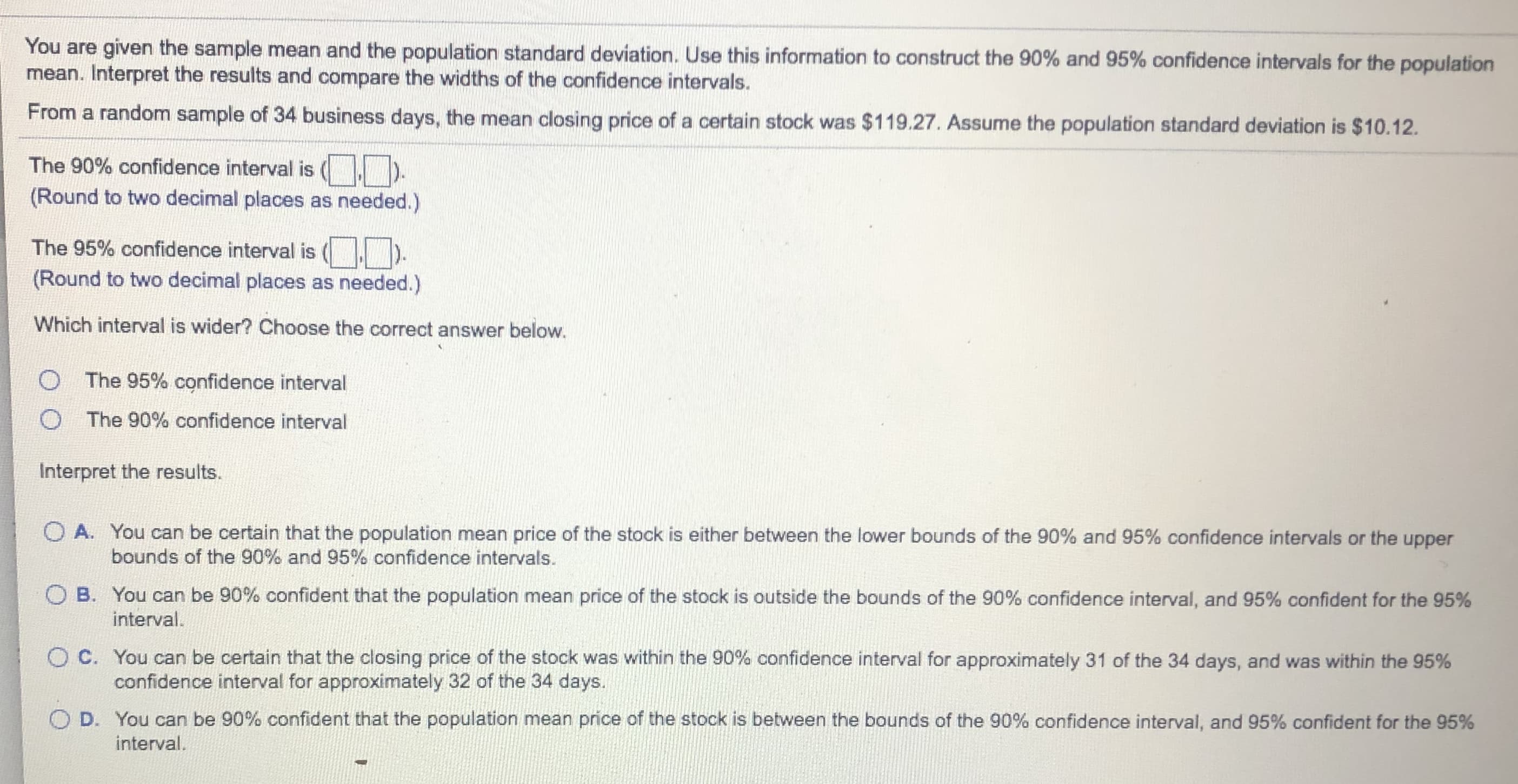

You are given the sample mean and the population standard deviation. Use this information to construct the 90% and 95% confidence intervals for the population mean. Interpret the results and compare the widths of the confidence intervals. From a random sample of 34 business days, the mean closing price of a certain stock was $119.27. Assume the population standard deviation is $10.12. The 90% confidence interval is ( ). (Round to two decimal places as needed.) The 95% confidence interval is ( ). (Round to two decimal places as needed.) Which interval is wider? Choose the correct answer below. O The 95% confidence interval O The 90% confidence interval Interpret the results. O A. You can be certain that the population mean price of the stock is either between the lower bounds of the 90% and 95% confidence intervals or the upper bounds of the 90% and 95% confidence intervals. O B. You can be 90% confident that the population mean price of the stock is outside the bounds of the 90% confidence interval, and 95% confident for the 95% interval. O C. You can be certain that the closing price of the stock was within the 90% confidence interval for approximately 31 of the 34 days, and was within the 95% confidence interval for approximately 32 of the 34 days. D. You can be 90% confident that the population mean price of the stock is between the bounds of the 90% confidence interval, and 95% confident for the 95% interval.

You are given the sample mean and the population standard deviation. Use this information to construct the 90% and 95% confidence intervals for the population mean. Interpret the results and compare the widths of the confidence intervals. From a random sample of 34 business days, the mean closing price of a certain stock was $119.27. Assume the population standard deviation is $10.12. The 90% confidence interval is ( ). (Round to two decimal places as needed.) The 95% confidence interval is ( ). (Round to two decimal places as needed.) Which interval is wider? Choose the correct answer below. O The 95% confidence interval O The 90% confidence interval Interpret the results. O A. You can be certain that the population mean price of the stock is either between the lower bounds of the 90% and 95% confidence intervals or the upper bounds of the 90% and 95% confidence intervals. O B. You can be 90% confident that the population mean price of the stock is outside the bounds of the 90% confidence interval, and 95% confident for the 95% interval. O C. You can be certain that the closing price of the stock was within the 90% confidence interval for approximately 31 of the 34 days, and was within the 95% confidence interval for approximately 32 of the 34 days. D. You can be 90% confident that the population mean price of the stock is between the bounds of the 90% confidence interval, and 95% confident for the 95% interval.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Transcribed Image Text:You are given the sample mean and the population standard deviation. Use this information to construct the 90% and 95% confidence intervals for the population

mean. Interpret the results and compare the widths of the confidence intervals.

From a random sample of 34 business days, the mean closing price of a certain stock was $119.27. Assume the population standard deviation is $10.12.

The 90% confidence interval is ( ).

(Round to two decimal places as needed.)

The 95% confidence interval is (

).

(Round to two decimal places as needed.)

Which interval is wider? Choose the correct answer below.

O The 95% confidence interval

O The 90% confidence interval

Interpret the results.

O A. You can be certain that the population mean price of the stock is either between the lower bounds of the 90% and 95% confidence intervals or the upper

bounds of the 90% and 95% confidence intervals.

O B. You can be 90% confident that the population mean price of the stock is outside the bounds of the 90% confidence interval, and 95% confident for the 95%

interval.

O C. You can be certain that the closing price of the stock was within the 90% confidence interval for approximately 31 of the 34 days, and was within the 95%

confidence interval for approximately 32 of the 34 days.

D. You can be 90% confident that the population mean price of the stock is between the bounds of the 90% confidence interval, and 95% confident for the 95%

interval.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill