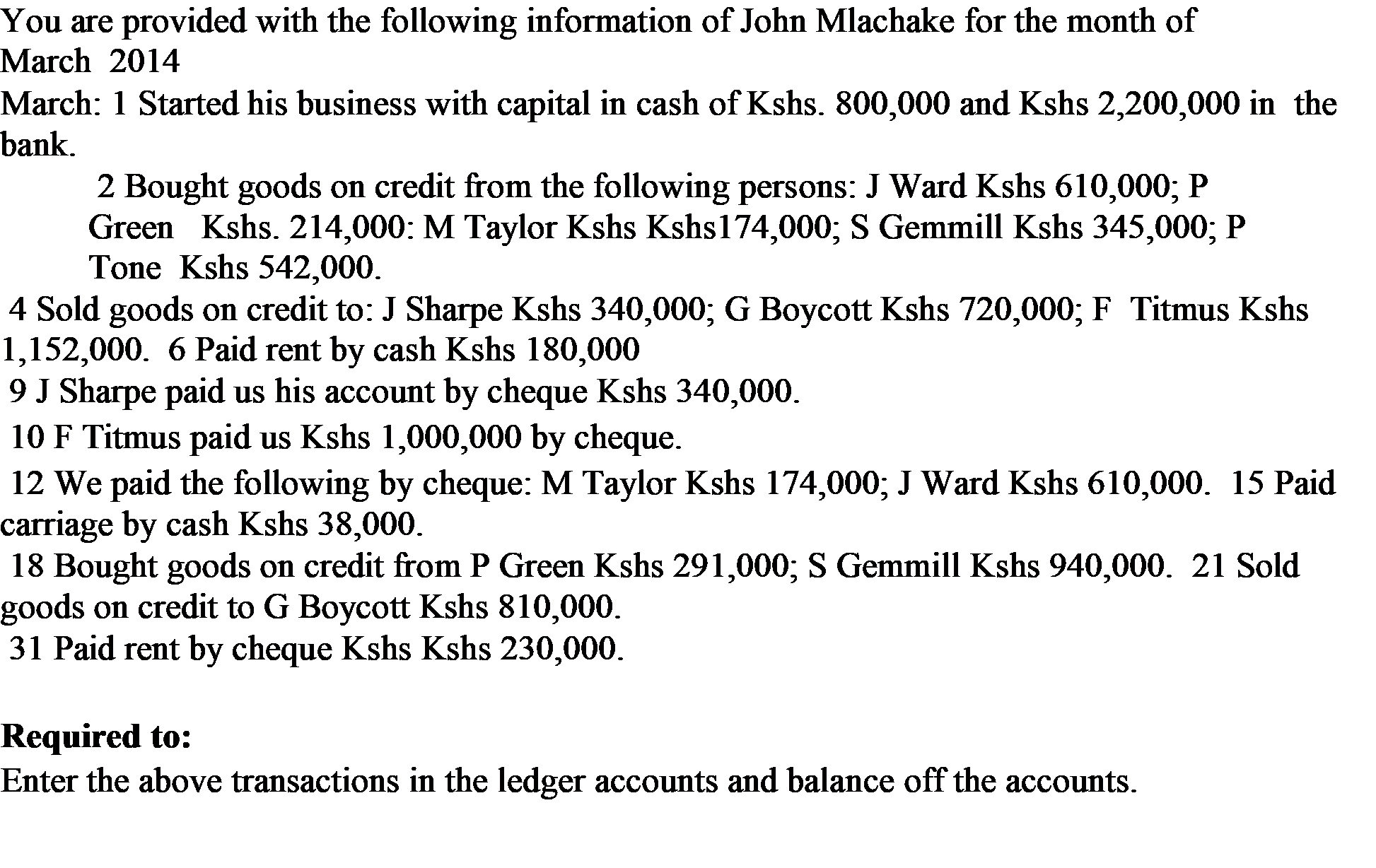

You are provided with the following information of John Mlachake for the month of March 2014 March: 1 Started his business with capital in cash of Kshs. 800,000 and Kshs 2,200,000 in the bank. 2 Bought goods on credit from the following persons: J Ward Kshs 610,000; P Green Kshs. 214,000: M Taylor Kshs Kshs174,000; S Gemmill Kshs 345,000; P Tone Kshs 542,000. 4 Sold goods on credit to: J Sharpe Kshs 340,000; G Boycott Kshs 720,000; F Titmus Kshs 1,152,000. 6 Paid rent by cash Kshs 180,000 9 J Sharpe paid us his account by cheque Kshs 340,000. 10 F Titmus paid us Kshs 1,000,000 by cheque. 12 We paid the following by cheque: M Taylor Kshs 174,000; J Ward Kshs 610,000. 15 Paid carriage by cash Kshs 38,000. 18 Bought goods on credit from P Green Kshs 291,000; S Gemmill Kshs 940,000. 21 Sold goods on credit to G Boycott Kshs 810,000. 31 Paid rent by cheque Kshs Kshs 230,000. Required to: Enter the above transactions in the ledger accounts and balance off the accounts.

You are provided with the following information of John Mlachake for the month of March 2014 March: 1 Started his business with capital in cash of Kshs. 800,000 and Kshs 2,200,000 in the bank. 2 Bought goods on credit from the following persons: J Ward Kshs 610,000; P Green Kshs. 214,000: M Taylor Kshs Kshs174,000; S Gemmill Kshs 345,000; P Tone Kshs 542,000. 4 Sold goods on credit to: J Sharpe Kshs 340,000; G Boycott Kshs 720,000; F Titmus Kshs 1,152,000. 6 Paid rent by cash Kshs 180,000 9 J Sharpe paid us his account by cheque Kshs 340,000. 10 F Titmus paid us Kshs 1,000,000 by cheque. 12 We paid the following by cheque: M Taylor Kshs 174,000; J Ward Kshs 610,000. 15 Paid carriage by cash Kshs 38,000. 18 Bought goods on credit from P Green Kshs 291,000; S Gemmill Kshs 940,000. 21 Sold goods on credit to G Boycott Kshs 810,000. 31 Paid rent by cheque Kshs Kshs 230,000. Required to: Enter the above transactions in the ledger accounts and balance off the accounts.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 32P

Related questions

Topic Video

Question

100%

Transcribed Image Text:You are provided with the following information of John Mlachake for the month of

March 2014

March: 1 Started his business with capital in cash of Kshs. 800,000 and Kshs 2,200,000 in the

bank.

2 Bought goods on credit from the following persons: J Ward Kshs 610,000; P

Green Kshs. 214,000: M Taylor Kshs Kshs174,000; S Gemmill Kshs 345,000; P

Tone Kshs 542,000.

4 Sold goods on credit to: J Sharpe Kshs 340,000; G Boycott Kshs 720,000; F Titmus Kshs

1,152,000. 6 Paid rent by cash Kshs 180,000

9 J Sharpe paid us his account by cheque Kshs 340,000.

10 F Titmus paid us Kshs 1,000,000 by cheque.

12 We paid the following by cheque: M Taylor Kshs 174,000; J Ward Kshs 610,000. 15 Paid

carriage by cash Kshs 38,000.

18 Bought goods on credit from P Green Kshs 291,000; S Gemmill Kshs 940,000. 21 Sold

goods on credit to G Boycott Kshs 810,000.

31 Paid rent by cheque Kshs Kshs 230,000.

Required to:

Enter the above transactions in the ledger accounts and balance off the accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you