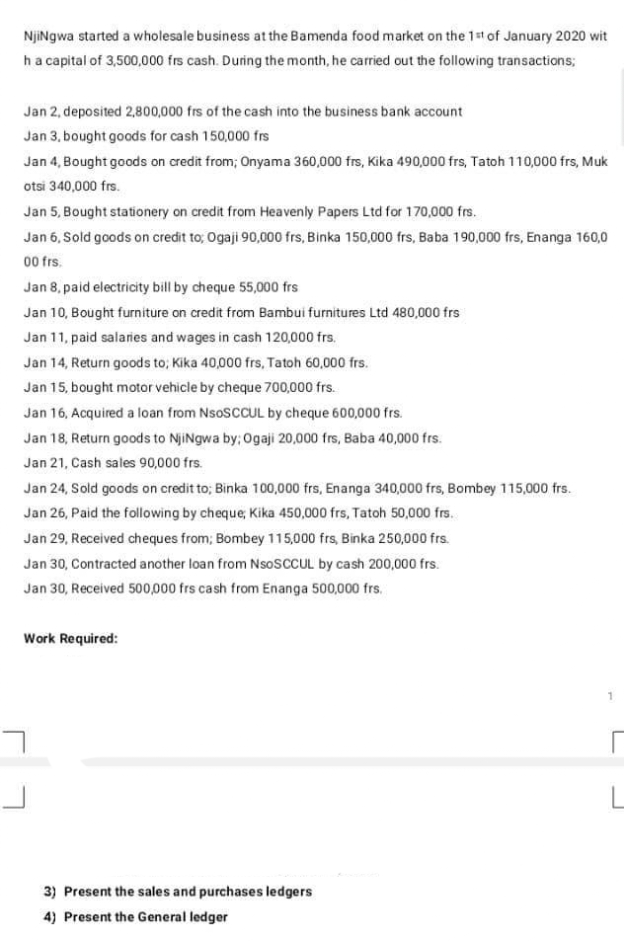

NjiNgwa started a wholesale business at the Bamenda food market on the 1st of January 2020 wit ha capital of 3,500,000 frs cash. During the month, he carried out the following transactions; Jan 2, deposited 2,800,000 frs of the cash into the business bank account Jan 3, bought goods for cash 150,000 frs Jan 4, Bought goods on credit from; Onyama 360,000 frs, Kika 490,000 frs, Tatoh 110,000 frs, Muk otsi 340,000 frs. Jan 5, Bought stationery on credit from Heavenly Papers Ltd for 170,000 frs. Jan 6, Sold goods on credit to; Ogaji 90,000 frs, Binka 150,000 frs, Baba 190,000 frs, Enanga 160,0 00 frs. Jan 8, paid electricity bill by cheque 55,000 frs Jan 10, Bought furniture on credit from Bambui furnitures Ltd 480,000 frs Jan 11, paid salaries and wages in cash 120,000 frs. Jan 14, Return goods to; Kika 40,000 frs, Tatoh 60,000 frs. Jan 15, bought motor vehicle by cheque 700,000 frs. Jan 16, Acquired a loan from NSOSCCUL by cheque 600,000 frs. Jan 18, Return goods to NjiNgwa by; Ogaji 20,000 frs, Baba 40,000 frs. Jan 21, Cash sales 90,000 frs. Jan 24, Sold goods on credit to; Binka 100,000 frs, Enanga 340,000 frs, Bombey 115,000 frs. Jan 26, Paid the following by cheque, Kika 450,000 frs, Tatoh 50,000 frs. Jan 29, Received cheques from; Bombey 115,000 frs, Binka 250,000 frs. Jan 30, Contracted another loan from NSOSCCUL by cash 200,000 frs. Jan 30, Received 500,000 frs cash from Enanga 500,000 frs.

NjiNgwa started a wholesale business at the Bamenda food market on the 1st of January 2020 wit ha capital of 3,500,000 frs cash. During the month, he carried out the following transactions; Jan 2, deposited 2,800,000 frs of the cash into the business bank account Jan 3, bought goods for cash 150,000 frs Jan 4, Bought goods on credit from; Onyama 360,000 frs, Kika 490,000 frs, Tatoh 110,000 frs, Muk otsi 340,000 frs. Jan 5, Bought stationery on credit from Heavenly Papers Ltd for 170,000 frs. Jan 6, Sold goods on credit to; Ogaji 90,000 frs, Binka 150,000 frs, Baba 190,000 frs, Enanga 160,0 00 frs. Jan 8, paid electricity bill by cheque 55,000 frs Jan 10, Bought furniture on credit from Bambui furnitures Ltd 480,000 frs Jan 11, paid salaries and wages in cash 120,000 frs. Jan 14, Return goods to; Kika 40,000 frs, Tatoh 60,000 frs. Jan 15, bought motor vehicle by cheque 700,000 frs. Jan 16, Acquired a loan from NSOSCCUL by cheque 600,000 frs. Jan 18, Return goods to NjiNgwa by; Ogaji 20,000 frs, Baba 40,000 frs. Jan 21, Cash sales 90,000 frs. Jan 24, Sold goods on credit to; Binka 100,000 frs, Enanga 340,000 frs, Bombey 115,000 frs. Jan 26, Paid the following by cheque, Kika 450,000 frs, Tatoh 50,000 frs. Jan 29, Received cheques from; Bombey 115,000 frs, Binka 250,000 frs. Jan 30, Contracted another loan from NSOSCCUL by cash 200,000 frs. Jan 30, Received 500,000 frs cash from Enanga 500,000 frs.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 5PA: Inner Resources Company started its business on April 1, 2019. The following transactions occurred...

Related questions

Question

Please help me

Transcribed Image Text:NjiNgwa started a wholesale business at the Bamenda food market on the 1st of January 2020 wit

ha capital of 3,500,000 frs cash. During the month, he carried out the following transactions;

Jan 2, deposited 2,800,000 frs of the cash into the business bank account

Jan 3, bought goods for cash 150,000 frs

Jan 4, Bought goods on credit from; Onyama 360,000 frs, Kika 490,000 frs, Tatoh 110,000 frs, Muk

otsi 340,000 frs.

Jan 5, Bought stationery on credit from Heavenly Papers Ltd for 170,000 frs.

Jan 6, Sold goods on credit to; Ogaji 90,000 frs, Binka 150,000 frs, Baba 190,000 frs, Enanga 160,0

00 frs.

Jan 8, paid electricity bill by cheque 55,000 frs

Jan 10, Bought furniture on credit fram Bambui furnitures Ltd 480,000 frs

Jan 11, paid salaries and wages in cash 120,000 frs.

Jan 14, Return goods to; Kika 40,000 frs, Tatoh 60,000 frs.

Jan 15, bought motor vehicle by cheque 700,000 frs.

Jan 16, Acquired a loan from NSOSCCUL by cheque 600,000 frs.

Jan 18, Return goods to NjiNgwa by; Ogaji 20,000 frs, Baba 40,000 frs.

Jan 21, Cash sales 90,000 frs.

Jan 24, Sold goods on credit to; Binka 100,000 frs, Enanga 340,000 frs, Bombey 115,000 frs.

Jan 26, Paid the following by cheque, Kika 450,000 frs, Tatoh 50,000 frs.

Jan 29, Received cheques from; Bombey 115,000 frs, Binka 250,000 frs.

Jan 30, Contracted another loan from NsoSCCUL by cash 200,000 frs.

Jan 30, Received 500,000 frs cash from Enanga 500,000 frs.

Work Required:

3) Present the sales and purchases ledgers

4) Present the General ledger

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,