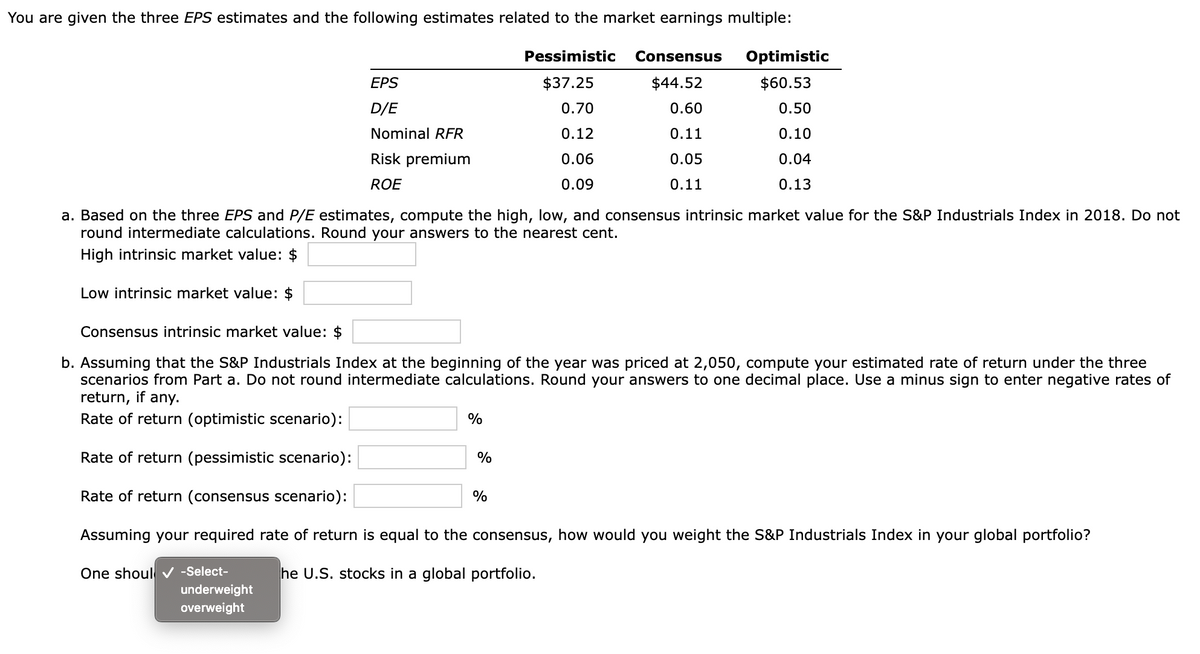

You are given the three EPS estimates and the following estimates related to the market earnings multiple: Pessimistic Consensus $37.25 $44.52 0.70 0.60 0.12 0.11 0.06 0.05 0.09 0.11 One shoul✓ -Select- EPS D/E Nominal RFR Risk premium ROE a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent. High intrinsic market value: $ Low intrinsic market value: $ Consensus intrinsic market value: $ b. Assuming that the S&P Industrials Index at the beginning of the year was priced at 2,050, compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any. Rate of return (optimistic scenario): Rate of return (pessimistic scenario): Rate of return (consensus scenario): Assuming your required rate of return is equal to the consensus, how would you weight the S&P Industrials Index in your global portfolio? he U.S. stocks in a global portfolio. underweight overweight % % Optimistic $60.53 0.50 0.10 0.04 0.13 %

You are given the three EPS estimates and the following estimates related to the market earnings multiple: Pessimistic Consensus $37.25 $44.52 0.70 0.60 0.12 0.11 0.06 0.05 0.09 0.11 One shoul✓ -Select- EPS D/E Nominal RFR Risk premium ROE a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do not round intermediate calculations. Round your answers to the nearest cent. High intrinsic market value: $ Low intrinsic market value: $ Consensus intrinsic market value: $ b. Assuming that the S&P Industrials Index at the beginning of the year was priced at 2,050, compute your estimated rate of return under the three scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of return, if any. Rate of return (optimistic scenario): Rate of return (pessimistic scenario): Rate of return (consensus scenario): Assuming your required rate of return is equal to the consensus, how would you weight the S&P Industrials Index in your global portfolio? he U.S. stocks in a global portfolio. underweight overweight % % Optimistic $60.53 0.50 0.10 0.04 0.13 %

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 2MAD

Related questions

Question

Transcribed Image Text:You are given the three EPS estimates and the following estimates related to the market earnings multiple:

EPS

D/E

Nominal RFR

Risk premium

ROE

One shoul✓ -Select-

a. Based on the three EPS and P/E estimates, compute the high, low, and consensus intrinsic market value for the S&P Industrials Index in 2018. Do not

round intermediate calculations. Round your answers to the nearest cent.

High intrinsic market value: $

Low intrinsic market value: $

underweight

overweight

Consensus intrinsic market value: $

b. Assuming that the S&P Industrials Index at the beginning of the year was priced at 2,050, compute your estimated rate of return under the three

scenarios from Part a. Do not round intermediate calculations. Round your answers to one decimal place. Use a minus sign to enter negative rates of

return, if any.

Rate of return (optimistic scenario):

Rate of return (pessimistic scenario):

Rate of return (consensus scenario):

Assuming your required rate of return is equal to the consensus, how would you weight the S&P Industrials Index in your global portfolio?

he U.S. stocks in a global portfolio.

%

Pessimistic Consensus

$44.52

$37.25

0.70

0.60

0.12

0.11

0.06

0.05

0.09

0.11

%

Optimistic

$60.53

0.50

0.10

0.04

0.13

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning