YOU ARE REQUIRED TO: 1. Prepare the entries in the General journal to record the events described for the admission of Simon. 2. Prepare the statement of financial position of the new partnership

YOU ARE REQUIRED TO: 1. Prepare the entries in the General journal to record the events described for the admission of Simon. 2. Prepare the statement of financial position of the new partnership

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

5

Transcribed Image Text:and Donald would be created.

YOU ARE REQUIRED TO:

1. Prepare the entries in the General journal to record the events described for the

admission of Simon.

2. Prepare the statement of financial position of the new partnership

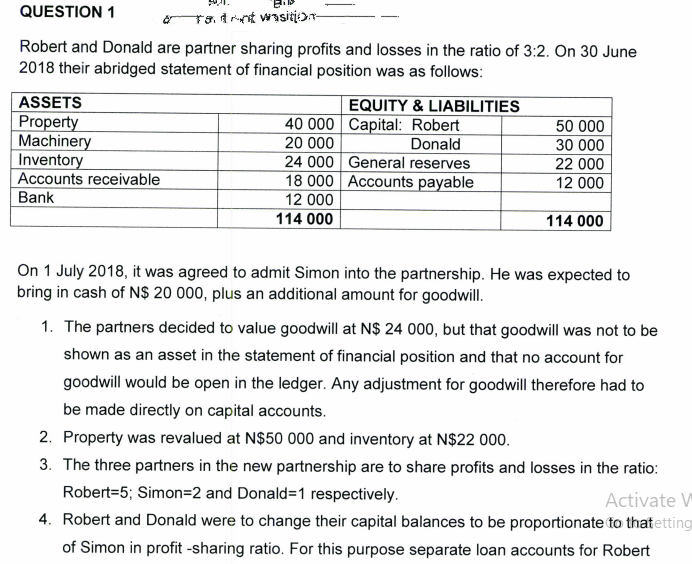

Transcribed Image Text:QUESTION 1

ra. trnt vwasition-

Robert and Donald are partner sharing profits and losses in the ratio of 3:2. On 30 June

2018 their abridged statement of financial position was as follows:

ASSETS

Property

Machinery

Inventory

Accounts receivable

Bank

EQUITY & LIABILITIES

40 000 Capital: Robert

20 000

24 000 General reserves

18 000 Accounts payable

12 000

50 000

30 000

22 000

Donald

12 000

114 000

114 000

On 1 July 2018, it was agreed to admit Simon into the partnership. He was expected to

bring in cash of N$ 20 000, plus an additional amount for goodwill.

1. The partners decided to value goodwill at N$ 24 000, but that goodwill was not to be

shown as an asset in the statement of financial position and that no account for

goodwill would be open in the ledger. Any adjustment for goodwill therefore had to

be made directly on capital accounts.

2. Property was revalued at N$50 000 and inventory at N$22 000.

3. The three partners in the new partnership are to share profits and losses in the ratio:

Robert=5; Simon=2 and Donald=1 respectively.

Activate

4. Robert and Donald were to change their capital balances to be proportionate to thatetting

of Simon in profit -sharing ratio. For this purpose separate loan accounts for Robert

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,