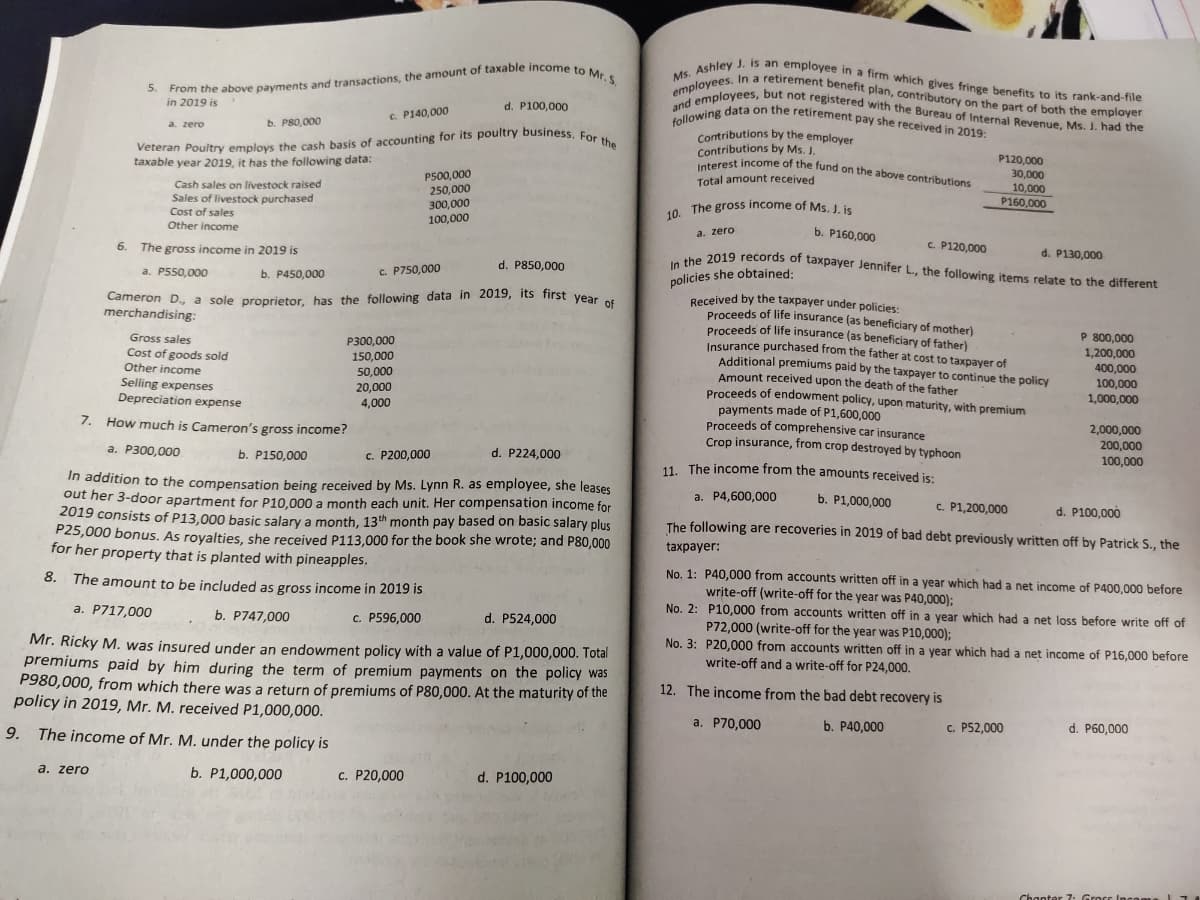

Veteran Poultry employs the cash basis of accounting for its poultry business. For the

following data on the retirement pay she received in 2019:

In the 2019 records of taxpayer Jennifer L., the following items relate to the different

Ms. Ashley J. is an employee in a firm which gives fringe benefits to its rank-and-file

and employees, but not registered with the Bureau of Internal Revenue, Ms. J. had the

employees. In a retirement benefit plan, contributory on the part of both the employer

Interest income of the fund on the above contributions

in 2019 is

d. P100,000

b. PS0,000

c. P140,000

a. zero

Veteran Poultry employs the cash basis of accounting for its poultry business, For

taxable year 2019, it has the following data:

Contributions by the employer

P500,000

250,000

300,000

100,000

Contributions by Ms. J.

Comcest income of the fund on the above contributions

P120,000

30,000

10,000

P160,000

Cash sales on livestock raised

Total amount received

Sales of livestock purchased

Cost of sales

Other income

10 The gross income of Ms. J, is

a. zero

b. P160,000

C. P120,000

he 2019 records of taxpayer Jennifer L, the following items relate to the different

6.

The gross income in 2019 is

d. P130,000

d. P850,000

policies she obtained:

Received by the taxpayer under policies:

Proceeds of life insurance (as beneficiary of mother)

Proceeds of life insurance (as beneficiary of father)

Insurance purchased from the father at cost to taxpayer of

Additional premiums paid by the taxpayer to continue the policy

Amount received upon the death of the father

Proceeds of endowment policy, upon maturity, with premium

payments made of P1,600,000

Proceeds of comprehensive car insurance

Crop insurance, from crop destroyed by typhoon

a. P550,000

b. P450,000

c. P750,000

Cameron D., a sole proprietor bas the following data in 2019, its first year .

merchandising:

P 800,000

Gross sales

Cost of goods sold

Other income

Selling expenses

Depreciation expense

P300,000

150,000

50,000

20,000

4,000

1,200,000

400,000

100,000

1,000,000

7. How much is Cameron's gross income?

2,000,000

а. РЗ00,000

b. P150,000

c. P200,000

d. P224,000

200,000

11 The income from the amounts received is:

100,000

In addition to the compensation being received by Ms. Lynn R. as employee, she leases

out her 3-door apartment for P10.000 a month each unit. Her compensation income for

2019 consists of P13,000 basic salary a month, 13th month pay based on basic salary plus

P25,000 bonus. As rovalties, she received P113.000 for the book she wrote; and P80,000

for her property that is planted with pineapples.

a. P4,600,000

b. P1,000,000

c. P1,200,000

d. P100,000

The following are recoveries in 2019 of bad debt previously written off by Patrick S., the

taxpayer:

No. 1: P40,000 from accounts written off in a year which had a net income of P400,000 before

8. The amount to be included as gross income in 2019 is

write-off (write-off for the year was P40,000);

No. 2: P10,000 from accounts written off in a year which had a net loss before write off of

P72,000 (write-off for the year was P10,000);

No. 3: P20,000 from accounts written off in a year which had a net income of P16,000 before

a. P717,000

b. P747,000

c. P596,000

d. P524,000

Mr. Ricky M. was insured under an endowment policy with a value of P1,000,000. Total

premiums paid by him during the term of premium payments on the policy was

P980,000, from which there was a return of premiums of P80,000. At the maturity of the

policy in 2019, Mr. M. received P1,000,000.

write-off and a write-off for P24,000.

12. The income from the bad debt recovery is

9. The income of Mr. M. under the policy is

a. P70,000

b. Р40,000

c. P52,000

d. P60,000

a. zero

b. P1,000,000

c. P20,000

d. P100,000

Chanter 7: Grocc Incoma

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT