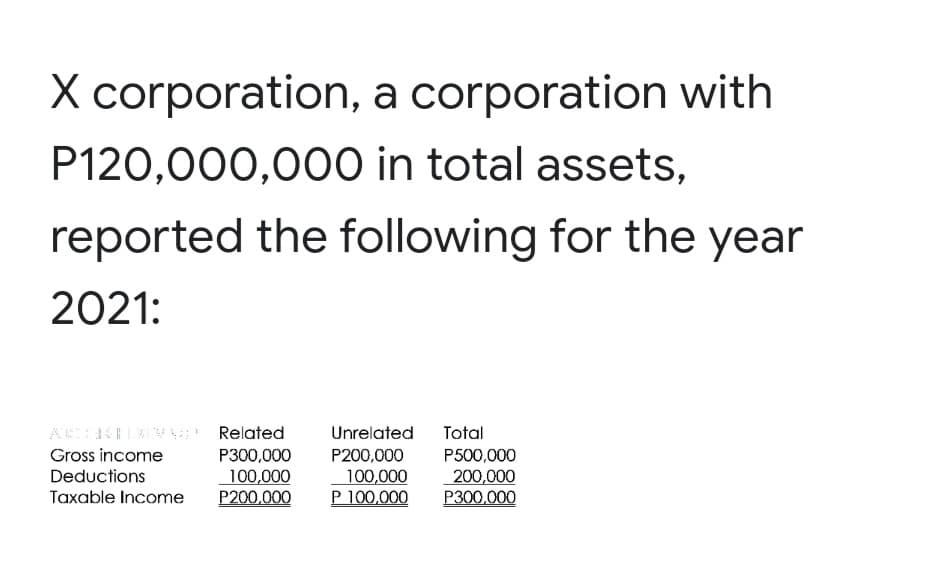

X corporation, a corporation with P120,000,000 in total assets, reported the following for the year 2021: ACELV Related P300,000 100,000 P200,000 Unrelated Total Gross income P200,000 P500,000 Deductions 100,000 P 100,000 200,000 P300.000 Taxable Income

Q: Peder Prescott is 58 years old and is employed as a corporate tax planning adviser by Senators LLP.…

A: Determination of disposals exempted from capital gain tax in 2021/22 B. Sale of Oil painting to Wife…

Q: ginning of curr with the follow lative preferenc a value P12, aut areş, P1,000,000

A: To find the amount of ordinary share and preference share as,

Q: nbulk Ltd. Lilydale Ltd Monbulk $2 950 300 17 100 ales (net credit) revenue for year llowance for…

A: Concepts Receivable Turnover Ratio indicate that, how many time sales are made and collection did…

Q: The following information is available for Marston Limited. The balance in the bank account of the…

A: Cash flow statement is made to reconcile the cash balance and to determine the activities where cash…

Q: The Boone Manufacturing had worked on two jobs, Job 101 and Job 102 last year. estimated…

A: The variance is the difference between the actual data and standard output of the production.

Q: Hi how do you get 2.73554 can you elaborate it?

A: Solution: Present value of an annuity due is computed as = Annuity amount * PVAD of $1 at given…

Q: A measure frequently used to evaluate the performance of the manager of an investment center is the…

A: Investment center is a segment within an organization with funds are allocated to each segment. The…

Q: What is the materials price variance? (Round per unit calculations to 2 decimal places, e.g. 1.25…

A: Waterways Corporation is using standard costing method to evaluate its manufacturing efficiency. The…

Q: the weighted average number of ordinary shares outstanding?

A: Date Particulars Shares Weights Weighted average 1 January Beginning ordinary shares 480,000…

Q: melgguo How much is the ending cash balance?

A: The Cash Balance at the end of the year : P16,350,000

Q: The following information on a defined benefit plan is provided: FVPA, beg…

A: Defined Benefit Plan Defined benefit plan which are provided to the employees of the entity after…

Q: Nhyiraba Limited lease a building worth R4 million to Quintin Limited under an operating lease for…

A: IAS 40 Investment Property governs the accounting for property (land and/or buildings) owned for…

Q: Jewel Ltd manufactures four products, A, B, C and D, and has produced the following budgeted figures…

A: For determination of ranking as per key factor we need to calculate first contribution per unit.…

Q: The primary source of revenue for a wholesaler is Oinvestment income. service fees. O the sale of…

A: The primary source of revenue is the main sources of income generated through main course of…

Q: The following information on a defined benefit plan is provided: FVPA, beg 4,000,000 PVDBO, beg…

A: OCI is the other comprehensive incomes, which is calculated in financial accounting, It is for the…

Q: A start-up mobile phone manufacturer who produces mother boards has fixed costs of $320,000 per year…

A: The point at which the cost of buying the product is equal to cost of making the product is known as…

Q: True or False 1. Intangible-purchase goals pertain to abstract goals such as happiness, long life,…

A: The answer is stated below:

Q: The Pierce Company started operations this month and had the following transactions: 1 Owners…

A: An accounting equation refers to a mathematical representation of the transaction. It indicates that…

Q: b-1. Quick ratio b-2. Current ratio b-3. Working capital b-4. Debt ratio

A:

Q: Waterway Company uses a periodic inventory system. Details for the inventory account for the month…

A: Ending inventory is the cost of things on hand at the end of the reporting period. For a corporation…

Q: Ex 7- Long-Term Note Payable a) What if the Einstein Corporation decided to raise capital (Cash) by…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: at is the income tax due if X corporation is a regular domestic corporation? P75,000 P60,000…

A: Domestic corporation are subjected to corporate tax rate and also depending on assets held by them…

Q: The main purpose of the auditor's consideration of internal control for a non-SEC client is to A.…

A: Audit of internal control is conducted by auditors to assess its efficiency and effectiveness and…

Q: 7. AHR Company has provided the following data: Inventory and prepaid expenses, P35,000; Current…

A: Assets and liabilities are the two components of the balance sheet. Assets can be long-term or…

Q: 17. Late in Year One, a company buys one share of a publicly traded company for P75. This investment…

A: correct option with proper explanation are as follows

Q: Discuss one aspect of the Statement of Cash Flows that can be difficult and write a short paragraph…

A: Introduction:- A cash flow statement denotes total amount cash is inflows and cash outflows your…

Q: Is it necessary to have several entries in a control structure? why?

A: Control structure is an amalgamation of the polices and procedure , which is implemented to ensure…

Q: The following transactions and adjusting entries were completed by a paper-packaging company called…

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is…

Q: Explain the circumatances that may income to be lowen if the unprofitabile produet line is…

A: Depending on the circumstances, income is defined variously, such as for taxation, financial…

Q: 1. A Machine costs P80,000 and an estimated life of 10 years with a salvage value of P5,000. What is…

A: Note:Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Determine the unit contribution margin and contribution margin ratio. Last month, Laredo Company…

A: Formula: Unit contribution margin = Sales price per unit - variable cost per unit

Q: ou are a credit analyst of a growing commercial bank and have recently received pan applications…

A: The question is related to Ratio Analysis. The Working Capital is the excess of Current Assets over…

Q: Of P13,636. Payments oI P9 were made on both January 2, 2017 and January 2, 2018. Welington's…

A: A lease is an agreement to rent an asset in exchange for periodic payments. The agreement's two…

Q: will be paid by his insurance company if a fire causes $710,000 in losses? O $568, 000 O $735, 000 D…

A: Insurance is contract entered between two parties ie. The company assuring in the contract of…

Q: Lil Wayne Corporation received dividends from ordinary shares (15% interest) and preference share…

A: Dividend refers to the amount distributed to the shareholders from amount earned during the…

Q: Which of the following types of messages might the Active Auditor display? Question 9 options:…

A: The auditor is the person who audits the books of the company. the verifies all the books and the…

Q: The company ordered the wine on September 15. It arrived on October 31, and the company made payment…

A: Call option premium on September 15 is $0.03. Vino Veritas purchased a 45-day call option for 600000…

Q: pany leased a new machine from Keriboomboom Company on January 1, 2016, under a lease with the…

A: Solution:- As per FASB and GAAP, a lease is classified as capital lease if any of the following four…

Q: Consider an annual 4 year coupon bond paying a coupon rate of 5%. If it is 1000 par and the YTM= .04…

A: Bond is a fixed interest bearing instrument that is issued by the company for funds and has a…

Q: the ABCD partnership on their 2020 income tax returns?

A:

Q: n October 1, 2021, A Corp. purchased goods from US based corporation worth 60,500 US dollars.…

A: Solution Concept in respect of the monetary assets and liabilities , there shall be initial and…

Q: Oct. Nov. Estimated sales (units) 25,000 25,000 27,000 27,500 28,000 Sales price per unit…

A: The production budget is formed from a combination of the sales forecast and the intended amount of…

Q: Mr. Ramos savings allow her to withdraw 50,000 semi-annually for 11 years starting at the end of 5…

A: Solution Concept This is the problem related to time value of money Present value is calculated by…

Q: Golden rules of Accounting

A: Accounting is the process of identifying and categorizing company activities. Transactions are…

Q: Joshua Company has a define contribution plan that covers its existing employees. The terms of the…

A: The prepaid expenses are the payment of expenses in advance before they arise. Prepaid insurance is…

Q: e product AB makes sense. If the colu dent and so are the columns of B. unter example to the…

A: To show the given statement is False as,

Q: Accounts payable generally present the auditors with difficult valuation problems. false…

A: Accounts payable is an obligation that an entity has to recompense within a year.

Q: This revenue recognition method applies when the customer wants to make payments in portions and the…

A: 1-Installment method Installment method refers to the method under which there is arrangement…

Q: 18. Troy's Tire Mart has a replacement value of $965, 000 and is insured for $588, 000, with an 80%…

A: The coinsurance reimbursement amount is determined by dividing the insured value by the required…

Q: Which of the following types of messages might the Active Auditor display? Question 9 options:…

A: The active auditor display is a tool used by the auditor while carrying out the audit procedures. It…

Step by step

Solved in 2 steps

- Oreo reported the following for the period:Sales P1,000,000Cost of Sales P300,000Operating expenses P100,000Determine the OSD assuming that Oreo is a corporationThe following information is provided for Sandhill Company and Indigo Corporation. (in $ millions) Sandhill Company Indigo Corporation Net income 2022 $125 $375 Net sales 2022 1540 4500 Total assets 12/31/20 1045 2010 Total assets 12/31/21 1220 3150 Total assets 12/31/22 1175 4070 What is Indigo's return on assets for 2022?E. An entity reported the following assets and liabilities at year-end: Carrying Amount Tax BaseProperty 10,000,000 7,000,000Plant and equipment 5,000,000 4,000,000Inventory 3,000,000 4,000,000Accounts receivable 2,500,000 3,000,000Liabilities 6,000,000 5,500,000The entity had made a provision for inventory obsolescence of P1,000,000. Further, an impairment loss against accounts receivable of P500,000 has been made. The tax rate is 25%.1. What amount should be reported as deferred tax liability?2. What amount should be reported as deferred tax asset?

- The following information relates to the Gates Corporation: Net assets, end of year P650,000 Net assets, beginning of year 300,000 Additional investment by shareholders 100,000 Dividends paid 150,000 Other comprehensive income for the year 80,000 Profit for the year is Group of answer choices 350,000 400,000 480,000 320,000he condensed balance sheet and income statement data for SymbiosisCorporation are presented below.SYMBIOSIS CORPORATIONBalance SheetsDecember 312014 2013 2012Cash $ 30,000 $ 24,000 $ 20,000Accounts receivable (net) 110,000 48,000 48,000Other current assets 80,000 78,000 62,000Investments 90,000 70,000 50,000Plant and equipment (net) 503,000 400,000 360,000$813,000 $620,000 $540,000 Current liabilities $ 98,000 $ 75,000 $ 70,000Long-term debt 130,000 75,000 65,000Common stock, $10 par 400,000 340,000 300,000Retained earnings 185,000 130,000 105,000$813,000 $620,000 $540,000SYMBIOSIS CORPORATIONIncome StatementsFor the Years Ended December 312014 2013Sales revenue $800,000 $750,000Less: Sales returns and allowances 40,000 50,000Net sales 760,000 700,000Cost of goods sold 420,000 406,000Gross profit 340,000 294,000Operating expenses (including income taxes) 230,000 209,000Net income $110,000 $ 85,000Additional information:1. The market price of Symbiosis common stock was $5.00, $3.50, and…The following information relates to the Gates Corporation: Net assets, end of year P650,000 Net assets, beginning of year 300,000 Additional investment by shareholders 100,000 Dividends paid 150,000 Other comprehensive income for the year 80,000 Profit for the year is a. 350,000 b. 400,000 c. 320,000 d. 480,000

- During the current year, The Jupiter Company, which is an S corporation, had the following items of income andexpenses: Income:Gross income from operations $150,000Interest income 5,000Qualified dividend income from investments 800Deductions:Compensation of Officers 67,000State taxes 5,000Short-Term Capital Loss 6,000Employee benefits 3,500Contribution to Pet Haven 1,000Interest 3,000Distributions to the shareholders 75,000a. Calculate the net ordinary income.b. List all the other items which must be separately reported.c. If the S corporation is on a calendar year, when is the corporation’s tax return due?A Corporation provided the following information for the current year: Income from continuing operation 2,000,000Loss on credit risk of financial liability at FVPL 200,000Revaluation surplus 1,500,000Loss from discontinued operation 300,000Unrealized gain on financial asset – FVPL 900,000Net “remeasurement” gain on defined benefit plan during the year 400,000 Unrealized gain on equity investment – FVOCI 1,000,000Investment gain on debt investment – FVOCI 900,000Unrealized loss on future contract designated as a cashflow hedge 200,000Translation gain on foreign operation 300,000 [Q7]: Determine the total amount of (21) other comprehensive income and (22) comprehensive income for the current year.Refer to the following financial information of Scholz Company: NOPAT 8,250,000.00 EBITDA 17,725,000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280,000.00 Tax rate 40% Calculate the Company’s depreciation and amortization expense

- Below is the Statement of Financial Position of Camille Corporation for the year 2020.Cash 675,000Accounts receivable (net) 2,695,000Inventory 2,185,000Property, plant, and equipment (net) 10,245,000Accounts payable and accrued liabilities 1,800,000Income tax payable 1,500,000Deferred tax liability 750,000Ordinary share (100,000 @ P15 per share) 1,500,000Preference share (50,000 @ P20 per share) 1,000,000Ordinary share premium 3,000,000Retained earnings, January 1 3,350,000Net sales and other revenue 15,000,000Cost and expenses 10,000,000Income tax expense 2,100,00027,900,000 27,900,000a. Supposed that the given values above are the accounting values of the Camille Corporation, what is its book value per share?b. Suppose that the market value of property, plant, and equipment of Camille Corporation increased by P3 million while all other assets remain the same. How much is the liquidation value per share of Camille Corporation?Computational (Show your computations. Round off as follows: e.g. ₩10.64=> ₩11, 0.123456 => 12.35%, 2.4321 => 2.43) . KG Co. had total assets of ₩1,200,000, total liabilities of ₩500,000, and retainedearnings of ₩300,000 at the beginning of 20x1. For the year, the corporationdeclared cash dividends of ₩50,000. At the end of the year, the company hadtotal assets of ₩1,400,000 and showed the debt ratio of 0.4. The company hadno accumulated other comprehensive income.1) Compute the total stockholders’ equity at the end of 20x1. 2) Compute KG’s net profit for 20x1, assuming no change in contributed capitalduring the yearRefer to the following financial information of Scholz Company: NOPAT 8,250,000.00 EBITDA 17,725,000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280,000.00 Tax rate 40% Calculate the Company’s depreciation and amortization expense Refer to the following financial information of Scholz Company: NOPAT 8,250,000.00 EBITDA 17,725,000.00 Net Income 5,050,000.00 Capital Expenditures 6,820,000.00 After tax capital costs 6,280,000.00 Tax rate 40% 13. Calculate the Company’s depreciation and amortization expense 14. Refer to Scholz Company, calculate its interest expense. Use 2 decimal places for your final answer. 15. Refer to Scholz Company, calculate its…