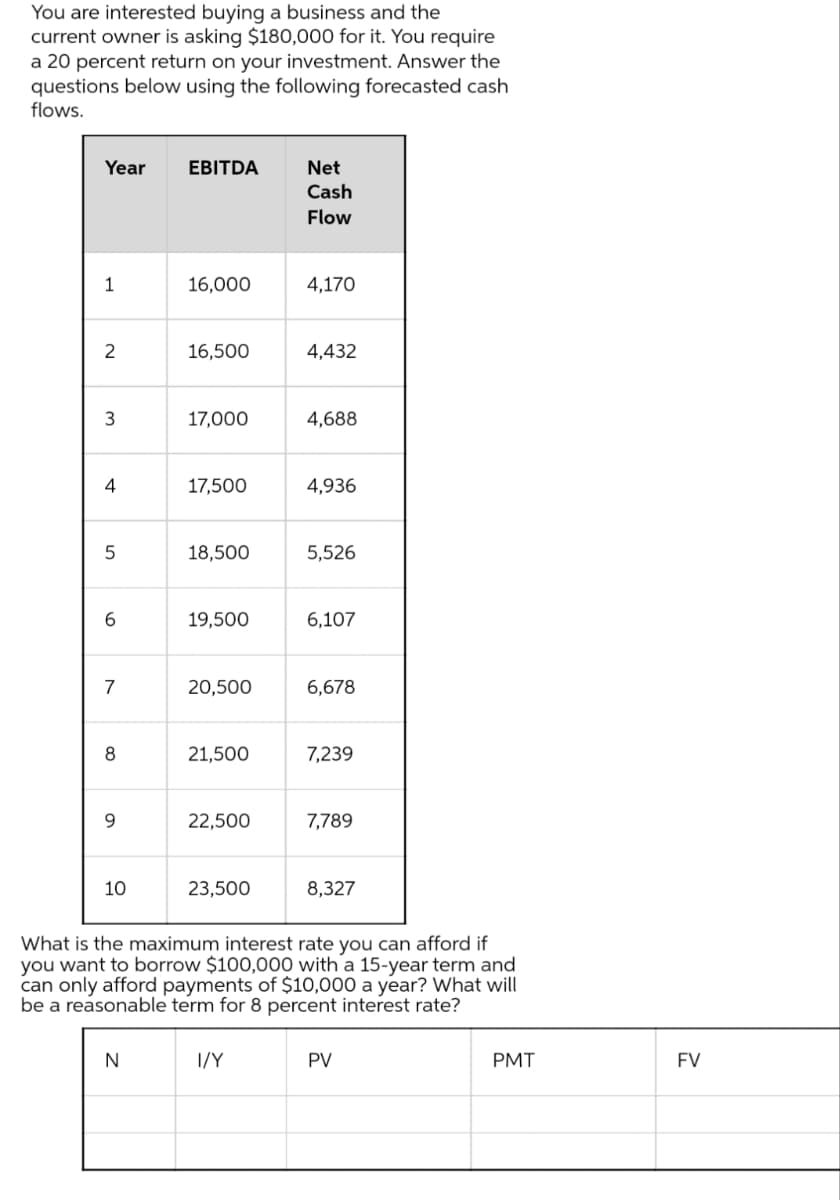

You are interested buying a business and the current owner is asking $180,000 for it. You require a 20 percent return on your investment. Answer the questions below using the following forecasted cash flows. Year EBITDA Net Cash Flow 16,000 4,170 2 16,500 4,432 17,000 4,688 4 17,500 4,936 1. 3.

You are interested buying a business and the current owner is asking $180,000 for it. You require a 20 percent return on your investment. Answer the questions below using the following forecasted cash flows. Year EBITDA Net Cash Flow 16,000 4,170 2 16,500 4,432 17,000 4,688 4 17,500 4,936 1. 3.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 5EB: A grocery store is considering the purchase of a new refrigeration unit with an Initial Investment...

Related questions

Question

please answer within 30 minutes.

Transcribed Image Text:You are interested buying a business and the

current owner is asking $180,000 for it. You require

a 20 percent return on your investment. Answer the

questions below using the following forecasted cash

flows.

Year

EBITDA

Net

Cash

Flow

1

16,000

4,170

2

16,500

4,432

17,000

4,688

4

17,500

4,936

18,500

5,526

19,500

6,107

7

20,500

6,678

21,500

7,239

9.

22,500

7,789

10

23,500

8,327

What is the maximum interest rate you can afford if

you want to borrow $100,000 with a 15-year term and

can only afford payments of $10,000 a year? What will

be a reasonable term for 8 percent interest rate?

N

I/Y

PV

PMT

FV

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College